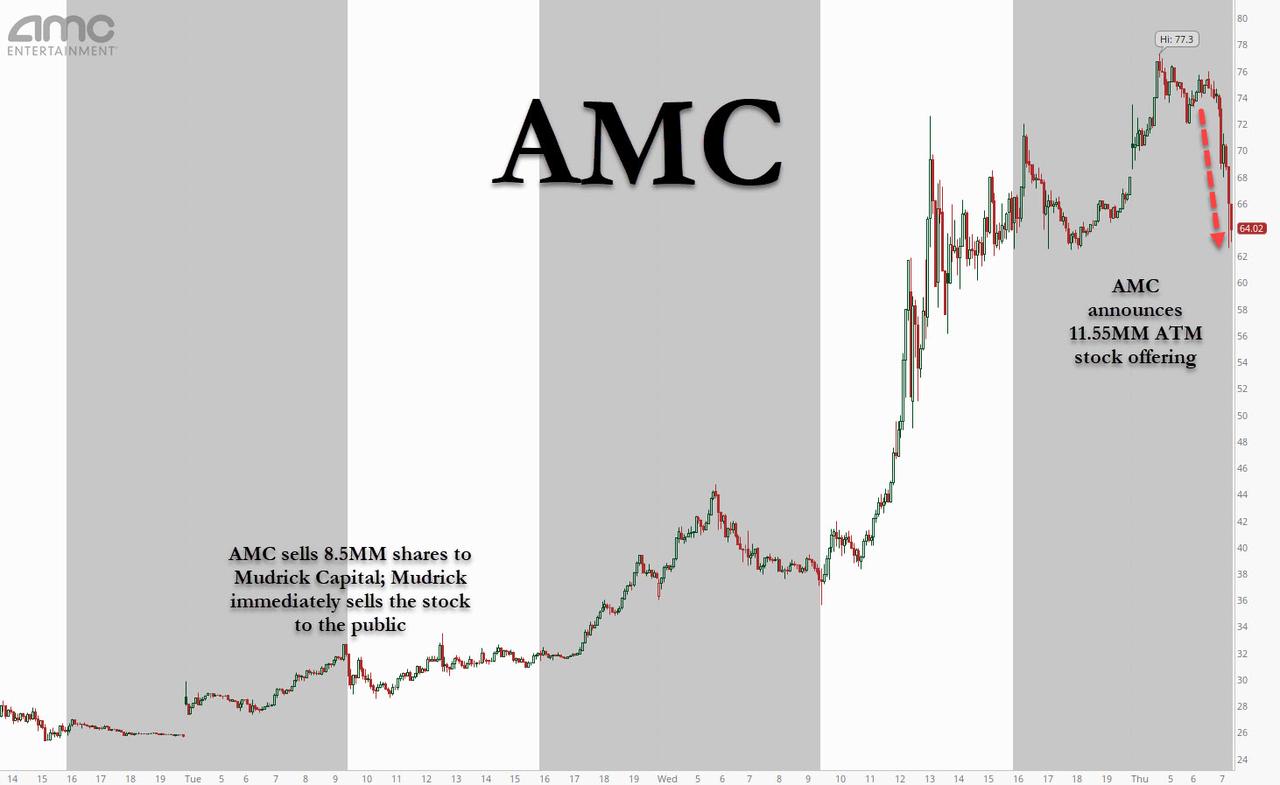

AMC Tumbles After Announcing It Will Sell 11.55 Million Shares Directly To The Public

Update: Finally, the stock is tumbling. Perhaps even retail investors realized that when AMC is pulling a Boiler Room-type "deal" to dump as much stock as it can, it will only end badly.

* * *

Last Friday, when meme stocks AMC and (to a lesser extent) Gamestop were soaring after the latest Reddit-raid decided to snuff out any remaining shorts while piling into the two legacy retail names, we said that the only question is "whether AMC management will surprise the Reddit army today or if it will wait until after the long weekend to unveil the latest dilution."

Well, a few days later, we learned that AMC did in fact wait until Tuesday to unveil that it had sold 8.5 million AMC shares to Mudrick Capital - which bought the shares at a premium the previous close just to aggravate the short squeeze - which we then learned immediately turned around the dumped the new share to Reddit at a profit.

In any normal world, this would have been sufficient to send the stock plunging, but not in this one, because the sale to Mudrick actually sent AMC stock surging 150%!

Predictably, emboldened by the sheer idiocy of Reddit, AMC CEO Adam Aron was not content with abusing the broken market, and one day after it launched a shareholder goodies program urging the company's millions of retail shareholders to "self identify" through the company's website, where they will receive "special offers" and "company updates" (including an initial offer of free large popcorn at any AMC-owned theater in the US)...

