All-Star Fund Eyes Growth And Value

As income investors and retirees, we need to ensure our income streams are highly diversified. We should never structure our portfolios so that any single unforeseeable event would bankrupt our income streams.

Liberty All-Star Equity Fund (USA) is an excellent pick to help you diversify and grow your income stream. USA is closed-end fund with outstanding management and an excellent track record.

One thing that makes USA unique is that it splits its holdings across five different managers, all with different strategies. Three managers follow different "value" strategies. Two follow different "growth" strategies. As a result, USA has a portfolio that is diversified by picks, sectors, and strategies.

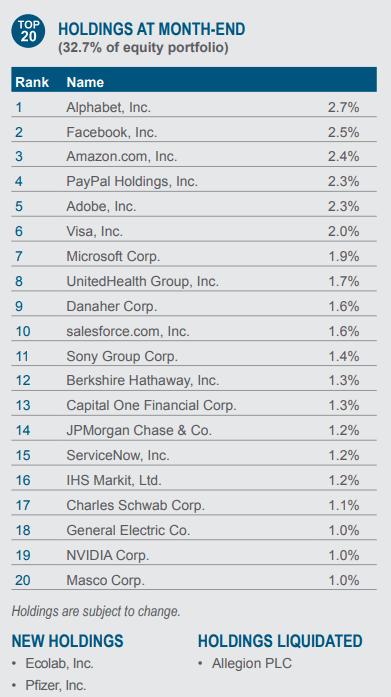

The fund has substantial holdings in the financial sector, the consumer discretionary sector, healthcare, and industrial, all of which are "value" sectors that we like and offer good upside potential. As for its actual portfolio holdings, USA holds more than 150 stocks that are handpicked by the managers, with the top 20 holdings as of July 31 listed below:

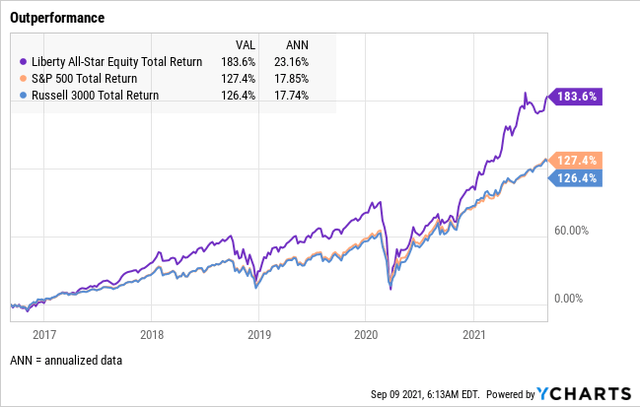

As a result of its exceptional management, USA has strongly outperformed the S&P 500 index and the Russell Small-Cap index over the long-term.

Another unique twist is that USA has a variable distribution policy. USA pays 2.5% of NAV (net asset value) each quarter. This means that as NAV grows, your income grows. Even if NAV is flat, the yield would still be 10%.

But the great news is that the distribution has been hiked over the past three consecutive quarters as NAV grew. We expect more distribution hikes to come and further capital gains as this strong bull market continues.

USA provides your portfolio with a solid income stream and great diversification. USA has exposure to growth stocks, while being overweight "value" stocks. This is the "secret sauce" of its success, in addition to having five different experienced individual managers taking care of different aspects of this fund.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.