AT&T Inc.: Is It A Buy?

Image Source: Unsplash

One of the cheapest stocks in our Stock Screeners is:

AT&T Inc (T)

The wireless business contributes nearly 70% of AT&T’s revenue. The firm is the third-largest US wireless carrier, connecting 72 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 16% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access, serving 14 million customers. AT&T also has a sizable presence in Mexico, with 23 million customers, but this business only accounts for 4% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

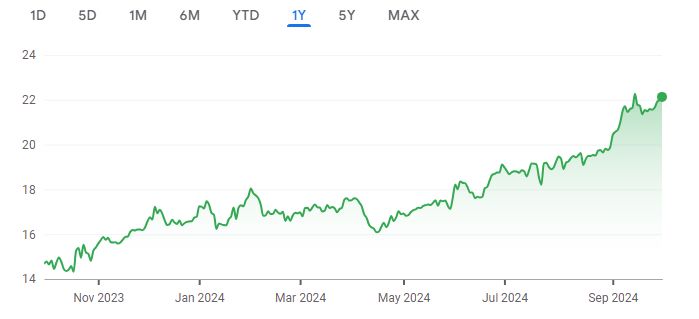

A quick look at the share price history (below) over the past twelve months shows that the price is up 50.85%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $158.7 Billion

Enterprise Value: $319.31 Billion

Operating Earnings

Operating Earnings: $24.69 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 12.90

Free Cash Flow (TTM)

Free Cash Flow: $20.99 Billion

FCF/MC Yield %:

FCF/MC Yield: 13.23

Shareholder Yield %:

Shareholder Yield: 5.30

Other Indicators

Piotroski F Score: 8.00

Div Yield %: 5.20

ROA (5 Year Avge%): 6

More By This Author:

Caterpillar Inc. Valuation: Is The Stock Undervalued?

TotalEnergies SE: Is It A Buy?

Exxon Mobil Corp. DCF Valuation: Is The Stock Undervalued?