April & Q2 Setting Up Nicely For The Bulls But Concerns Remain

Let’s focus on April and what it seasonally brings to the stock market. We know that it is a historically strong month for stocks, especially in a pre-election year. We also know that when it begins the month in an uptrend, it averages more than 1% return. We also know that the super strong trends that began at last November’s election continue this month and through Q2.

Regarding Q1 ending, when the stock market does not breach the lowest levels from December, the rest of the calendar up is up roughly 90% of the time. And when Q1 is higher against the backdrop of weak previous year, it also calls for higher prices for the next 9 months. In short as bullish as I was in Q4 2022 because of the overwhelmingly strong seasonal stats, it’s hard to temper that enthusiasm with what I see today.

Of course, the day-to-day data and geopolitical news make it more difficult to see the forest through the trees, but that’s what makes coming to the office so fun each and every day.

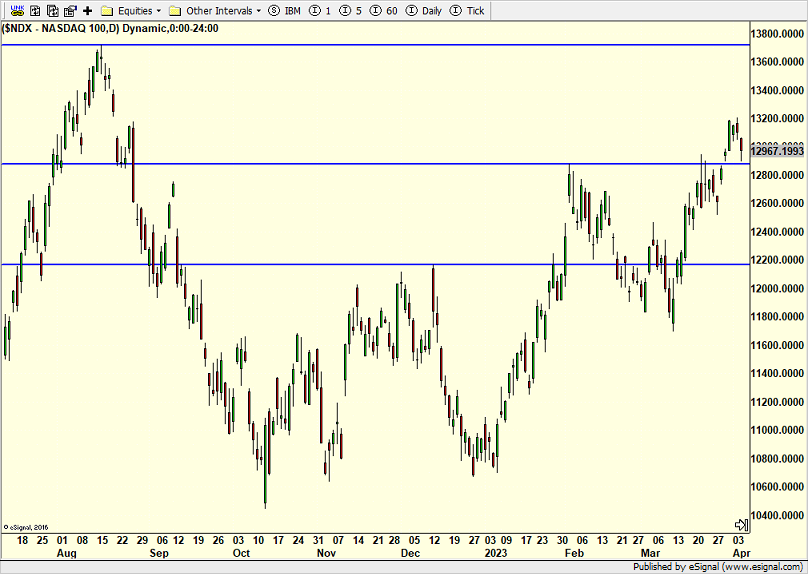

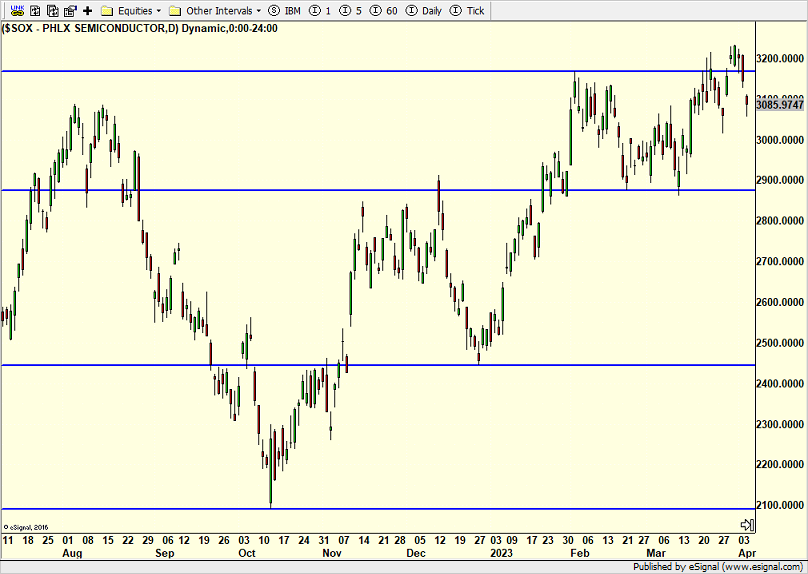

The NASDAQ 100 and Semiconductors (SOX) continue to lead and neither appears to be petering out right here. It is important that pullbacks are mild.

