ASML Holding: A Chip Equipment Play In A Strong, But Narrow, Market

Image source: Pixabay

Inflation cooled for the second straight month in May, the US labor market seems back to pre-pandemic levels, and the economy is expanding at a low but steady pace. Therefore, the Fed is holding back on interest rate cuts. Probably the right move. Keep the ammo dry for when it is really needed. Meanwhile, I like ASML Holding NV (ASML), writes Carl Delfeld, editor of Cabot Explorer.

A wall of active and passive money flows still supports the stock market, though the narrowness of the rally bothers me a bit. The 10 largest stocks represent about 34% of the value of the S&P 500 versus 27% in 2000 – right before the sharp dotcom-era pullback.

Volatility is also picking up, with more stocks experiencing sharp swings even on days that the overall market moves very little. This ought to be a great setup for stock picking. My goal is to help you navigate the risk and uncertainty that is out there, but not at the expense of missing out on opportunities.

This is why we start with a solid ETF base, add some dominating blue-chip stocks, and then add a layer of disruptive, aggressive stocks that offer us more upside potential for taking on more risk and volatility.

The key is to have some balance – to avoid going overboard in any sector or chasing any trend since the future is unknowable.

ASML Holding NV (ASML)

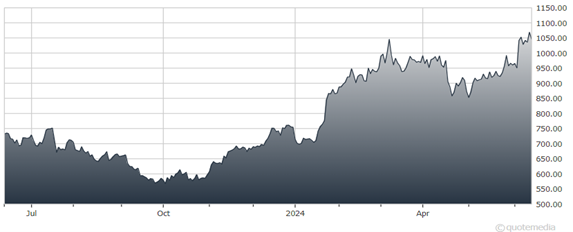

As for ASML Holding, its shares recently popped from 1,045 to 1,069 in their first week as a recommendation. ASML Holding makes the lithography equipment that manufacturers use to make advanced chips.

By 2026, ASML Holding's revenue could reach at least $40 billion as the market for AI chips is projected to grow at an annual rate of 36% through 2030. This is an aggressive stock trading at a high multiple to earnings and sales, so you may want to move incrementally in building a position.

My recommended action would be to consider buying shares of ASML Holding.

About the Author

Carl Delfeld is chief analyst of Cabot Explorer published by Cabot Wealth Network. He is also the managing editor of Far East Wealth and chairman of the William H. Seward Center for Economic Diplomacy. Over the past three decades, he has held senior positions in business, finance and government, was a Forbes Asia columnist and author of Red, White & Bold: The New American Century.

More By This Author:

Tech: Don't Let Hedge Fund Selling Scare You Out Of These Market Leaders

Gold And Silver: Updated Targets And Forecasts For The Next Phase Of The Rally

D: Should You Buy The Utility As An AI Power Play?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more