Amazon Soars After Smashing Top-Line Expectations Thanks To Solid AWS, Blows Away Guidance

With the bulk of the FAAMG stocks - which is now GAMMA following Facebook's rebranding to Meta (at least until the company quietly changes its name back now that the whole Metaverse farce has blown up in its face) - having reported Q2 results (some good like MSFT and GOOGL, some terrible, like Facebook), investors were keenly looking to Amazon and Apple earnings after the close today, to round out the picture for the market generals and set the tone for the rest of the summer and until the Jackson Hole meeting, and also to find whether the massive post-FOMC 2-day Nasdaq short squeeze surge was justified.

Focusing on Amazon, the world's biggest online retailer hasn’t lost money for two quarters in a row since 2014. That streak may now be in jeopardy. Analysts are expecting slower growth and diminishing profits amid an aggressive increase in the US inflation rate that is hitting consumer spending and pushing companies to cut back on spending. For Amazon, that could translate into another ugly quarter, after the company posted a loss in April on write-downs related to its investment in electric vehicle maker Rivian.

Turning to Amazon’s cloud division, AWS, it remains the growth engine of the company and a source of intense attention during earnings. Sales by AWS are expected to rise 31% to $19.4 billion. Analysts also think AWS might decelerate a few percentage points in the second half of the year, which reflects both AWS’s difficulty keeping up startup-like momentum at its gargantuan scale, as well as questions about IT spending in a potential recession. On the other hand, earlier this week, arch-rivals Google and Microsoft touted continued momentum and resilience in their cloud-computing divisions.

Operating expenses are another metric to watch closely today, according to Bloomberg. Amazon executives admit that they over-expanded during the pandemic and are now trying to cut costs in their fulfillment and transportation units as sales slow and shoppers return to physical stores. The company said it faced about $6 billion in added costs in the first quarter compared to the prior year. That’s higher wages, fuel costs, and lower productivity from overstaffed warehouses, among other things. Amazon has warned those costs likely amounted to $4 billion in the second quarter. Guidance on where this figure goes in the second half of the year should be a good yardstick for CEO Jassy’s progress in cutting costs and putting Amazon back on firm footing.

Furthermore, during Amazon’s first-quarter conference call back in April, executives insisted the problem with Amazon’s retail business was high costs and too much capacity, not weakening shopper demand. Since then, inflation has continued to climb, and retail rivals like Walmart and Target have cut their profit forecasts, blaming the rising costs of essentials like groceries and gasoline.

There was some good news for those worried whether Walmart’s profit warning spilling over into Amazon, don’t. According to Bloomberg intelligence, “Amazon’s got a more affluent customer base, so it’s better positioned than Walmart to navigate through inflation that’s forcing consumers to shift spending to lower-margin categories like food and away from discretionary.”

Separately, this will be the first full quarter in which Amazon has owned Metro-Goldwyn-Mayer, which was probably an insignificant contributor to Amazon’s revenue. But it’s worth keeping an eye out in their filings to see how the company accounts for the revenue stream from the film studio, which Amazon bought for $8.5 billion and boasts a massive back catalog of movies and TV, including the James Bond franchise.

With that in mind, moments ago AMZN just reported Q2 results which should put all those worried that AMZN's magic has ended at ease, because not only did it beat on the top line and reported stellar AWS growth, but also guided solidly above consensus.

- Loss per share 20c, missing estimates of +0.13c

- Net sales $121.23 billion, +7.2% y/y, beating estimate $119.53 billion

- Physical Stores net sales $4.72 billion, +12% y/y, beating estimate $4.42 billion

- Online stores net sales $50.86 billion, -4.3% y/y, missing estimate $51.81 billion

- Third-Party Seller Services net sales $27.38 billion, +9.1% y/y, beating estimate $26.05 billion

- Subscription Services net sales $8.72 billion, +10% y/y, missing estimate $8.81 billion

