HD: A Housing Sector Bellwether That Offers Solid Value

Image Source: Unsplash

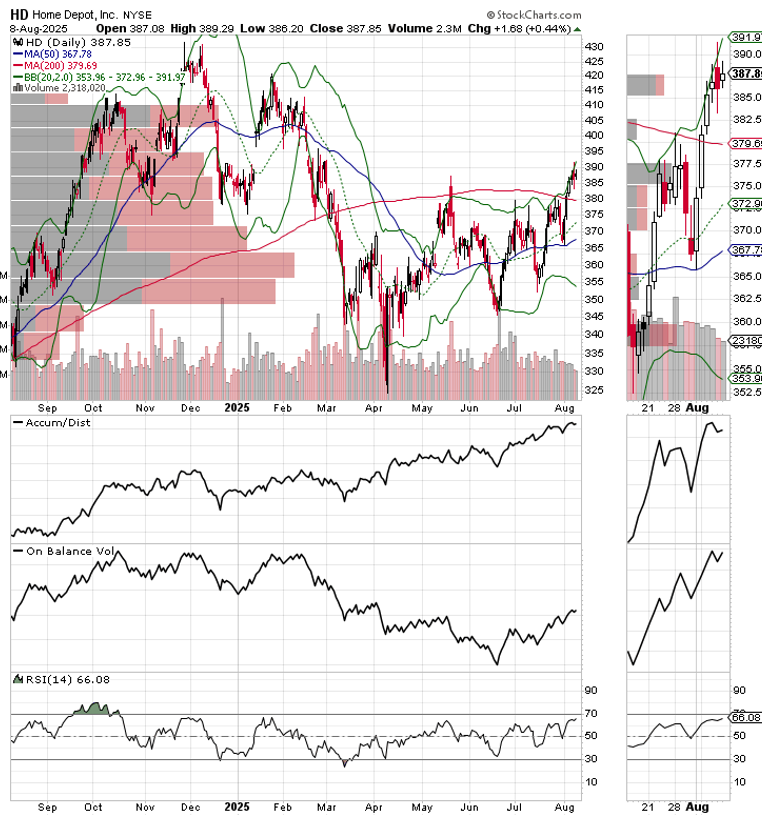

The stock market is nearing a major decision point whose outcome will likely define the next several months of trading action. Since there are areas of the market which are starting to register positive money flows, I am putting some well-targeted money to work. That brings me to Home Depot Inc. (HD)

Over the last few weeks, I’ve been chronicling the improved performance of the homebuilder sector. Last week, I highlighted the improvement in the shares of the largest homebuilder in the US – DR Horton Inc. (DHI). It so happens that DHI, which I own, and which is a holding at the Weekender portfolio is still trending higher, although it’s due for a bit of a rest.

As for HD, it’s a bellwether for the home improvement section, and to some degree reflects the status of the US consumer and perhaps the existing home market. That’s because potential sellers like to fix their homes before they put them on the market.

My recent trips to Home Depot have been surprising as the store traffic has been fairly robust, especially in the garden center and landscaping. The number of pro trucks in the parking lot also seems to be increasing.

My point is that Home Depot’s earnings, to be released on Aug. 19 should be interesting, especially if the company lifts some of the gloom it’s put forth over the last couple of reports. Revenue growth has been muted and earnings have come in close to estimates on good quarters.

What’s most remarkable about the recent rebound in homebuilding stocks is that: 1) No one is paying attention…2) No one believes it’s happening when you tell them about what you see…and 3) the recovery is happening in the face of no rate cuts from the Federal Reserve.

In other words, the action in the homebuilder sector smells of smart money slowly building long-term positions in an area of the market which is offering value.

More By This Author:

Fed: What Miran Nomination Means As Labor Market Questions SwirlLHX: A "Triple Beat" Earnings Play In The Defense Sector

XLP: Gains Likely After Put-Call Ratio Signal Triggered

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more