AT&T Mega-Merger With Discovery: How Should Shareholders React?

Telecom giant AT&T Inc. (T) has long been a reliable dividend holding for income investors. AT&T has typically offered a high dividend yield well above the market average. In addition, AT&T has increased its dividend each year for over 30 consecutive years, earning it a place on the exclusive Dividend Aristocrats list.

But AT&T has not increased its dividend in over a year, mainly due to an elevated debt load as a result of its acquisition spree over the past few years.

Now, AT&T is looking to get rid of many major assets it has acquired in recent years—including DIRECTV and WarnerMedia—which could have negative implications for its dividend.

This article will discuss AT&T’s recent mega-merger news, and how AT&T shareholders should position themselves moving forward.

Photo by Galen Crout on Unsplash

Transaction Overview

AT&T is a telecommunications giant, providing a wide range of services, including wireless, broadband, and television. The company currently operates in three business units:AT&T Communications (providing mobile, broadband and video to over 100 million U.S. consumers and nearly 3 million businesses), WarnerMedia (including Turner, HBO, Warner Bros. and Xandr), and AT&T Latin America serving 11 countries.

AT&T is a mega-cap stock with a market capitalization above $200 billion.

The company made a huge move on May 17th, 2021 when it announced an agreement to combine WarnerMedia with Discovery, Inc. (DISCA) to create a new global entertainment company.

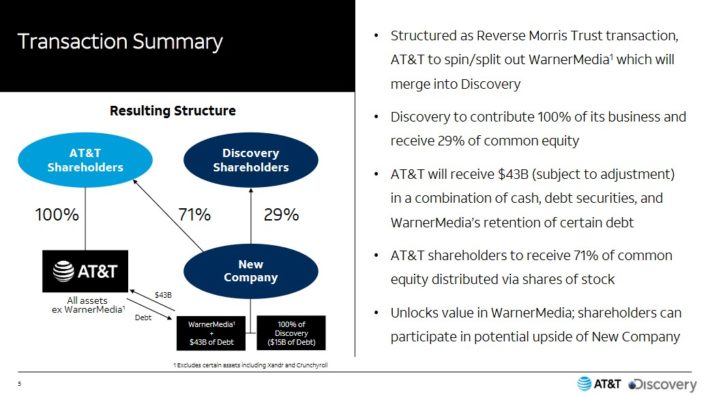

Source: Investor Presentation

Under the terms of the transaction AT&T will receive $43 billion in a combination of cash, securities and retention of debt.

In addition, AT&T shareholders receive stock representing 71% of the new company, with Discovery shareholders owning 29%. The company will combine HBO Max and Dsicovery+ to compete in the direct-to-consumer business, bringing together names like HBO, Warner Bros., Discovery, CNN, HGTV, Food Network, TNT, TBS and more.

The new company expects $52 billion in 2023 revenue and the transaction is expected to close in mid-2022.

Conceivably, AT&T’s renewed focus on its telecommunications businesses is an attempt to return to growth. By separating its media businesses, AT&T intends to refocus on its core competencies, without the burden of having to invest in wireless network infrastructure and media assets at the same time.

Nevertheless, there are significant implications for AT&T shareholders, particularly for income investors.

Dividend Analysis

Of course, no discussion of AT&T would be complete without mentioning the dividend. As a Dividend Aristocrat with over 30 consecutive years of dividend growth and a high dividend yield of 7%, AT&T’s dividend is a major reason why investors purchase the stock.

AT&T was having some difficulty growing its dividend after the Time Warner acquisition. In fact, the company had not raised its per-share dividend since December 2019. This has actually placed AT&T’s status as a Dividend Aristocrat in jeopardy. The company would need to raise its dividend sometime this year in order to remain a Dividend Aristocrat.

After the merger with Discovery, there is a high likelihood AT&T will reduce its dividend. Not having its media assets in tow will result in a significant drop in revenue and cash flow. And, since AT&T’s financial resources were already stretched with its elevated debt load, this makes it unlikely that AT&T shareholders will receive the same dividend payout as before on a per-share basis.

