Almost But Not Quite

The sea of red is a delight to the eye, but we’re not out of the woods yet. Since the market bottomed a month ago, we’ve been banging out a series of higher lows. Mercifully, we have not had higher highs; instead, it’s been stalling out below its price gap. But the point is that we need to take out that most recent “higher low”.

The same holds true for SPY, although we’re closer to accomplishing this goal.

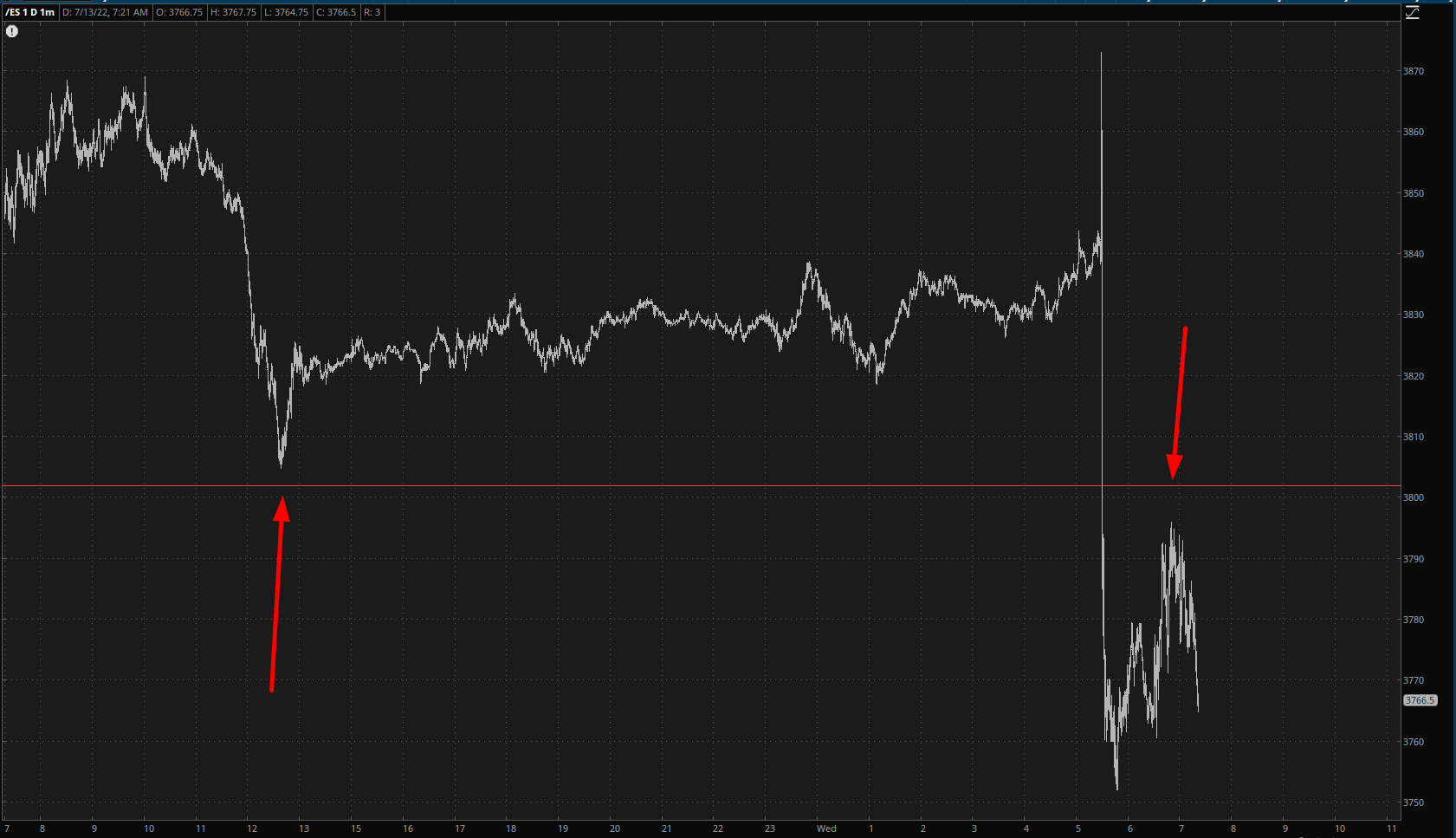

The good news is that Fibonacci support has now FLIPPED to resistance, as beautifully proved by a variety of important futures and indexes, not the least of which is the /ES.

(Click on image to enlarge)

In my personal account, I held on to my big IYR put position, but I sold my XLV and XLE puts at a profit. Here’s a live shot of me at the very moment I did so. You can see the steely grit of my character as I scurried out of these positions and took profits that are sure to explode massively without me.

More By This Author:

Topsy-Turvey Tuesday

Pre-CPI Indexes

Stock Market: The Wreck Of The Hesperus