Are Retail Investors About To Be Blown Up?

Manage WebsitePreviewAdd Widget to PageCreate New PagePage Settings

TalkMarkets Image Library

By Staff

SECTOR: Basic Materials / Commodities

(additional keywords: shipping, crops, coffee, soybeans, grain)

Image Source: Unsplash

Image Source: Pixabay

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

SECTOR: Capital & Industrial Goods

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image source: Unsplash

SECTOR: Communications

Image Source: Unsplash

Photo by Galen Crout on Unsplash

Image Source: Unsplash

Image Source: Pexels

Image Source: Unsplash

SECTOR: Conglomerates

Image Source: Unsplash

Image Source: Unsplash

SECTOR: Consumer Goods

(additional keywords, retail stores, malls, food, clothes, electronics, retail, ecommerce)

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Pixabay

SECTOR: Energy

(Additional Keywords Solar, wind, alternate energy, gas, crude, oil, EV, electric)

Image Source: Unsplash

Image Source: Pixabay

Photo by Timothy Newman on Unsplash

NATURAL GAS

Image Source: Unsplash

Photo by American Public Power Association on Unsplash

Photo by American Public Power Association on Unsplash

Photo by Martin Adams on Unsplash

SOLAR/WIND RENEWABLE ENERGY

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pixabay

Image Source: Unsplash

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pexels

Image Source: Pexels

Image Source: Unsplash

Image Source: Pexels

Image Source: Unsplash

SECTOR: Financial

Image Source: Pixabay

Image Source: Pexels

Image Source: Unsplash

SECTOR: Gold/Precious Metals (Gold, Silver, Copper, Platinum, Palladium)

Image Source: Unsplash

Image Source: Pixabay

Image Source: Pixabay

.webp)

Photo by Zlaťáky.cz on Unsplash

Photo by Dmitry Demidko on Unsplash

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pixabay

Image Source: Unsplash

Image Source: Unsplash

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pexels

Image Source: Unsplash

Image Source: Pexels

Image Source: Pixabay

Image Source: Pixabay

SECTOR: Healthcare

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pixabay

Image Source: Pexels

Image Source: Pexels

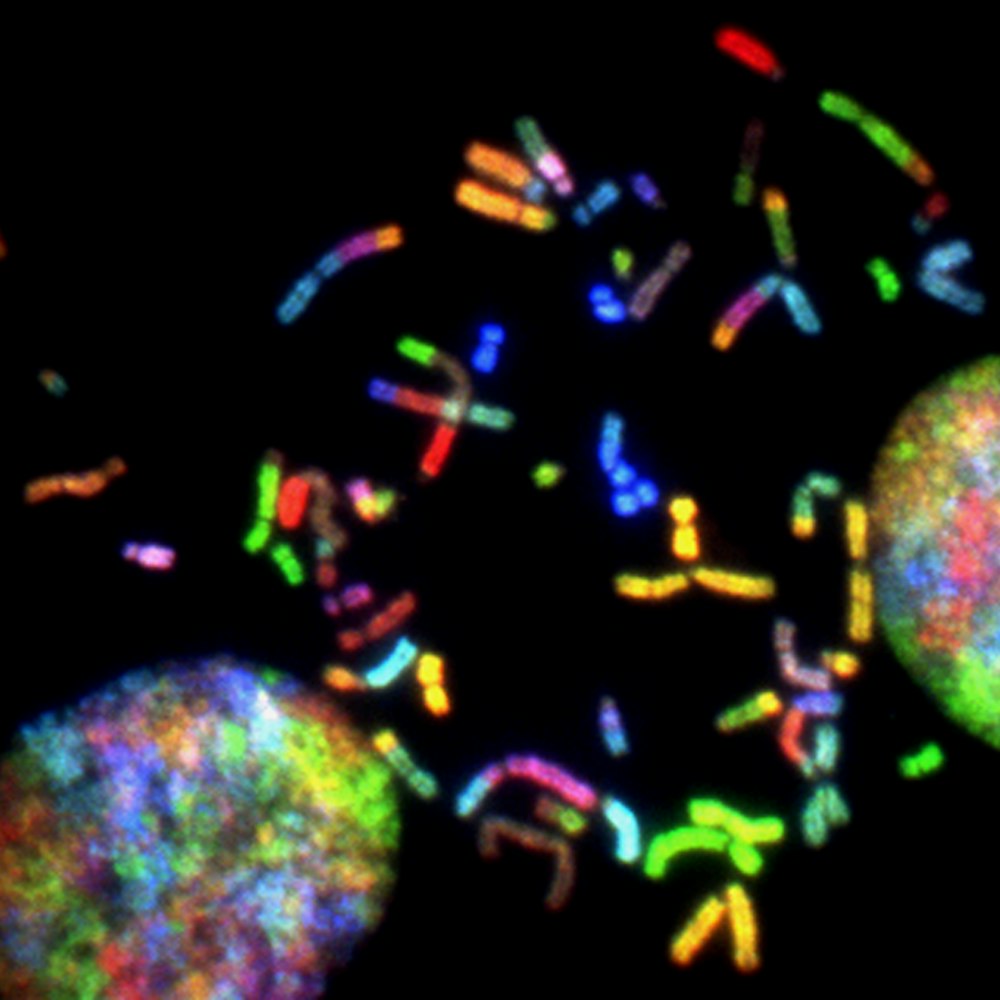

SECTOR: Pharma/Biotech

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Unsplash

Image Source: Pixabay

SECTOR: Services

Image Source: Pexels

Image Source: Pexels

Image source: Unsplash

Image Source: Pixabay

SECTOR: Technology, AI , artificial intelligence

Image Source: Unsplash

Photo by Mohamed Nohassi on Unsplash

Photo by Steve Johnson on Unsplash

Photo by Steve Johnson on Unsplash

Image Source: Unsplash

Are Retail Investors About To Be Blown Up?

You know the stock market is frothy when your doorman or landscaper is bragging about how much they made in the stock market this year buying artificial intelligence (AI) stocks.

Retail investors have plowed into AI and AI adjacent stocks. Of course some of these companies will continue to do very well and others are all hype.

For example, allegations of investment fraud have been leveled against an AI company called “Builder.ai” which recently filed for bankruptcy. Supposedly, Builder.ai claimed to be able to build apps faster and cheaper than the competition with unique AI capabilities. In reality, it was largely developer driven. Sadly, this will be the first of many casualties in the ever so hot AI space.

Retail customers have also flocked to private equity investments that have had spectacular failures such as First Brands and Tricolor. JP Morgan’s Jamie Dimon commented that there are likely more ”cockroaches” in the private equity space.

We’ve seen this movie before and know that it ends badly for mom and pop investors.

In 2000, the Nasdaq “dot com bubble” burst resulting in customer losses of 80% or more.

In 2008, the Great Financial Crisis wiped out investors holding once solid bank stocks such as Lehman Brothers, Bear Stearns and Wachovia.

In a new book on the Great Depression titled “1929”, noted financial author Andrew Ross Sorkin observed that he fully expects an AI market crash—he just doesn’t know when and how bad it will be.

Retail investors whose brokers pushed them to put a large percentage of their portfolios in AI stocks would be wise to consult with an investment fraud attorney.

More By This Author:

The Easterly Fund Goes South

Private Equity Dumped On The “Dumb Money” Crowd

Investor Rights In A Margin "Blowout"

Disclaimer:This article does not contain investment, tax or legal advice.