- AWS net sales $19.74 billion, +33% y/y, beating estimate $19.41 billion

- North America net sales $74.43 billion, beating estimate $70.45 billion

- International net sales $27.07 billion, missing estimate $28.8 billion

- Operating income $3.32 billion, -57% y/y, beating estimate $1.57 billion

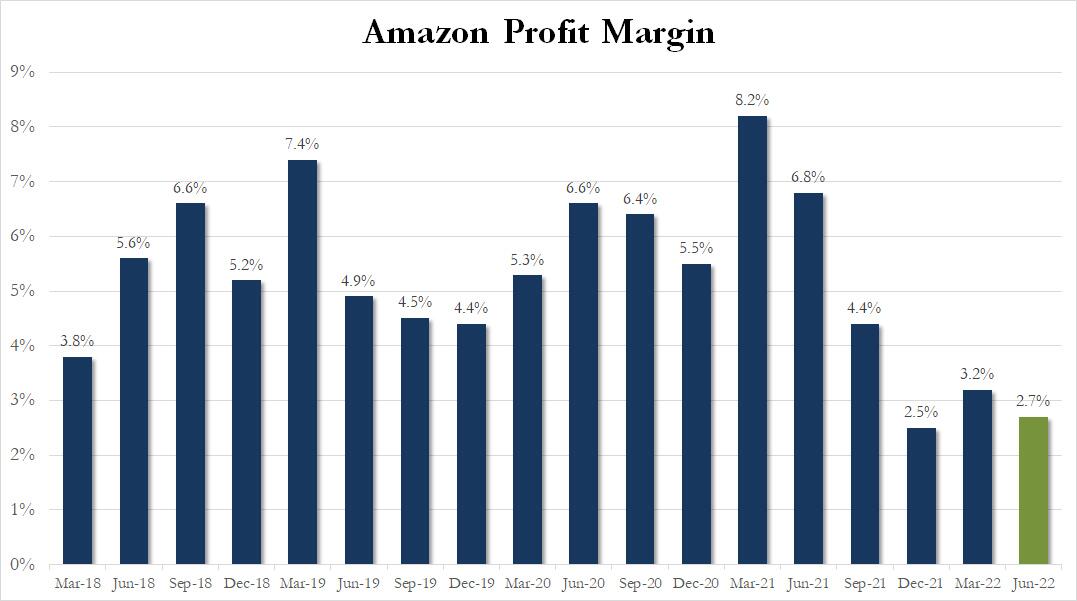

- Operating margin 2.7% vs. 6.8% y/y, beating estimate 1.65%

Indeed, as noted above, Amazon notched its second straight quarterly loss, posting a net loss of $2.0 billion in the second quarter, or 20 cents per diluted share, compared with net income of $8.1 billion, or $15.79 per diluted share, in first quarter 2021. (Reminder: Amazon conducted a 20-1 stock split in June, which is why this quarter’s per-share loss look so dramatically small.) The last time Amazon lost money for two quarters in a row was in 2014.

That said, there were some silver linings in the bottom line miss, to wit: the loss is completely attributable to the second straight quarterly write-down from Amazon’s investment in Rivian. Amazon also beat on net sales ($121.2 billion, versus analyst estimates of $119.53 billion.) and for those worried Walmart would carryover, there was no reason to: Amazon shoppers were more protected from the hazards of rising inflation and a possible recession.

Some more Q2 details, which excludes FX impacts:

- Third-party seller services net sales excluding F/X +13% vs. +34% y/y, smashing estimate +6.96%

- Subscription services net sales excluding F/X +14% vs. +28% y/y, beating estimate +12%

- Amazon Web Services net sales excluding F/X +33%, beating estimate +31.7%

- Fulfillment expense $20.34 billion, +15% y/y, beating estimate $21.14 billion

- Seller unit mix 57% vs. 56% y/y, beating estimate 56%

But while revenue was solid and AWS was stellar, the reason why AMZN stock is exploding higher after hours is because the company's guidance blew away timid expectations, to wit:

- Sees net sales $125.0 billion to $130.0 billion, the midline coming above the median estimate of $126.97 billion

- Sees operating income is expected to be between $0 and $3.5 billion, missing the median estimate of $3.83BN

- This guidance anticipates an unfavorable impact of approximately 390 basis points from foreign exchange rates.

While operating margins dipped modestly, from 3.2% in Q1, to 2.5%, it was well above the 1.65% expected.

(Click on image to enlarge)

