AT&T Stock: Why It’s A Buy In 2020

Shares of telecommunications giant AT&T Inc. (T) have enjoyed a meaningful rebound in 2019, after a few difficult years. After peaking at $43 in the summer of 2016, shares of AT&T declined to under $30 by the end of 2018. However, the stock has surged 33% year-to-date, outperforming the S&P 500 Index so far this year. AT&T has provided investors with an even stronger return in 2019 after including dividends.

AT&T has long been an impressive dividend stock, with a high dividend yield above 5% and a long history of steady annual increases. The company has increased its dividend payout for over 30 years in a row, making it a member of the prestigious Dividend Aristocrats, a group of S&P 500 stocks with at least 25 consecutive years of dividend increases.

AT&T’s resurgence this year is the result of its transformation into a content giant and diversified telecom conglomerate. In this update, we’ll take a look at AT&T’s recent developments as well as the value proposition the stock offers, as determined by our Sure Analysis Research Database, where we rank stocks based upon total expected returns.

AT&T continues to rank highly among the hundreds of stocks in our coverage universe. We believe that the stock remains a strong buy for 2020 and beyond, due to its high expected returns.

Company Overview and Recent Events

AT&T traces its roots back to 1876 when Alexander Graham Bell invented the first version of the telephone. In its current form, AT&T is the result of a tangled web of mergers and spinoffs that have taken place since 1984, when the former AT&T spun off its local telephone operations but retained its long-distance, R&D and manufacturing segments. SBC Communications was born from this and with it, the modern AT&T was as well.

SBC acquired several smaller telecommunications players, including what was left of AT&T in 2005, creating the company we know today. Since then, AT&T has purchased Cingular Wireless, Cricket Wireless, lusacell, and Nextel Mexico, respectively, to add to its core business. In addition, it has diversified away from phone service with its DirecTV acquisition in 2015, and the 2018 acquisitions of AppNexus and Time Warner Inc.

Today, AT&T is the largest communications company in the world, operating in four distinct business units: AT&T Communications, which provides mobile, broadband, video and other communications services to more than 100 million U.S. consumers and more than 3 million businesses; WarnerMedia which includes Turner, HBO, and the Warner Bros. studio; AT&T Latin America which offers pay-TV and wireless service to 11 countries; and its advertising platform Xandr. The company generates roughly $170 billion in annual revenue. AT&T’s market capitalization today is nearly $280 billion, making it a mega-cap stock.

AT&T reported third-quarter earnings on October 28th. For the quarter the company generated $44.6 billion in revenue, down from $45.7 billion in the year-ago quarter, as declines in legacy wireline services, WarnerMedia, and domestic video were partially offset by growth in strategic and managed business services, domestic wireless services and IP broadband.

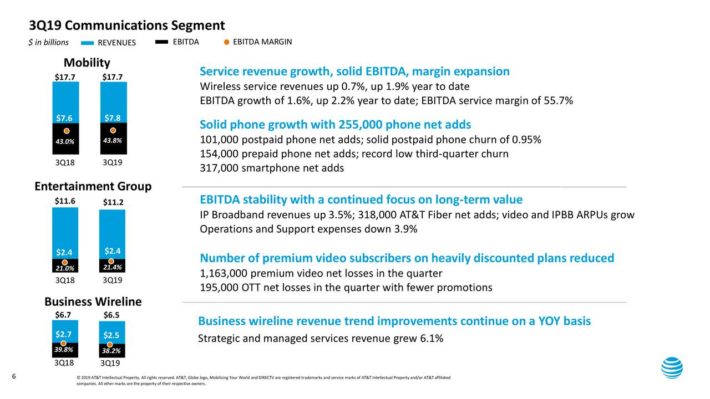

Source: Investor Presentation

The core Communications Segment led the way for AT&T, particularly in the Mobility and Entertainment Group businesses. AT&T’s Mobility and Entertainment segments both generated EBITDA margin expansion for the quarter. Wireless service revenue increased 0.7% last quarter and 1.9% through the first three quarters, driven by 255,000 phone net adds. AT&T also reported a low postpaid churn rate of 0.95% for the quarter.