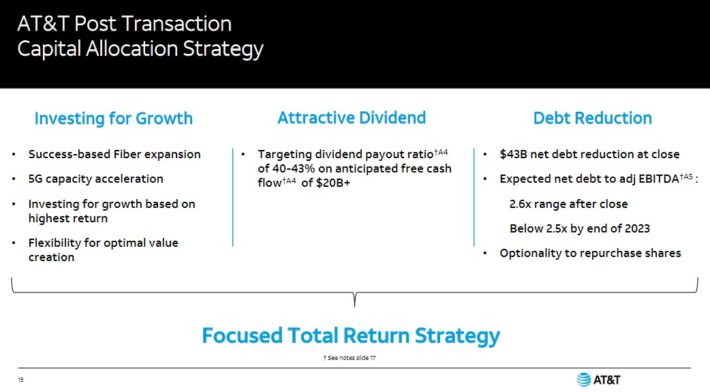

Following the close of the transaction, the remaining AT&T business expects low single digit revenue growth, mid-single digit adjusted earnings-per-share growth, $24 billion in annual capital expenditures, a net-debt-to-EBITDA ratio of 2.6x and a resized dividend (to account for the distribution of WarnerMedia) equaling 40% to 43% of $20+ billion in free cash flow.

Source: Investor Presentation

This implies ~$8 billion in annual dividends (~$1.15 per share) compared to the current $2.08 annual payment.

A revised dividend of $1.15 per share would equal a current dividend yield of 4%. This is likely to be viewed as a disappointment for investors accustomed to receiving a high yield of ~7% from AT&T.

It is possible shareholders may receive a dividend from the new company once the merger is complete, although investors have no guarantee of this. For what it’s worth, Discovery does not currently pay a dividend to its own shareholders. Even though AT&T shareholders will own nearly 30% of the combined company, it remains unlikely that dividends, even in the aggregate, will equal the current $2.08 per-share payout.

Reasons For Optimism

While income investors never want to see one of their stock holdings cut its dividend, particularly a Dividend Aristocrat such as AT&T, there are reasons for shareholders to be optimistic. The new AT&T is going to be much more simplified and slimmed down, with a renewed focus on the core telecommunications businesses that made AT&T into the industry giant it is today.

This also means AT&T will likely have an improved financial position with less debt. Investors should keep in mind that paying down debt has been a financial priority for AT&T in the past several years. The mega-merger with Discovery is not the only deal AT&T has made; the company previously announced a number of asset sales and other moves, all with the goal of deleveraging.

For example, on February 25th AT&T announced it will spin off a separate company called New DIRECTV that will own the DirecTV satellite TV business, as well as AT&T TV and U-verse video. AT&T will sell 30% ownership to TPG for approximately nearly $8 billion, which will also be used to pay down debt.

Therefore, while AT&T’s dividend reduction will be a negative for shareholders in the short-term, it could pave the way for a return to dividend growth down the road. And, AT&T returning to a focus on telecommunications could help the company better compete with its fierce rivals Verizon Communications (VZ) and T-Mobile US (TMUS), both of which are investing heavily in 5G.

Valuation & Expected Returns

Our calculations of expected returns include three key inputs: future earnings-per-share growth, dividends, and any change in the valuation multiple (indicated by the P/E ratio). We are reiterating our expectations of 3% annual earnings-per-share growth for AT&T, as well as its $35 per share fair value which is unchanged from our previous estimate.

We believe the spin-off could unlock greater value than the current company holds. Therefore, the recent sell-off in AT&T stock after the merger announcement is a potential buying opportunity. With a current share price of ~$29, a fair value estimate of $35 plus the 7% current dividend yield implies a total expected return of more than 13% per year. As a result, AT&T stock remains a buy.

Final Thoughts

AT&T’s announcement to spin off its media assets into a merger with Discovery is likely to result in a reduced dividend once the transaction is complete. On the other hand, the various transactions AT&T has announced in recent months pave the way for a slimmed down, more efficient company with an improved growth outlook and a healthier balance sheet.

Whether investors should continue to hold the stock depends on the individual investor’s goals. For investors solely focused on current dividend income, AT&T’s reduced dividend could be reason to sell, although the stock should still yield in the area of 4% based on the current share price. This yield is on par with the dividend yield offered by Verizon.

Plus, investors who were also concerned by AT&T’s high debt levels and slowing growth, may find reason to hold the stock due to the company’s renewed growth potential.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

Hope ur right