Apple: Buy Adobe, Not Tesla

I appreciate Mark Hibben's analysis of Apple's (NASDAQ:AAPL) opportunity in electric vehicles. However, I strongly disagree with the call of a Business Insider writer's call for Apple to buy Tesla (NASDAQ:TSLA). I opine that paying $26 billion just to avail of Elon Musk's future-thinking vision and Tesla cars' premium branding might not be the best option for expansion.

I appreciate Mark Hibben's analysis of Apple's (NASDAQ:AAPL) opportunity in electric vehicles. However, I strongly disagree with the call of a Business Insider writer's call for Apple to buy Tesla (NASDAQ:TSLA). I opine that paying $26 billion just to avail of Elon Musk's future-thinking vision and Tesla cars' premium branding might not be the best option for expansion.

Musk's decision to give away all of Tesla's patents made the electric vehicle business a more crowded space. Apple is thermonuclear-selfish when it comes to protecting its patents. Musk's generous approach to intellectual property allows anybody to create a high-end clone of a Tesla car at one-half the price tag.

Unlike the walled-off iOS ecosystem, the electric vehicle after-sales monetization would not be under the exclusive control of Apple. Due to the open-source nature of Tesla's patents, any company would have the right to market their products to future Apple's electric car owners without prior consent of Apple.

Toyota (NYSE:TM) has also decided to give away its thousands of patents on fuel cells. Tesla's gigafactory of lithium-ion batteries now faces a tough competitor with an open-source hydrogen fuel cell EV platform. Toyota is a proven winner when it comes to making luxury and consumer cars.

Honda (NYSE:HMC) and Hyundai (OTC:HYMTF), both global car leaders, are also advocates for hydrogen fuel cell-powered electric vehicles. Musk mocks the hydrogen fuel cell concept. However, John Voelcker wrote a very compelling article highlighting the advantages of hydrogen fuel cell batteries.

My point is that Tesla is a risky move against well-entrenched leaders of the automobile industry. I opine that Adobe (NASDAQ:ADBE) is a better option for Cook's diversification strategy.

Adobe, Like Apple, Loves Protecting Its Intellectual Property

Adobe has an almost-monopoly grip on graphic design software - which made the stock market value this software vendor at P/E ratio of 148.98. Adobe, like Apple, became successful because of its adamantly protective approach to its products. Before buying rival graphics & design software vendor Macromedia in 2005, Adobe won a patent suit against Macromedia in 2002.

The patent infringement suit involved Adobe's user interface-related "tabbed palette" technology. Apple also sued rival Samsung (OTC:SSNLF) on user interface matters. Cook made it very clear in 2009 that he shares the late Steve Jobs' intense desire to protect Apple's patents.

Unlike Elon Musk, Jobs was not very generous when it came to patents. Rumor has it that Jobs threatened to use patent litigation to enforce a no-hire agreement he struck with other tech giants. Tesla's open source approach to patent is therefore very much in contrast to Apple's continuing fortress-like defense of valuable patents.

Software As A Service Is Safer Than Selling Electric Vehicles

The majority of creative professionals in the world today are still heavily dependent on Adobe software because nobody is allowed to copy the user interface of Adobe Photoshop, Illustrator, Premiere, After Effects, and Adobe Acrobat. Even a switch to Software-as-a- Service (SaaS) business model did not lessen Adobe's almost-monopoly leadership in graphic & design software.

The initial angry reaction to Adobe's switch to a monthly subscription for its creative suite died down. In spite of the many free or cheaper alternatives to Adobe's design software, the ever-increasing number of subscribers to Adobe's monthly offer indicates professional designers still love Adobe.

In spite of Adobe's high P/E ratio, the management of that company are superoptimistic by announcing a $2 billion buyback program. Adobe's management estimates that 2015 will deliver 6.1 million Creative Cloud subscribers, and 8.2 million by end of 2017.

I doubt if Musk is as confident as Adobe's leaders when it comes to the future of Tesla cars. Selling software as a service is a business that is not subject to import taxes, government regulation, and production delay. Potential lawsuits against Apple electric cars is not farfetched; even the geniuses at Tesla cannot prevent their cars from joining the list of many cars going up in flames.

Selling software is safe, profitable, and is never hostage to short supply of components (like what the iPhone 6 Plus experienced last year). Renting out software also only requires a small team of programmers to come up with regular updates and bug fixes.

Adobe enjoys gross margin of 85%, and the company's willingness to cater to the amateur/freelance designer by renting out its software very cheaply only increases the total addressable market of its products. Adobe's flagship product, Photoshop, can be rented for just $9.99 per month.

The low subscription fees of Adobe CC software means free alternatives like GIMP or nkscape cannot compete with Adobe's monopoly of professional graphic design.

Conclusion

The electric vehicle business is crowded by many mega-cap players like Toyota, General Motors (NYSE:GM), Ford (NYSE:F), Honda, and Hyundai. Those automobile giants' penchant for price wars (even for luxury car models) will make it hard for Apple to attain leadership status in electric cars.