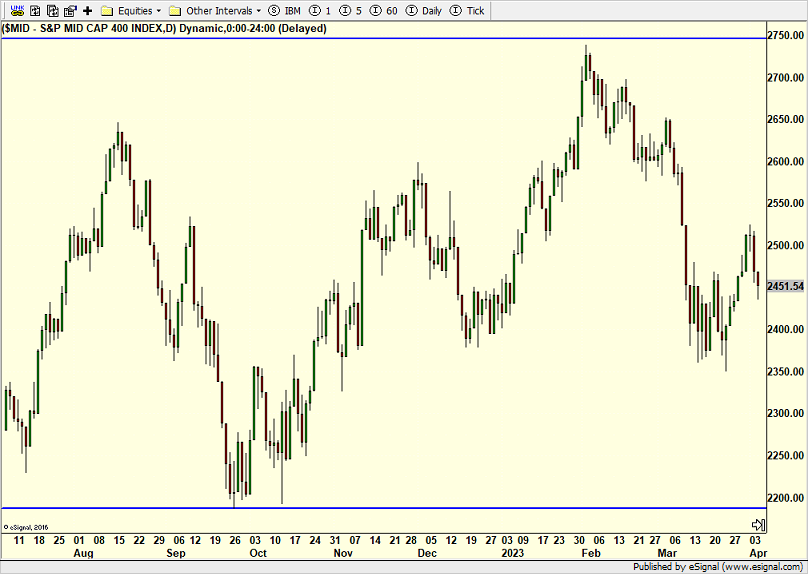

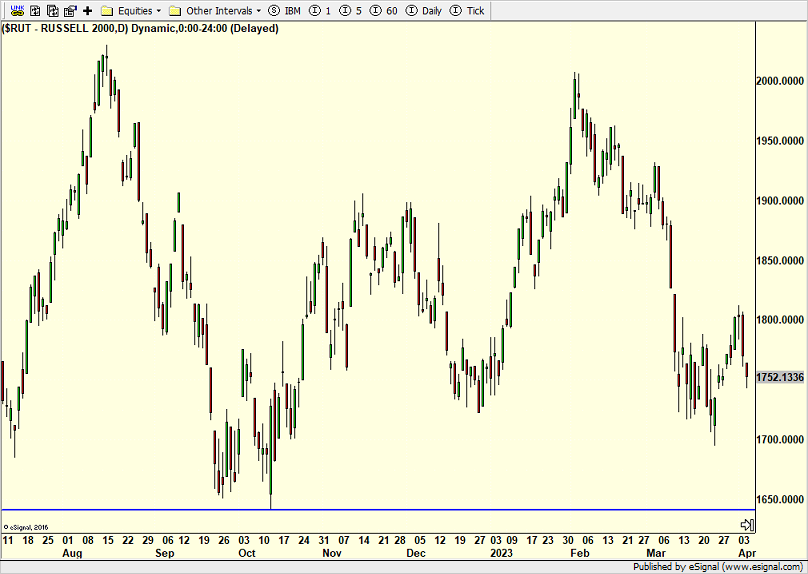

On the flip side, the S&P 400 and Russell 2000 are lagging badly. It doesn’t matter why nor the narrative being spun. It is not good and needs to be repaired.

A big response to tomorrow’s employment report is coming. We will learn if bad news is bad news or bad news is good news or vice versa. That reaction will tell us a lot about what’s coming this quarter and what sectors will lead.

It’s been 9 years since the UCONN men earned a Final Four berth and subsequent national championship. Most schools have never been to one. What a great victory for the team, school and state of CT! It was such a fun weekend in Houston and I am glad my daughter was with me to enjoy and celebrate. The little guy made the freshmen baseball team so he had a tough decision to make. Go to Houston and miss baseball or miss what could be a one shot opportunity. Missing baseball would mean being in the doghouse for a while. He chose baseball. Good life lesson about difficult decisions.

Markets are closed for Good Friday but the government is still releasing the all-important employment report. That’s obnoxious and disrespectful to those observing the holiday. I hate when they do that. My plan was to head north for some spring skiing and pack up for the season. Then I saw the highs only about 30 and our mountain not closing until April 23rd. First world problems.

On Tuesday we bought levered S&P 500 and more levered NDX. We sold levered inverse S&P 500. On Wednesday we bought HFLAX, more levered NDX, more PCY, and more EMB. We sold some IWN.

More By This Author:

New Month & Quarter – Could Banks Be A Winner?

How A 2023 Recession May Impact The Elderly

Seasonals Remain Strong – Banks Still Key

Please see HC's full disclosure here.