Americans Are Waking Up To The Consequences Of U.S. Tariffs Aimed At Canada

Image Source: Unsplash

Yesterday, Canada chose a new Prime Minister, Mark Carney, former Governor of the Bank of Canada and Bank of England. He and his ruling Liberal party have been preparing for the rash of US tariffs, ever since Trump was elected. Despite the on-again, off-again nature of Trump’s tariff policy, the Canadian authorities have not budged from their hard line response to US tariffs. Carney has been instrumental in formulating Canada’s response and his hardline position remains so.

Meanwhile, Americans are just now coming to grips with the implications for their economy of tariffs. Claiming that the US does not need what Canada produces, Trump took dead aim at the essential US imports, only to waffle on theirstarting dates and then on the actual level of tariffs . The lack of clarity is affecting all economic decisions in both countries. More importantly, Canadians do not understand what Trump is asking Canada to do in exchange for removing tariffs. The Canadian government has always considered that Trump’s claims regarding the flow of illegal immigrants and the flow of illegal drugs across the border never constituted a valid grievance. Now, Trump, simply, lashes out with a new batch of tariffs, almost daily, with no rationale.

On a macro level, the uncertainty created by Trump’s volatile behaviour has already dampened consumer confidence and boosted inflation expectations. The Atlanta Fed’s GDPNow calls for a first-quarter GDP decline of 2.8%. Inflation is expected to be boosted by as much as 0.8%. The US economy is not that powerful that it can force its competitors to absorb the cost of these import taxes, a false claim made by Trump numerous times. A considerable portion of the tax burden will fall on the US consumer.

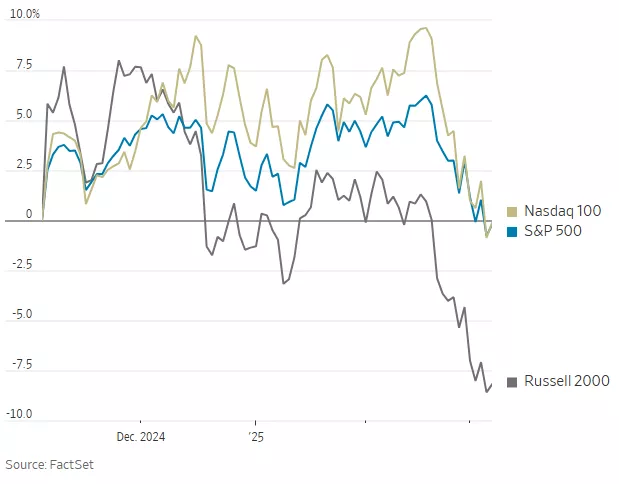

The US election released a widespread belief that Trumpian policies such as deregulation, tax cuts and reduced government spending would unleased growth. Investors piled into assets that stood the most to benefit from this new Administration. Alas, that euphoric has not lasted long, and the past month investors have undertaken to undo those previous trades. Stock indices continue to slide; bond yields drop; and the USD has fallen nearly 5% since mid-January. Going long Trump is no longer the favoured strategy.

Stock Indices Since the Election

Looking under the hood, there are significant Canadian exports subject to tariffs that clearly will harm the US economy. The stock marketlead the way in selling off when the Trump tariffs were announced. Individual industrial sectors quickly followed suit when supply chains were whipsawed as businesses tried to build up inventories in advance and seek out alternative suppliers, where possible, viz:

Canadian Lumber Exports. Canada is one of the world’s largest producers and exporters of softwood lumber and a major supplier to the US homebuilding industry. Upwards of 30% of softwood lumber consumed in the U.S. each year comes from Canada. Moreover, the U.S. is unable to meet demand from its own forestry industry. Homebuilders are left no choice but to pass the higher costs to their customers.Homebuilding has declined steadily over the past 6 months, and now face yet higher construction costs and a softening of demand.

Canadian Aluminum Exports. The U.S. is the world’s largest importer of raw aluminium, reaching US$ 1 billion in 2024. Canada accounted for 75 % of all US aluminium imports. The advantage of cheap electricity and easy market access, allows Canada to main this relative strong position. Putting tariffs on aluminum imports will just push up the cost of finished products, especially in the US auto industry.

Canadian Mineral Exports. Simply put, Canada remains the biggest source of US mineral imports, such as uranium, nickel, steel copper, and aluminium. Currently, the U.S. buys nearly $50 billion in mining products which are mostly headed for the defense, nuclear energy and heavy manufacturing industries. All these minerals are critical to the well-being of the US economy and its national security apparatus. Uranium serves as an example of how dangerous tariffs remain for US security interests, given that Russia and China dominate the world’s uranium enrichment capability.

Canadian Automotive Exports. Without question, the most complex and worrisome aspect of a North American trade war concerns the application of tariffs on auto parts .The North American auto industry is the most highly integrated industry in the region and represents just how vulnerable that industry is to an across-the-board tariff structure. The industry accounts for more than 10% of total regional trade and that equates to hundreds of billions of dollars in manufacturing activity throughout. No wonder industry executives have voiced the claim that tariffs would blow a hole in the North American auto industry.

Energy Exports. Oil and gas exports are subject to a 10% tariff. However, this is considerable confusion regarding electricity exports. In a pre-emptive move, effective today, Ontario will add a 25% surcharge on its power exports to Minnesota, Michigan and New York in response to Trump’s tariffs.

The markets have already started to prepare for a slower economy. The Fed faces a dilemma whether to drop rates to counter a possible recession or maintain rates to contend with tariff-induced inflation. The bond market has signalled that recession is on its way when 10-year Treasury yield dropped by some 50 bp in less than a month.

More By This Author:

One By One Trump Walks Back Tariffs Aimed At CanadaTrump Miscalculates His “Adversaries” In The Trade War

The Great Trump Trade Is Now Souring As Realty Sinks In