Compared to Tesla, Adobe offers immediate profitability, consistent growth, and a huge base of loyal customers. The design industry is devoted to Mac hardware and Adobe software. Apple can benefit from Adobe's strong revenue stream as an option against any future decline in iPhone sales.

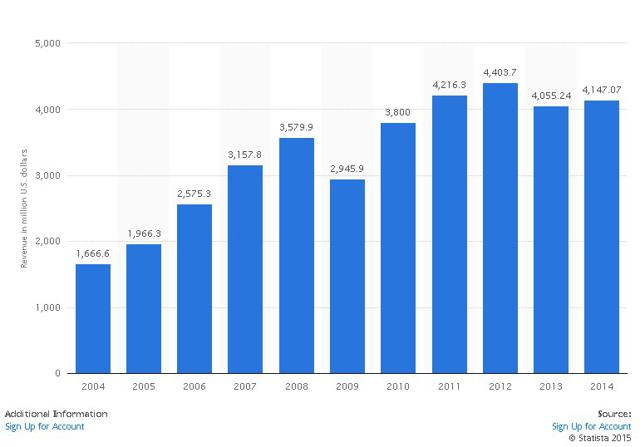

Statista's chart below reveals Adobe's expansion as a cloud service operator is also helping that company maintain over $4 billion/year revenue success. Adobe is not only helping graphic artists design ads, it is now also a cloud-based advertising/marketing company.

(click to enlarge)

Acquiring Adobe gives Apple an instant foothold in the CRM and e-marketing industries. Adobe is certified as the leader when it comes to Enterprise Marketing Software Suites. You can read Forrester Research's report to understand better why Adobe is emerging as a giant digital marketing.

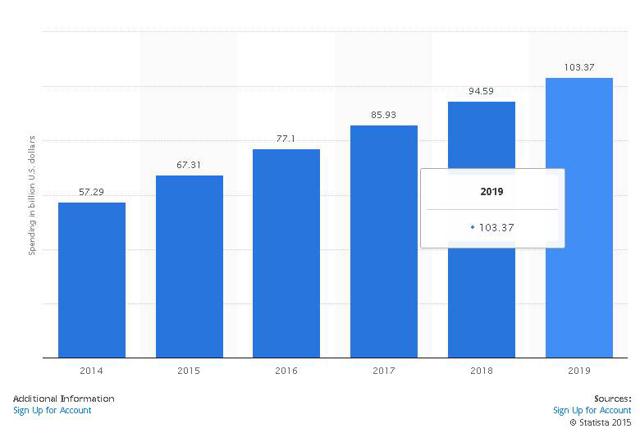

Getting involved in digital marketing is good for Apple. In the U.S. alone, Statista predicts that digital marketing will be worth $103.37 billion.

(click to enlarge)

I reiterate my Buy rating for AAPL. I am not worried about the recent patent setback suffered by the company. The dip in AAPL's price should not linger for long. Apple also lost a patent trial against VirnetX but the decision was reversed last year. Apple will appeal the verdict and I hope that the company's highly paid lawyers will again overturn the first Smartflash judgment.

Adobe is also a Buy. Tesla is NOT a Buy.

Disclosure: The author is long AAPL

As unlikely and nonsensical as it is, Apple buys Adobe I'm switching to Corel.

Go! No one is preventing you to go. We're happy to see you switch to Corel.

Apple will certainly not find it easy to prosper with Tesla and the Lithium battery against Hydrogen power and Toyota and other established global automotive giants. In fact, Apples'' rivals must be rubbing their hands in delight, at the prospect of the Giant being 'brought down'' by any rash decision to buy Tesla.

And support Windows? No way :)

I never see this happening. Adobe sells to the pro market and that's not where Apple positions itself.

Just an observation, but why doesn't $AAPL buy $DIS, $BBRY, $CALL and/or private company's Soundhound and Soundcloud? This way they have content, enterprise, and social/mobile with money to spare!

Please Apple will not buy Adobe. First Apple waged war against Adobe, thus there is bad blood. If they did they would be investigated by the government for monopolistic practices. Then Adobe would find half it's customers switch to another solution rather than giving money to their enemy. Last Adobe is already a very overpriced stock right now.

Tesla is equally bad. Although Tesla is a early adopter of electric cars it is by far not proven to be a long term winner. Likewise, it rebuffed Apple's dances to become a rolling iTunes box as did most other car companies for good reason. And Tesla is also ridiculously expensive given they only make a profit off of government subsidies. If anything taxpayers, especially California taxpayers should buy it out to save money by cutting the numbers of cars made, not the reverse.

Just to play devil's advocate... bad blood doesn't preclude an acquisition. By definition, isn't that what a hostile takeover is?

True, however, Apple for good reason doesn't acquire companies that don't like to be taken over. I have yet to recall any instance of it. For one thing it would be terribly expensive given their market cap. For another, technology wise they would tend to lose all the people they probably want. Also, usually they create bad blood for a good reason and acquiring them would be an admission of defeat. And last, in Adobe's case they would not just lose their existing business but get swatted with anti-trust investigations which would preclude from buying them even if they wanted to.