All 5 Pure-Play CyberSecurity Software Stocks Fell W/e November 7th - Here's Why

Image Source: Pixabay

An Introduction

Cyber security is crucial to protect networks, systems and other digital infrastructure from malicious cyber attacks (see here) and it is estimated that cyber security spending should grow at a CAGR of 13.8% between now and 2030 (source) suggesting that many cybersecurity software and hardware companies should be excellent long-term buys.

Cyber Attacks

Cyber attacks take many forms, such as:

- malware which is malicious software, including spyware, ransomware, and viruses. that accesses a network through a weakness such as a fraudulent link or email attachment;

- phishing which involves a fraudulent message that appears to come from a legitimate source through email, text, or social networks with the goal is to steal information by installing malware or by cajoling the victim into divulging personal details;

- man-in-the-middle which involves an attacker coming between two members of a transaction to eavesdrop on personal information;

- denial-of-service which involves flooding systems with traffic to clog up bandwidth so they can’t fulfill legitimate requests and, thereby, shut down systems, and

- password attacks which involve stealing passwords.

Cyber Security

There are 4 types of cyber security, namely:

- Network security which protects the connections between networks, including data transfers to and from the internet, and hardware like routers and switches,

- Endpoint security which protects devices like laptops, phones, and servers,

- Application security which protects software, data and access at the individual application level, and

- Cloud security which protects cloud environments and data from vulnerabilities and threat actors (source).

AI's Role In Cyber Security

AI makes it a perfect value addition technology for cyber security because it is fundamentally a complex mathematical equation that generates outputs with new data by using existing data which enables cyber security companies to train their models with data from previous attacks to create autonomous systems that can detect if an attack is ongoing based on certain readings. This provides companies and users with a critical capability in the risk management framework, as it increases their lead time for an attack and allows them to prepare mitigation and response strategies.

Our Pure-Play CyberSecurity Software Stocks Portfolio

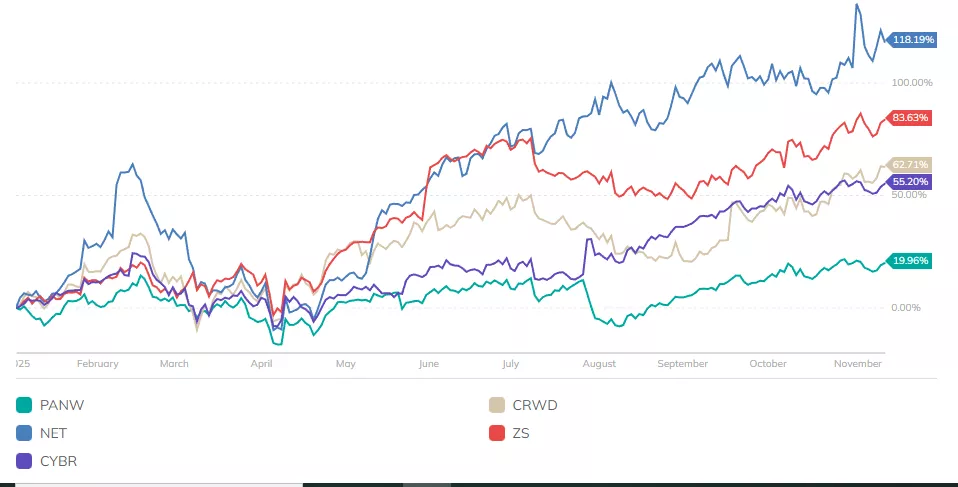

eSecutityPlanet.com provides a list of cyber security companies (see here) of which the 5 largest pure-play companies (i.e. +$20B in market capitalization) are included in our Pure-Play CyberSecurity Software Stocks Portfolio. and below is the focus of each constituent, how it performed week-ending November 7th, in descending order, and in October, its market capitalizations, the catalyst(s) contributing to the change in its stock price last week, and a chart showing the performance of the portfolio YTD.

- CrowdStrike Holdings (CRWD): DOWN 0.6% w/e November 7th; UP 10.7% in October

- Focus: offers corporate endpoint and cloud workload security, identity protection, threat intelligence, and data protection

- Market Capitalization: $140B

- Performance Catalyst(s): dipped due to

- profit-taking after surging to a new all-time high on November 3, driven by optimism around its CoreWeave partnership, which enhances AI cloud security via its Falcon platform with investors selling the news, locking in gains ahead of earnings and amid sector-wide caution, and

- Q3 guidance was previously seen as soft leaving investors remain wary of revenue deceleration and fallout from the 2024 IT outage as CRWD approaches earnings season, prompting defensive positioning.

- CyberArk Software (CYBR): DOWN 3.2% w/e November 7th; UP 7.8% in October

- Focus: develops, markets, and sells software-based identity security solutions and services

- Market Capitalization: $26B

- Performance Catalyst(s): fell due to

- Herald Investment Management fully exiting its position in CYBR which likely triggered copycat selling and short-term technical weakness and,

- while Q3 beat EPS, signaling strong execution, investors used the earnings event as a profit-taking opportunity in light of CYBR's 7.8% advance in October.

- Zscaler (ZS): DOWN 3.4% w/e November 7th; UP 10.5% in October

- Focus: offers cyberthreat, data and application protection products

- Market Capitalization: $52B

- Performance Catalyst(s): fell due to

- profit-taking by traders locking in gains (the stock advanced 10.5% in October) ahead of earnings later in November, and

- muted response to investors regarding the acquisition of AI security firm SPLX, aimed at accelerating its shift-left security capabilities as investors weighed the integration risk and short-term dilution.

- Palo Alto Networks (PANW): DOWN 3.6% w/e November 7th; UP 8.2% in October

- Focus: provides threat prevention and security solutions, including URL filtering, and DNS Internet of Things, API, and SaaS security, data loss prevention, and services to resolve network disruptions

- Market Capitalization: $147B

- Performance Catalyst(s): fell due to

- profit-taking due to its 8.2% advance in October and

- the absence of new product announcements or AI monetization updates left the stock vulnerable to macro-driven derating.

- Cloudflare (NET): DOWN 8.1% w/e November 7th; UP 18.0% in October

- Focus: provides website and application security products similar to PANW including web application firewall, bot management, distributed denial of service protection, API security, and SSL/TLS encryption

- Market Capitalization: $84B

- Performance Catalyst(s): fell due to

- traders locking in gains after the 18% October stock price increase.

Chart Of Portfolio Performance YTD

Source of Chart: PortfoliosLab.com

Chart Comparing Performance of Portfolio Constituents YTD

(Click on image to enlarge)

Source of Chart: PortfoliosLab.com

Summary

On average, the above 5 pure-play cybersecurity software stocks were DOWN 3.2% week-ending November 7th after having gone UP 10.5% in October, and they have an average market capitalization of $90B.

More By This Author:

Our Cloud SaaS Computing Stocks Portfolio Fell 7% W/e November 7th - Here's Why

Pure-Play Plant-Based Food Stocks Fell 6% Last Week - Here's Why

Our Pure-Play AI-Focused Drug Discovery Stocks Portfolio Fell 23% Last Week - Here's Why

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.