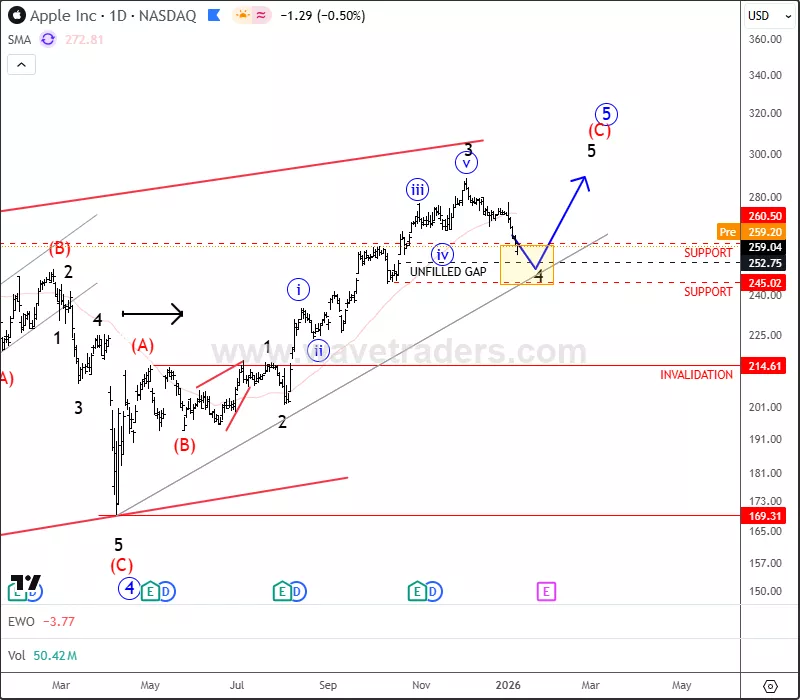

Apple Approaches Potential Final Push Within An Ending Diagonal Structure

Photo by Bangyu Wang on Unsplash

We talked about Apple (AAPL) back in October 15 and then on November 18 of 2025, and it's moving nicely higher as anticipated.

Apple has been trading steadily higher throughout most of the second half of 2025, confirming that the broader uptrend remains intact. Price action continues to respect rising support levels, but recent developments suggest the rally may be entering a more mature phase.

From a technical perspective, Apple is currently unfolding a wave four pullback within the ongoing advance. This correction is a normal part of an uptrend and may still offer a base for another push higher. Ideally, the pullback should find support near the 252 area, where a rising trend line from April intersects with current price action, making this level a key zone to monitor.

AAPL Daily Chart

If support around 252 holds, Apple could still see one more rebound toward the upper boundary of the current ending diagonal structure. However, while additional upside remains possible, such formations often signal slowing momentum and increasing risk as the trend progresses.

In summary, Apple remains constructive as long as it holds above key support, but traders should be mindful that the market may be approaching the later stages of this move. Any further advance could represent a final push before conditions become less favorable.

For a detailed view and more analysis of other single stocks, you can watch our latest video analysis: DIRECT LINK

More By This Author:

GBPUSD Update: Cable Eyes Corrective Dip After Extending Rally

EURAUD: Bearish Momentum Returns Into 2026

Alphabet – Bullish Impulse Continues; Wave 5 Setup Emerging