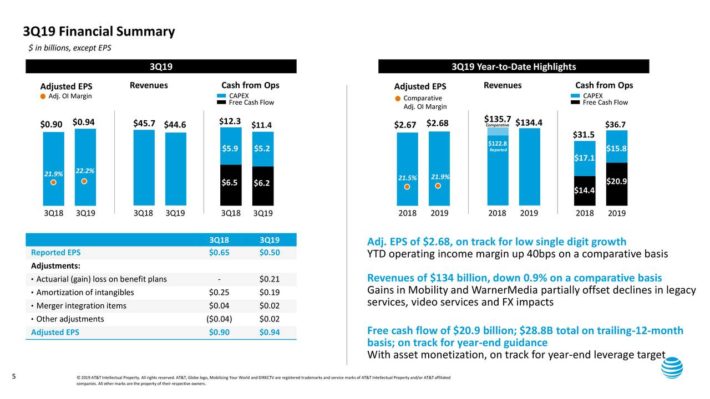

This led to strong financial performance overall. Net income came to $3.7 billion or $0.50 per share versus $4.7 billion or $0.65 per share prior. On an adjusted basis, earnings-per-share equaled $0.94 compared to $0.90 previously for a 4.4% increase. Adjusted earnings-per-share increased 0.4% year-over-year, resulting in a slightly higher adjusted operating income margin.

Source: Investor Presentation

Over the first nine months of 2019, AT&T generated 9.5% revenue growth, as 11% growth in services more than offset a 4.4% decline in the much smaller equipment business. AT&T is a cash cow–the company produced $21 billion of free cash flow over the first three quarters of the year.

This allowed the company to return significant amounts of cash to shareholders, including $11.1 billion of dividends paid over the first three quarters. AT&T also repaid $24.4 billion of long-term debt through this period. A reduced debt load will help free up additional cash flow for AT&T to continue investing in growth initiatives.

Growth Prospects

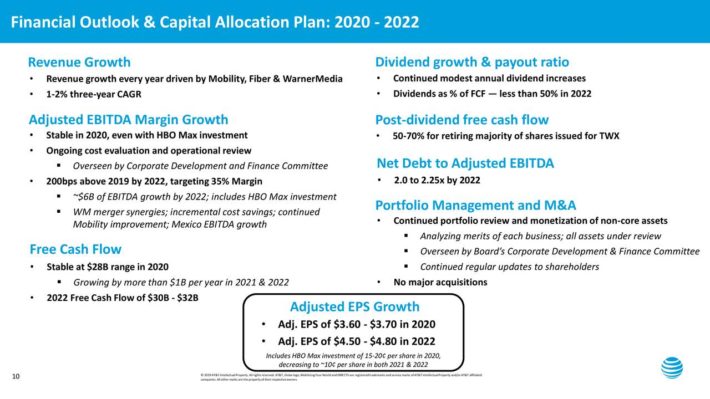

Along with its recent earnings results, AT&T also provided a 2020 outlook and 3-year financial guidance and capital allocation plan. For 2020 the company expects revenue growth of 1% to 2%, adjusted earnings-per-share of $3.60 to $3.70 and a dividend payout ratio in the low-50% range.

By 2022, AT&T expects 1% to 2% revenue growth, $4.50 to $4.80 in earnings-per-share (representing roughly 10% annual growth), continued dividend increases making up less than 50% of free cash flow, and a net-debt-to-adjusted EBITDA ratio of 2.0x to 2.25x.

Source: Investor Presentation

AT&T also forecasts free cash flow of $30 billion to $32 billion by 2022. The company will use the remaining cash after dividend payments to buy back ~70% of the shares issued for the Time Warner acquisition, as well as retiring 100% of the debt issued in the transaction. Aggressively paying down debt is especially important for AT&T, as the company took on a huge level of debt to finance its massive Time Warner acquisition, as well as other bolt-on deals in recent years. AT&T ended the most recent quarter with $153.57 billion in long-term debt, although this represents a reduction from $166.25 billion at the same point last year.

Fortunately, AT&T generates huge cash flow which will keep the overall debt load manageable, as evidenced by the reasonable leverage ratios the company has targeted. In turn, we also expect the company to report steady growth going forward, as it has done for many years. AT&T is a colossal business, but it is not a fast grower. From 2007 through 2018 AT&T grew earnings-per-share by 2.2% per year. While the company is picking up growth opportunities, notably in its recent acquisitions of DirecTV and Time Warner, we recognize the sizable debt incurred as well as the declines in certain legacy businesses.

