Fed Hikes 75bps: Remains "Highly Attentive" To Inflation But Cautions Economy "Softening"

Since the last FOMC Statement on June 15th, we have witnessed the biggest combined stock-bond rally in more than two decades - Stocks and bonds have soared in the last month, the dollar rallied, but gold has been clubbed like a baby seal...

Source: Bloomberg

As Bloomberg notes, fixed-income and equity bulls are likely expecting that Fed Chair Powell’s hawkish mission will be tempered by signs inflation has peaked as an economic downturn nears - a wager not without significant risk.

“The market has shifted to bad-news-is-good-news again, the whole idea that central banks will pivot because the data is so bad,” Goldman Sachs Group Inc. strategist Christian Mueller-Glissmann said in an interview on Bloomberg TV.

“We’re going back to a template that we know well.”

On the other side, wagering on a friendly Fed is too premature a bet for Ajay Rajadhyaksha, a strategist at Barclays Plc. The way he sees it, policy officials would try to avoid the mistake they made in April. That month, central bankers talked down the size of rate hikes that would be ultimately needed, prompting bond traders to question the Fed’s commitment to its inflation target. Treasury yields spiked, spurring losses across assets. The S&P 500 dropped almost 9% for the worst month since the pandemic crash.

“The Fed has seen what happens when it prematurely declares victory over inflation and is unlikely to repeat that mistake,” said Rajadhyaksha.

“Stocks and bonds are both hoping that the Fed will pivot away from its commitment to overtightening. It’s a hope that is likely to be dashed this week.”

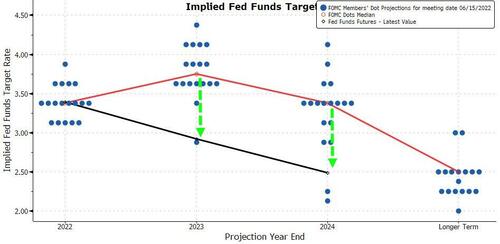

Interestingly, full-cycle rate-hike expectations have actually slipped dovishly (although they spiked pre-FOMC on the WSJ leak), and subsequent rate-cut expectations have soared (to almost 5 rate-cuts now)...

Source: Bloomberg

The odds of a 100bps hike today have crashed in the last two weeks and the odds of a 75bps hike in September have also tumbled. Dec 2022 now has a mere 50% chance of a 25bps hike priced in...

Source: Bloomberg

The market is now dramatically more dovish than The Fed's latest dotplot...

Source: Bloomberg

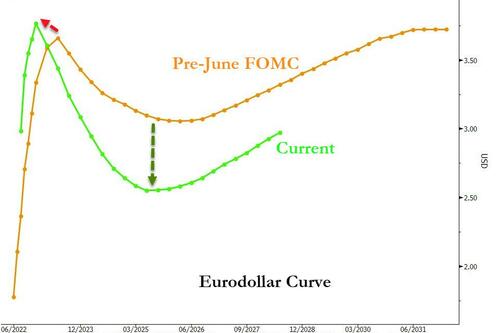

Seen more simply, the market has pulled the peak Terminal Rate higher and sooner and the subsequent rate-cut trajectory dramatically more aggressive since the last FOMC statement...

Source: Bloomberg

The bottom line is that the market has dragged forward The Fed Pivot - the question is, will Powell push back against that, or not?

“What appears to be missing is a ‘green light’ that would allow macro investors to go all in on these trades,” according to Viraj Patel, a strategist at Vanda Research.

“One common missing ingredient is a clear dovish Fed pivot - which could come as early as this week if US policy makers acknowledge the global growth concerns starting to dominate markets.”

So - what exactly did The Fed do...

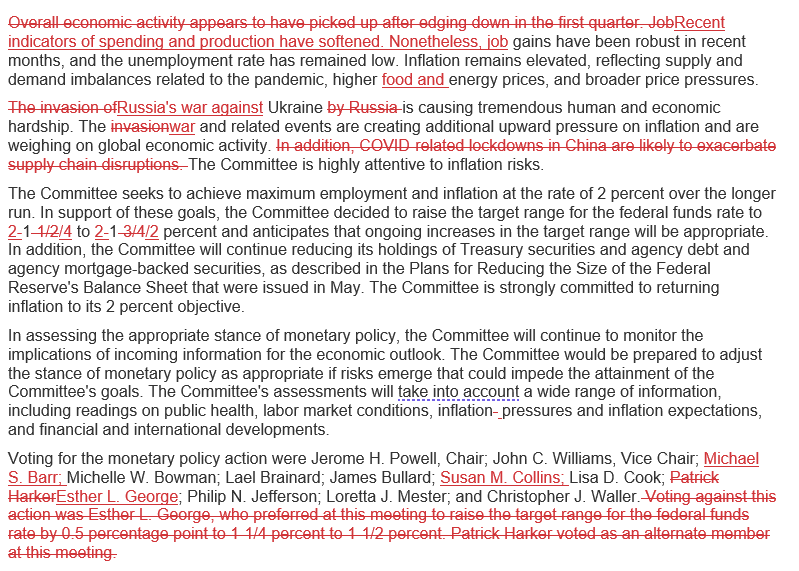

- The Fed unanimously hiked rates by 75 basis points to a range of 2.25%-2.5%, in line with expectations.

- FOMC acknowledges that “spending and production have softened,” yet also affirms that “job gains have been robust in recent months.”

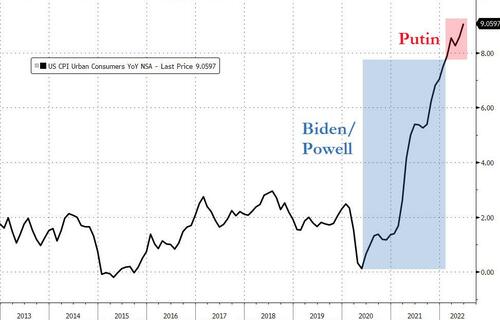

- Russia’s war in Ukraine is adding “upward pressure” on inflation as well as weighing on economic activity, the Fed says.

- The FOMC repeats that it’s “highly attentive to inflation risks.”

We can't help but read the line focus on Russia driving inflation as a pathetic nod to the Biden administration and pure ignorance of the fact that inflation was exploding higher long before Putin's moves...

A quick reaction from Neil Dutta at Renaissance Macro Research:

“All I learned from the statement: The Fed marked down its growth assessment and still ended up going as much as it did in June.”

The statement offers no clues about what the Fed will do at its September meeting: traders will be looking to Chair Powell s remarks for a guide here.

Read the full Redline below:

(Click on image to enlarge)

More By This Author:

European Gas Soars As Russia Throttles NS1 Flows To just 20% Of CapacityBoeing Misses Across The Board But Stock Jumps After Operating Cashflow Unexpectedly Turns Positive

Google Jumps Despite Missing On Top & Bottom Line Thanks To Stronger Ad Sales

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more