Alibaba: The Bottom Is In

Andrew Burton/Getty Images News

Several days ago, Alibaba Group (BABA) entered freefall mode, crashing to levels not seen in years. The company's forward P/E ratio dropped to a rock bottom 13, while its relative strength index ("RSI") cratered below 20 for the first time. Shares of the e-commerce juggernaut were never battered this badly. I wrote about the opportunity to pick up Alibaba and other top China tech shares at the lows several days ago. While Alibaba has rebounded by more than 10% since then, plenty of upside potential lies ahead for the patient investor.

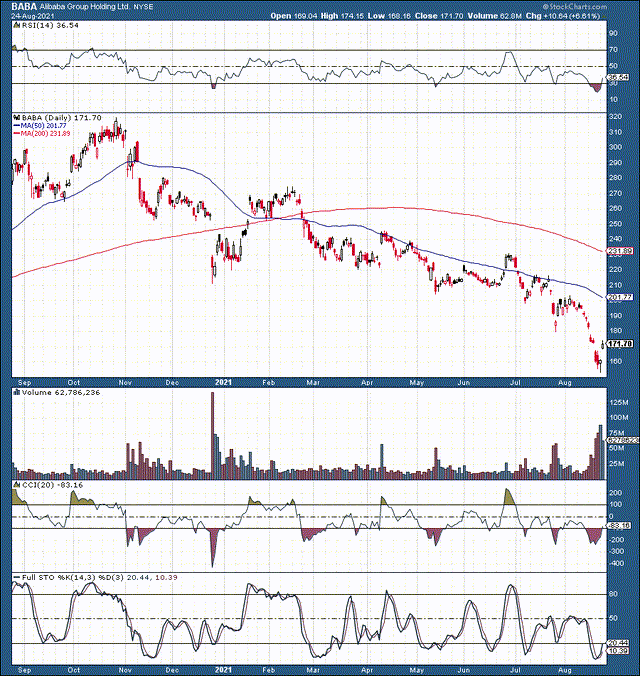

BABA 1-Year Chart

Source: stockcharts.com

Alibaba hit levels not seen since 2019 and was down by more than 50% from its all-time high ("ATH") achieved less than one year ago. At the same time, Alibaba's valuation was debased to a rock bottom 13 times consensus forward EPS estimates. A 13 P/E ratio seems like a ludicrous valuation, provided that the company should maintain a robust double-digit revenue growth rate in future years. The $64,000 question is, with new regulations coming out of Beijing, is Alibaba truly uninvestable, or will the company's shares stabilize, rebound, and begin to move higher?

What Is The Problem With Alibaba?

The problem is not just with Alibaba, as this destruction in market cap and shareholder value is a China-wide phenomenon. Many top Chinese names have declined by similar margins as Alibaba in the last months.

Other Top China Tech

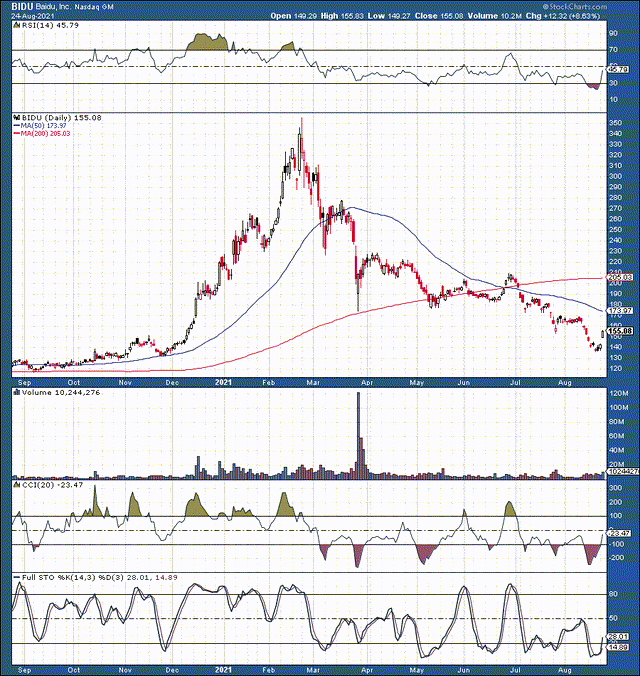

Baidu (BIDU) - Was down by 62% from ATH around 1-year ago

Source: stockcharts.com - Baidu was down to an RSI of about 22, and a forward P/E ratio of around 12 before catching a strong bid. The stock is now 16% off its lows.