That said, AT&T is optimistic about generating reasonable growth, resulting in excess funds to divert toward paying down debt. Moreover, after the debt is under control, management has indicated the potential for share repurchases down the line. While the company put out strong growth expectations through 2022, we forecast 4% annual EPS growth.

Cord-cutting amongst consumers has impacted many TV providers in recent years and was no different in the last quarter. In response, investors could see consolidation among the legacy cable providers, particularly when it comes to satellite providers which are struggling disproportionately. On Friday, June 7th, it was announced that both AT&T and Dish Network Corp (DISH) could be interested in merging their satellite TV businesses.

With the high number of new competitors in the TV space, Dish and DirecTV might be able to gain regulatory approval for the merger. This remains speculative as both companies denied that they had engaged in talks. AT&T’s legacy satellite segment continues to struggle with both revenue growth and with negative operating leverage that accompanies revenue losses.

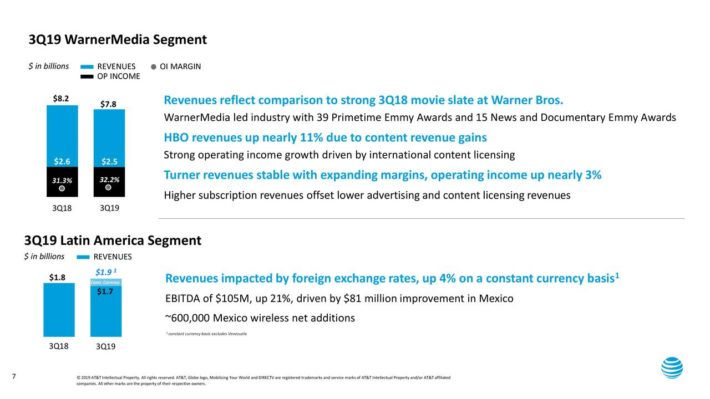

Fortunately, AT&T’s enormous acquisition of Time Warner has already begun to pay dividends for the parent company.

Source: Investor Presentation

While WarnerMedia segment revenue declined 4.9% year-over-year, due to a very unfavorable comparison period from a strong movie slate in the year-ago quarter, it did generate nearly 11% revenue growth at HBO. In addition, the WarnerMedia segment produced operating income margin expansion of 90 basis points for the quarter.

Overall, AT&T reported another strong quarter and should continue to grow revenue and earnings through a number of positive catalysts. We think this is key for AT&T’s profitability and growth moving forward, and the financial results over the first three quarters of 2019 show not only that AT&T’s focus on costs is working, but also that its newer lines of business are driving growth.

Balance Sheet Analysis

One potential concern for AT&T that investors should be aware of is the impact of the company’s increasing debt, particularly in a rising interest rate environment. AT&T’s balance sheet has become stretched, due to the major acquisitions of DirecTV and Time Warner in recent years.

Fortunately, AT&T generates high levels of excess cash flow each quarter, which should help the company steadily pay down debt. In the past year, AT&T has produced more than $25 billion in free cash flow. In the first quarter alone, it produced $5.9 billion in free cash flow, using $3.7 billion of that to pay dividends, and using the remaining $2.3 billion to deleverage its balance sheet.

In addition to free cash flow, the company is selling off non-core assets like its former stake in the Hulu business, and office space in the Hudson Yards development. These transactions, which resulted in $3.6 billion in additional cash for AT&T, are providing the company with billions of dollars in additional capital that it will use to reduce its debt load.

Paying debt down this quickly should help assuage any fears investors may have about AT&T’s debt, as its leverage will be down to ~2.5X EBITDA by the end of 2019. This is a healthy leverage ratio. Paying down debt will also result in less interest expense each year, freeing up additional cash flow for continued dividend increases each year. With a projected dividend payout ratio of 56% for 2019, AT&T has a highly secure dividend payout with room for annual increases in the low single-digit range.

