Caterpillar Inc. Valuation: Is The Stock Undervalued?

Image Source: Pixabay

As part of an ongoing series, each week we typically conduct an analysis on one of the companies in our screens. This week, however, we will take a closer look at a stock that is not currently in our screens: Caterpillar Inc. (CAT).

Profile

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world’s largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial.

Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Recent Performance

Over the past 12 months, the share price has moved up approximately 46.50%. Please note that the numbers provided are as of Oct. 10, 2024.

Source: Google Finance

Inputs

- Discount rate: 7%

- Terminal growth rate: 2%

- WACC: 7%

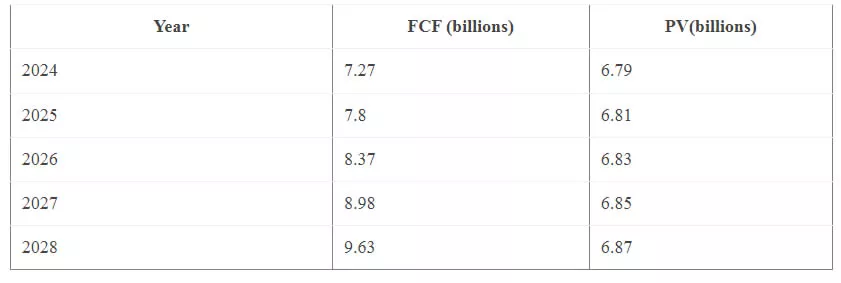

Forecasted Free Cash Flows (FCFs)

Terminal Value

- Terminal Value = FCF * (1 + g) / (r – g) = 196.45 billion

Present Value of Terminal Value

- PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 140.07 billion

Present Value of Free Cash Flows

- Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 34.16 billion

Enterprise Value

- Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 174.22 billion

Net Debt

- Net Debt = Total Debt – Total Cash = 32.97 billion

Equity Value

- Equity Value = Enterprise Value – Net Debt = 141.25 billion

Per-Share DCF Value

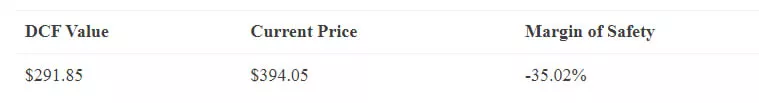

- Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $291.85

Conclusion

Based on the DCF valuation, the stock seems to be overvalued. The DCF value of $291.85 per share is lower than the recent market price of $394.05. The margin of safety is around -35.02%.

More By This Author:

TotalEnergies SE: Is It A Buy?Exxon Mobil Corp. DCF Valuation: Is The Stock Undervalued?

Eli Lilly And Co DCF Valuation: Is The Stock Undervalued?