ATO: One Of My Favorite Utilities In A Booming Market

Image Source: Unsplash

Second-quarter earnings results and guidance updates are all in for CUI Portfolio recommendations. The big takeaway: The best-in-class are not just crushing it as businesses. They’re setting up for even better to come over the next few years. One of my favorite names is Atmos Energy Corp. (ATO).

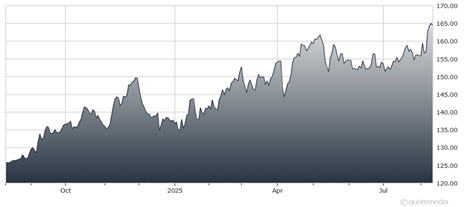

Not every utility stock I track has made money so far in 2025. But the average return for stocks of the 41 companies represented in the portfolios is 13.4%, well ahead of the Big Tech-burdened S&P 500 Index (SPX) year-to-date.

Atmos Energy Corp. (ATO)

Utilities are providing the “picks and shovels” for the ongoing Artificial Intelligence (AI) gold rush. There’s reason to doubt some of the more expansive projections for future electricity demand. But actual company results and guidance show clearly that growth is already the fastest since the 1950s.

The lowest-risk investments are in the regulated power and natural gas grid. These days, Capex is pre-approved by regulators and investment is usually recovered as incurred in rate riders. That’s a huge change from the 1970s and 80s, when utilities did all the work and spending before regulators decided (with 20-20 hindsight) how much cost recovery to allow in rates as “prudent.”

It can take years to build a major power transmission line or natural gas pipeline. But most grid projects are completed in months, which means companies can keep tight control of costs. It adds up to extraordinarily predictable and robust earnings growth. Unfortunately, finding an energy distributor trading at a good entry point has been challenging the past couple years.

My favorite in the sector is ATO. It just boosted its FY2025 (ending Sept. 30) earnings guidance for the third time this year. It’s a great company. But if you buy the stock now, just know you’re going to get a yield of barely 2%.

More By This Author:

O’Reilly Automotive: A "Cannibal" Stock That You Should Consider

HD: A Housing Sector Bellwether That Offers Solid Value

Fed: What Miran Nomination Means As Labor Market Questions Swirl

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more