Our Pure-Play AI-Focused Drug Discovery Stocks Portfolio Fell 23% Last Week - Here's Why

Image Source: Unsplash

Introduction

The pharmaceutical industry is embracing artificial intelligence technology to help in the research and development of new drugs as it is reputed to be up to 250 times more efficient than the traditional method of drug discovery and, as such, holds the potential to reduce timelines for drug discovery, increase accuracy of predictions on efficacy and safety, as well as to create better, and more, opportunities to diversify drug pipelines. In addition, Morgan Stanley believes that AI-powered drug discovery will lead to an additional 50 novel therapies being brought to market over the next decade, with annual sales in excess of $50 billion! In other words, a $50 billion AI drug discovery revolution is underway.

Our Model Pure-play AI-focused Drug Discovery Stocks Portfolio

This article highlights the performance last week, in descending order, and in October, of the 3 companies that are focused exclusively (i.e. are pure-play) in our model Ai-focused Drug Discovery Stocks Portfolio, the focus of each company with their market capitalizations, and the catalyst(s) contributing to their stock price changes, as follows:

- Recursion Pharmaceuticals (RXRX): DOWN 16.3% w/e November 7th; UP 13.1% in October

- Focus: decodes biology by integrating technological innovations to industrialize drug discovery (see details here)

- Market Capitalization: $2.4B

- Price Change Catalysts:

- fell due to a major shortfall in its Q3 revenue which was 69% below analyst expectations attributed to timing issues related to prior-year milestone payments from Roche, raising concerns about revenue consistency which made investors more cautious.

- Absci Corporation (ABSI): DOWN 22.0% w/e November 7th; UP 40.8% in October

- Focus: analyzes drug characteristics that may provide therapeutic benefit. (see details here),

- Market Capitalization; $500M

- Price Change Catalysts:

- fell due to the lack of near-term catalysts despite insider buying and participation in investor conferences, and

- analysts saw their consensus average target price as overly optimistic despite a consensus “Strong Buy” rating with Wall Street Zen downgrading ABSI to “Strong Sell”, citing weak fundamentals.

- AbCellera Biologics (ABCL): DOWN 29.5% w/e November 7th; UP 10.3% in October

- Focus: searches for antibodies from natural immune responses which are then outsourced to their partners. (see details here)

- Market Capitalization: $1.2B

- Price Change Catalysts:

- fell due to analyst downgrades, poor financial metrics, and deepening concerns about its growth trajectory and operational efficiency.

- fell due to analyst downgrades, poor financial metrics, and deepening concerns about its growth trajectory and operational efficiency.

Chart Of Portfolio Performance YTD

Source of Chart: PortfoliosLab.com

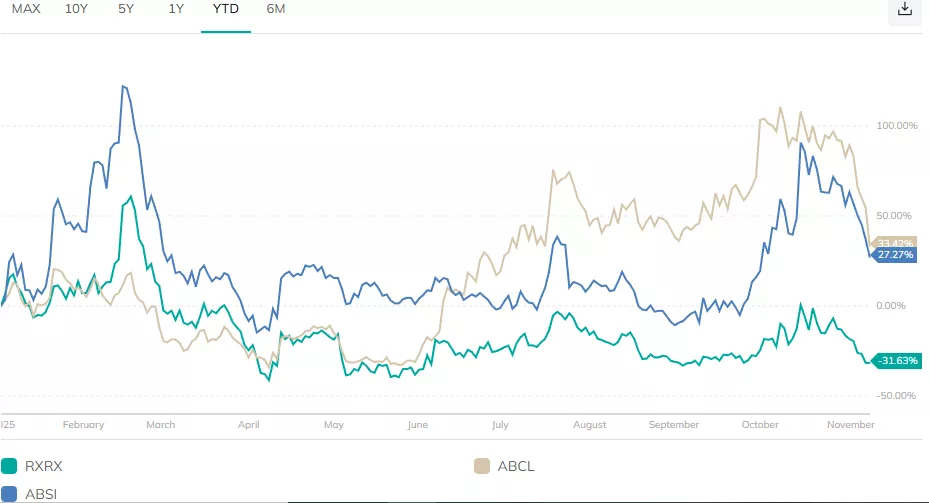

Comparison Chart Of Constituent Performances YTD

Source of Chart: PortfoliosLab.com

Summary

The Portfolio was DOWN 22.7% w/e November 7th; UP 18.5% in October.

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.