Today, AMC and I launch an innovative effort to communicate often with AMC shareholders. #AMCInvestorConnect gets you AMC Stubs benefits and ***SPECIAL SHAREHOLDER REWARDS*** for those who patronize AMC Theatres in the U.S. Sign up is completely free at https://t.co/b5l62CQlD0 pic.twitter.com/h42VGCCD1I

— Adam Aron (@CEOAdam) June 2, 2021

... the company decided to again pull the rug from under its retail shareholders and at 7am this morning AMC filed an 8K announcing it would sell 11.55 million shares in an At The Market offering - meaning it bypasses a selling syndicate and sells directly to the public - the kind popularized by Gamestop, and which will crater the stock in the coming days as every bout of buying by retail investors will be met by aggravated selling by the company.

And in a novel twist, unlike GME, AMC is using not one but two banks not as underwriters, but as cold-callers, i.e., Sales Agents to help it sell as much stock to retail investors as possible. It gets better: AMC is actually paying B Riley and Citi a 2.5% commission to cold call investors and sell them stock, in a move right out of Boiler Room.

Here is the full 8-K:

On June 3, 2021, AMC Entertainment Holdings, Inc. (the “Company”) entered into an equity distribution agreement (the “Equity Distribution Agreement”) with B. Riley Securities, Inc. and Citigroup Global Markets Inc. as sales agents (each, a “Sales Agent” and collectively, the “Sales Agents”), to sell up to 11,550,000 shares of Class A common stock, par value $0.01 per share, of the Company (the “Common Stock”), from time to time, through an “at-the-market” offering program (the “Offering”).

Subject to the terms and conditions of the Equity Distribution Agreement, the Sales Agents will use reasonable efforts consistent with their normal trading and sales practices, applicable law and regulations, and the rules of the New York Stock Exchange to sell the Common Stock from time to time based upon the Company’s instructions for the sales, including any price, time or size limits specified by the Company.

Each Sales Agent will receive a commission up to 2.5% of the gross sales price of the Common Stock sold through it as the Company’s Sales Agents under the Equity Distribution Agreement, and the Company has agreed to reimburse the Sales Agents for certain specified expenses. The Company has also agreed to provide the Sales Agents with customary indemnification and contribution rights. The Company is not obligated to sell any Common Stock under the Equity Distribution Agreement and may at any time suspend solicitation and offers under the Equity Distribution Agreement. The Equity Distribution Agreement may be terminated by the Company at any time by giving written notice to the Sales Agents for any reason or by each Sales Agent at any time, with respect to such Sales Agent only, by giving written notice to the Company for any reason.

The Company intends to use the net proceeds, if any, from the sale of the Common Stock pursuant to the Equity Distribution Agreement for general corporate purposes, which may include the repayment, refinancing, redemption or repurchase of existing indebtedness, acquisition of theatre assets, working capital or capital expenditures and other investments.

The Common Stock will be offered and sold pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-255546) filed on April 27, 2021 with the Securities and Exchange Commission (the “SEC”). The Company filed a prospectus supplement, dated June 3, 2021 (the “Prospectus Supplement”), to the prospectus, dated April 27, 2021, with the SEC in connection with the offer and sale of the Common Stock.

And then there are the obligatory risk factors, which make it very clear, that the stock is only green because greater fools are selling to even greater fools:

Extreme fluctuations in the market price of our Class A common stock have been accompanied by reports of strong and atypical retail investor interest, including on social media and online forums. The market volatility and trading patterns we have experienced create several risks for investors, including the following:

- the market price of our Class A common stock has experienced and may continue to experience rapid and substantial increases or decreases unrelated to our operating performance or prospects, or macro or industry fundamentals, and substantial increases may be significantly inconsistent with the risks and uncertainties that we continue to face;

- factors in the public trading market for our Class A common stock include the sentiment of retail investors (including as may be expressed on financial trading and other social media sites and online forums), the direct access by retail investors to broadly available trading platforms, the amount and status of short interest in our securities, access to margin debt, trading in options and other derivatives on our Class A common stock and any related hedging and other trading factors;

- our market capitalization, as implied by various trading prices, currently reflects valuations that diverge significantly from those seen prior to recent volatility and that are significantly higher than our market capitalization immediately prior to the COVID-19 pandemic, and to the extent these valuations reflect trading dynamics unrelated to our financial performance or prospects, purchasers of our Class A common stock could incur substantial losses if there are declines in market prices driven by a return to earlier valuations;

- to the extent volatility in our Class A common stock is caused, as has widely been reported, by a “short squeeze” in which coordinated trading activity causes a spike in the market price of our Class A common stock as traders with a short position make market purchases to avoid or to mitigate potential losses, investors purchase at inflated prices unrelated to our financial performance or prospects, and may thereafter suffer substantial losses as prices decline once the level of short-covering purchases has abated; and

- if the market price of our Class A common stock declines, you may be unable to resell your shares at or above the price at which you acquired them. We cannot assure you that the equity issuance of our Class A common stock will not fluctuate or decline significantly in the future, in which case you could incur substantial losses.

What is most hilarious about this entire joke, is that AMC stock is still up compared to its Wednesday close.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Not scared at all. Holding and buying $AMC!