Topsy-Turvey Tuesday

Jeez, what an insane day. These bulls just won’t let it go, will they??

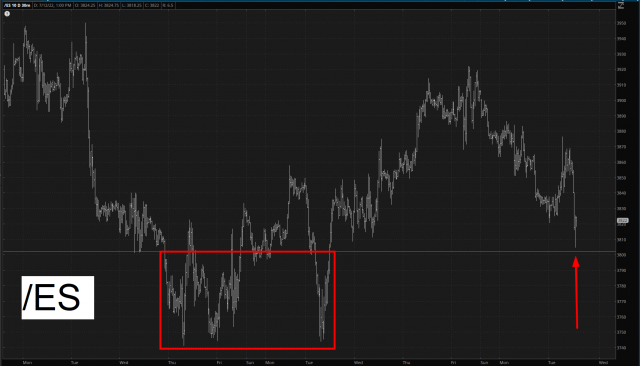

Chart after chart shows the same thing: the Fibonacci support being defended, even in the face of massive selling in advance of the CPI. So here we see the S&P 500 futures with the Fibonacci (red line) represented rock-solid support, with the brief earlier exception in the box………

Precisely the same thing with NASDAQ (honestly, this is almost unbelievable; look at what happened later today!!!)

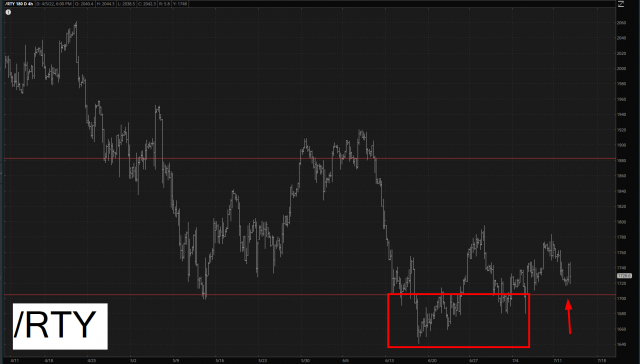

And exactly the same thing with the Russell 2000. Keep in mind, these are VASTLY different indexes with COMPLETLEY different components, and yet they’re all working on lockstep.

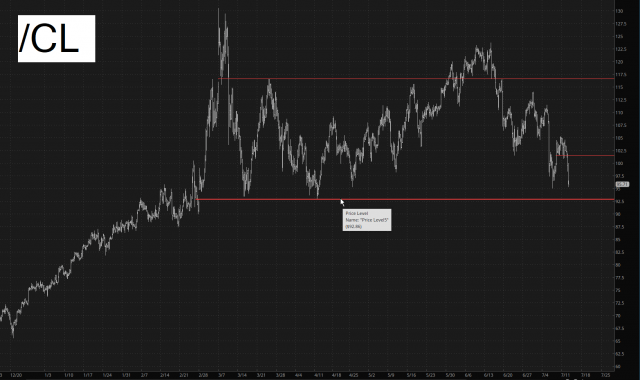

The most interesting one of all? Crude oil, of course! The representative of the future of the economy. Depression! Layoffs! Riots! Mayhem! Political pandemonium! It’s all coming, and oil is lighting the way.

As for myself:

- Pure bear positions, of COURSE;

- Medium-aggressive, with a hearty 25% in cash;

- I’ll be watching the CPI with, of course, intent interest

- The reaction in the first two hours may not even matter. Let’s see how the market digests the news.

The Powers That Be are desperate to have the CPI interpreted bullishly. They’ll spin this any way they can. But, no, no, you’re not going to take decades of FRAUD (from 1987 through 2021) and just undo it with a tiny blip down in equities. What’s required for us to pay for our sins is a complete, total, utter, global wipeout.

Thus spoke Zarathustra.

More By This Author:

Pre-CPI IndexesStock Market: The Wreck Of The Hesperus

ETF Focus: Foreign Markets