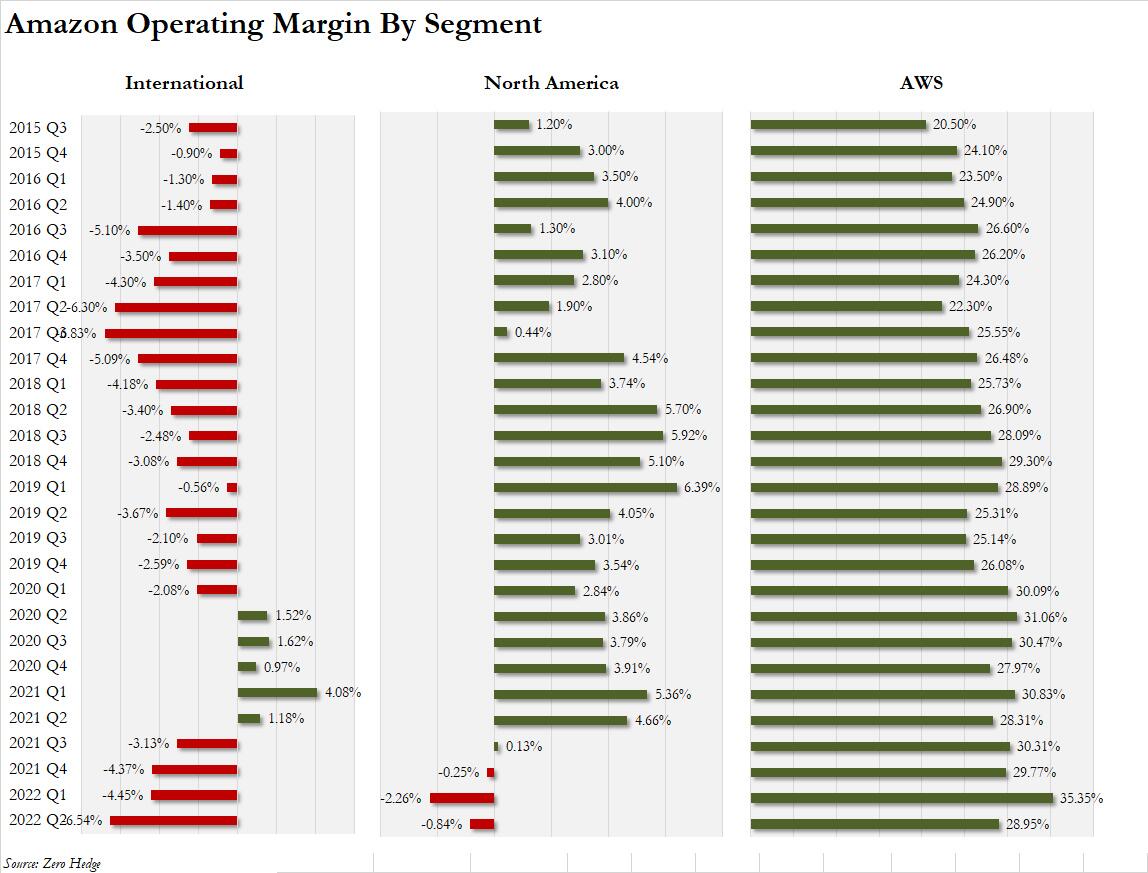

However, the market cared little about the overall profit margin and was instead far more focused on just AWS, where results were solid, despite a drop in margins to just over 28% from 35%: the rationale it could have been much worse when looking at Microsoft.

(Click on image to enlarge)

Looking at margins, it appears that Amazon is getting expenses under control, reassuring investors that even with slower growth, Amazon will fill the space it created during an explosive pandemic expansion.

Indeed, as Bloomberg notes, this quarter, cost of sales decreased to $66.4 billion from $66.5 billion in the first quarter. Fulfillment expenses were flat at $20.3 billion and under analyst estimates of $21.14 billion. To me, these numbers suggest Amazon is having some success paring back costs, after slowing its fulfillment center expansion and subleasing properties it acquired. That’s a main reason Amazon stock is reacting so favorably this afternoon.

Another important metric is full- and part-time employees. Last quarter, that number jumped by 28%. This quarter, it’s down to 14%. After one of the biggest staff-ups in business history, Amazon is finally slowing down hiring.

One key figure that might not jump out immediately is Subscription Services, which grew 14% to $8.72 billion, reversing three consecutive quarters or slowing growth. That’s a key figure since it shows Amazon can keep attracting new Prime members who spend a lot more than occasional shoppers.

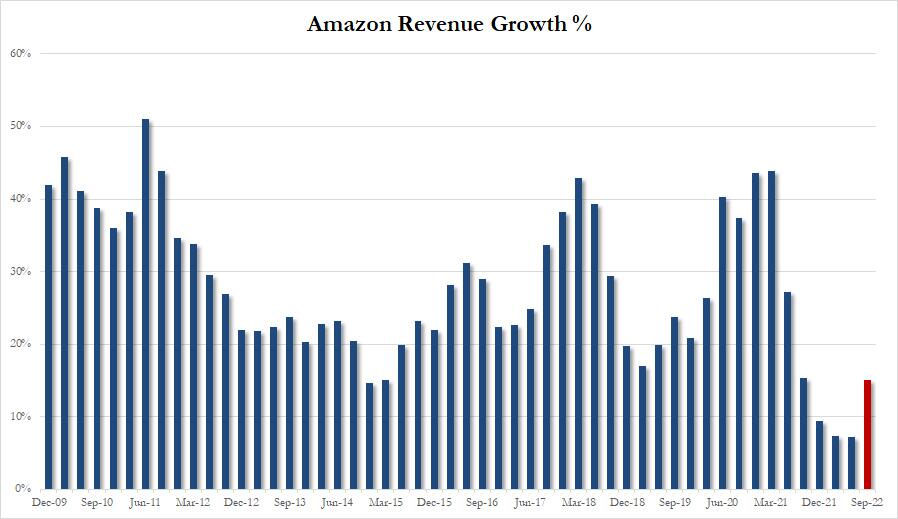

Finally, what markets are clearly focused on is that revenue growth in a range of $125-$130BN (midline at $127.5BN) suggests that the worst of revenue growth may be behind the company