Another reason to expect continued earnings growth for AT&T is its stable business model. As a telecom provider, AT&T enjoys steady demand, as consumers are extremely reluctant to give up their broadband and wireless service, even during recessions. We view AT&T as among the most recession-resistant Dividend Aristocrats. Consider its excellent performance during the Great Recession:

- 2007 earnings-per-share: $2.76

- 2008 earnings-per-share: $2.16

- 2009 earnings-per-share: $2.12

- 2010 earnings-per-share: $2.29

AT&T did see its earnings decline during the Great Recession but at a modest rate. The company remained highly profitable during the recession, which allowed it to continue growing its dividend throughout. And, AT&T eventually eclipsed its pre-recession earnings level by 2016. It has kept on a strong earnings growth trajectory in the years since.

Expected Returns

We continue to expect very strong returns for AT&T in the coming years due to a variety of factors. We compute total expected returns in our Sure Analysis Research Database using the sum of dividend yield, valuation change, and earnings-per-share growth. Using these criteria, AT&T is among the most attractive stocks in our coverage universe today, particularly for those investors desiring income.

Beginning with growth, we are forecasting 4% annual expansion in AT&T’s earnings-per-share for the next five years. We see the company’s focus on cutting costs to boost margins – as it did with great effect over the course of 2019– as a key driver. In addition, we expect revenue growth from WarnerMedia, as well as stronger performance from wireless service revenue.

However, we believe these factors will be partially offset by continued, slow declines in legacy businesses like business wireline. Still, margin expansion is expected through 2022, which should be enough to boost earnings growth despite lackluster revenue growth in the legacy businesses.

While bottom-line growth is important, additional shareholder returns will accrue from the combination of the stock’s high dividend yield and the change in the valuation multiple. The company’s dividend is now $2.04 per share, putting the current yield at 5.4%. That makes AT&T a premier income stock in just about any context, particularly outside of traditional income stocks like REITs or utility stocks.

In addition, the payout ratio is less than 60% of earnings for 2019 so it is very safe. For context, the company had an average dividend payout ratio of 71% from 2009 through 2018. Combined with a 35-year dividend increase streak, we see the payout as having a lot of room to run in the coming years.

You can watch a video further detailing AT&T’s dividend safety below:

The final component of total returns is change in the valuation, which we also see as a significant tailwind for AT&T. Shares trade today at just 10.4 times our 2019 earnings-per-share estimate of $3.65. That is near the lowest price-to-earnings ratio the stock has seen in the past decade. For comparison purposes, the S&P 500 index has an average price-to-earnings ratio of more than 21.

AT&T is also undervalued relative to its own historical averages. In the past decade, AT&T stock traded with an average price-to-earnings ratio between 12 and 13. As a result, at a current P/E of 10.4, we view the stock as considerably undervalued right now.

Our fair value estimate is a price-to-earnings ratio of 12. If AT&T stock expands from the current P/E multiple of 10.4 up to our fair value estimate of 12, it would boost annual shareholder returns by 2.9%. We believe AT&T stock is a buy under $44. With a current share price of $38, the stock is trading meaningfully below our fair value estimate. This makes the stock attractive for value investors, in our opinion.

Given all of this, we see total annual returns in excess of 12%, consisting of the 5.4% dividend yield, 4% expected EPS growth, and a ~2.9% positive impact from changes in the stock valuation.

Final Thoughts

Consistent with our previous review of AT&T, we believe that the stock offers investors the chance to own a piece of a dominant wireless business that also has several growth levers it can pull in the coming years, particularly with recently acquired businesses. Debt remains a concern for investors, but the company’s immense free cash flow, in our view, diminishes the importance of this concern. Non-core asset sales will also aid in deleveraging.

Given this, and very high expected total returns, not the least of which is the company’s enormous dividend yield, we rate AT&T a strong buy for 2020. The company’s strong quarterly earnings reports throughout 2019 reinforce our bullish view on the stock. AT&T shares have significantly outperformed the S&P 500 Index year-to-date, meaning AT&T is not quite as compelling of a buy recommendation as it was at its 52-week lows. But we still view the stock as undervalued, and with a high dividend yield above 5% and positive EPS growth, it remains a buy for income and value investors.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

I had written off AT&T years ago but I've been surprised as the company has rebounded. Now I wish I hadn't sold $T back then.