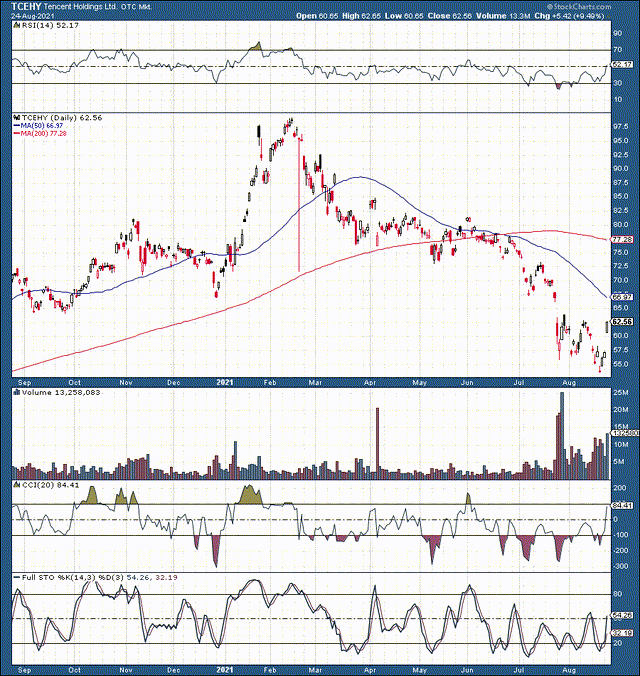

Tencent (OTCPK: TCEHY) - Was down by 44% from recent highs

Source: stockcharts.com - Tencent started to rebound ahead of others, now up by about 17% off the lows.

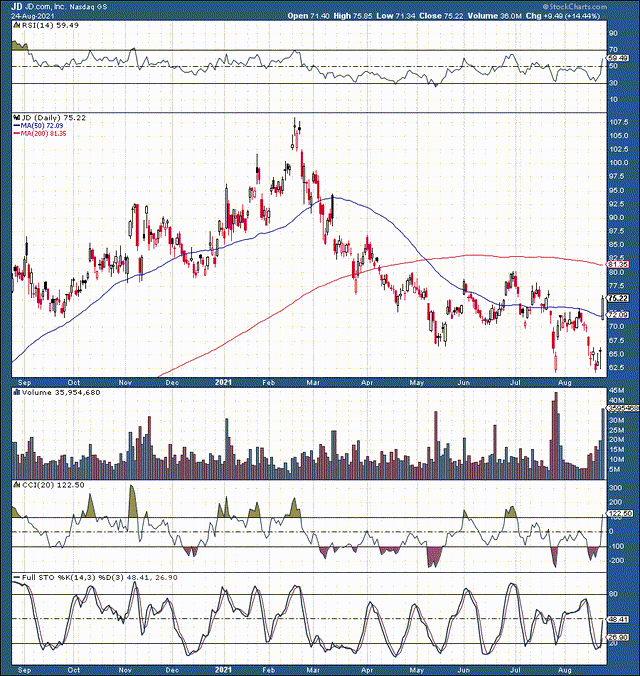

JD.com (JD) - Was down by 42% from its highs

Source: stockcharts.com - JD made a double bottom and is now 21% off its bottom.

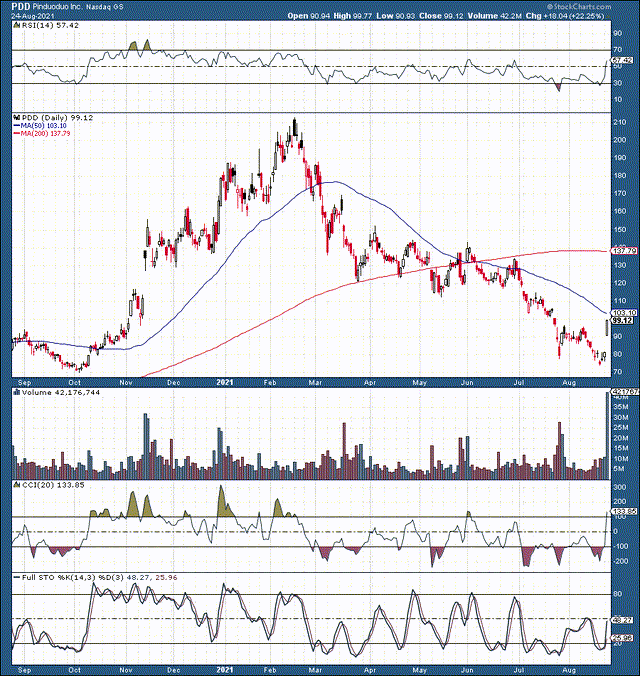

Pinduoduo (PDD) - Was down by 64% from its ATH

Source: stockcharts.com - PDD hit an RSI of around 15 during the previous low, then the stock made a higher low on the RSI during the bottom. Now PDD is up by a whopping 32% from the recent low.