(Click on image to enlarge)

As Bloomberg Intel notes, “The guidance is actually really good for the mid-teens sales increase next quarter. The customer is shopping where they find value, convenience and speed.”

Finally, for those worried that Amazon is running out of ways to grow, Bloomberg had some more good news:“I think the misconception is that is Amazon is mature across any of its businesses. That’s just incorrect. There’s so much opportunity ahead for Amazon. They’re just scratching the surface.”

Putting it all together, while AMZN reported solid topline and AWS growth as well as impressive guidance, the one number investors may be most excited about was the company's operating expenses which came in at $117.9 billion, below expectations. New CEO Andy Jassy is showing investors he can be frugal.

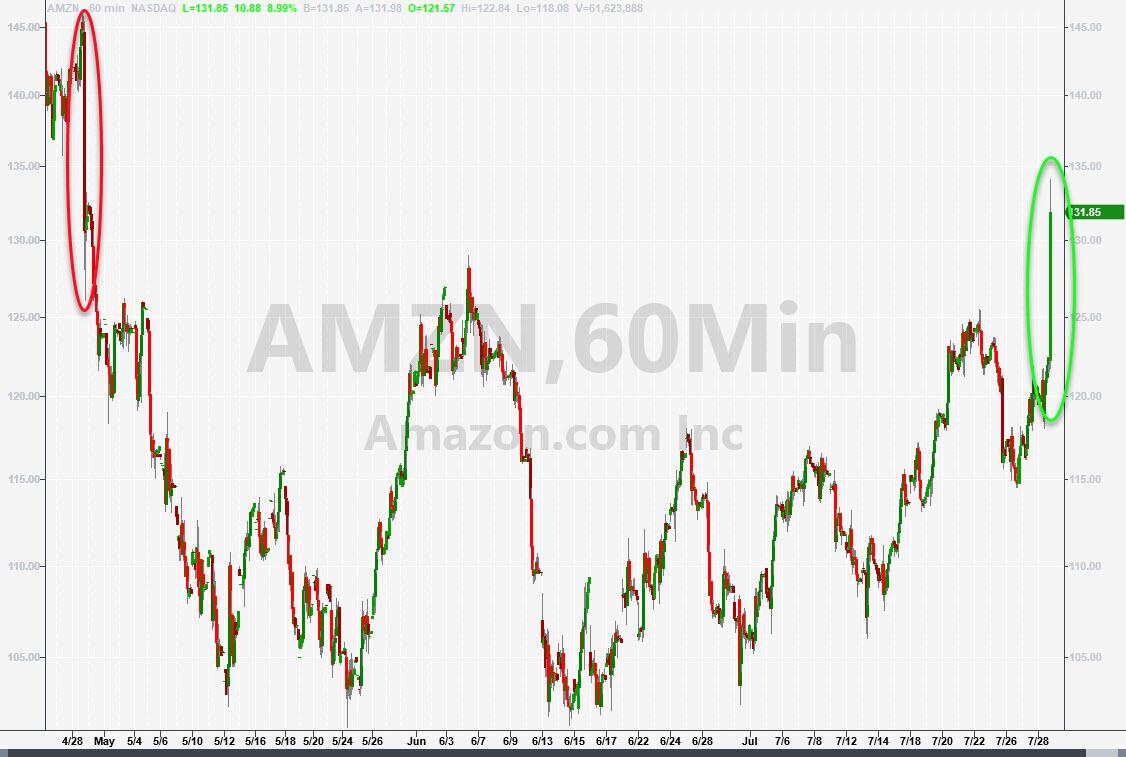

The market seems to agree and the stock has exploded some 10% higher, soaring from $122 at the close to $136, a massive gain in market cap...

(Click on image to enlarge)

... and certainly helping Jeff Bezos in his quest to regain the position of the world's richest person.

More By This Author:

Facebook Slides After Miss On Top And Bottom Line, Atrocious Guidance Amid "Weak Ad Demand"

Fed Hikes 75bps: Remains "Highly Attentive" To Inflation But Cautions Economy "Softening"

European Gas Soars As Russia Throttles NS1 Flows To just 20% Of Capacity

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more