These five large-cap Chinese tech companies lost around $1.2 trillion in market cap since the declines began earlier this year. So, why such epic destructions of value in the first place?

Well, several factors are responsible for the downturn. A perfect storm of factors has been hammering Chinese equities for months now. We saw the controversy with U.S. regulators, the hedge fund blow up, the Ant Group debacle, initial talks about the China big tech crackdown, and Alibaba's record fine. Prominent short-seller Carson Block even called Chinese stocks uninvestable around the beginning of the year. Now there's concern about China's growth story and new proposed regulations from China's Communist Party, the CCP.

This massive wall of worry has proven too high to climb for Chinese equities. With prices cascading to multi-year lows, Alibaba and Chinese stocks, in general, are trading like they could get nationalized. However, this scenario is highly improbable. Why would the CCP nationalize its most prominent and brightest corporations? What would be of benefit for the Chinese government? Also, what kind of message would the nationalization of mega-cap corporations send to businesses in China and the rest of the world?

The CCP is not out to create panic, instability, or destroy wealth in its markets. Moreover, there's no viable reason to nationalize Alibaba. Instead, the CCP is likely after information, and it could be laying down the groundwork to attain it. Incidentally, the Chinese government's latest round of regulations is aimed at data collection by big tech firms. Therefore, we may be looking at a transitory phenomenon that could get resolved soon.

Fundamentals Still Matter

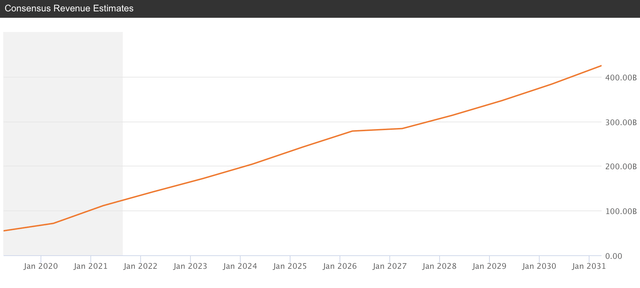

While Alibaba and many other Chinese companies are decoupled from fundamentals right now, this phenomenon is likely transitory. Alibaba delivered over $111 billion in revenues last year, and consensus analyst estimates call for around $142 billion in revenues for this year. This projected growth amounts to about a 28% YoY increase. Moreover, analysts anticipate revenue to continue to grow by double-digits for several years into the future.

Revenue Estimates

Source: seekingalpha.com

Ultimately, Alibaba should cross $400 billion in revenues by around 2030. These enormous growth projections make sense as China has a massive population with a developing middle-class consumer who will likely spend more each year. Additionally, Alibaba is building a presence outside of China as well.

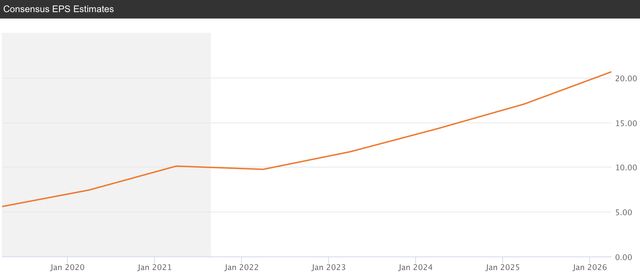

EPS Estimates

Source: seekingalpha.com

As far as profitability goes, analysts expect the company will bring in $11.71 next year. At roughly $153 a share, this brings the company's forward P/E ratio to a remarkably low 13. This ultra-low valuation is the kind of P/E ratio you expect to see on a mature value company with little to no growth prospects, not a dominant tech company with a considerable growth runway. There is undoubtedly a risk premium built into the share price now. However, it may be overdone, and the stock price should expand substantially once the risk premium begins to get priced out of the share price again.

Before this debacle began, Alibaba was trading at about 30 times EPS estimates. Now the stock is down to just 12. In comparison, Amazon (AMZN), a company with a very similar business to Alibaba, trades at a forward P/E ratio of nearly 50. Even slower growth tech stocks like Apple (AAPL) and Microsoft (MSFT) trade at about 30 times forward earnings expectations, roughly triple the P/E of Alibaba.

The point is that most stocks are generally far from cheap right now. However, due to the perpetual negative news flow out of China, Alibaba is remarkably inexpensive.

What Alibaba May Look Like Going Forward

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue | $142B | $172B | $204B | $242B | $278B | $284B | $313B | $346B | $383B |

| Revenue Growth | 28% | 21% | 19% | 19% | 15% | 2% | 10% | 11% | 11% |

| EPS | $9.73 | $11.70 | $14.28 | $17.04 | $20.64 | $21.67 | $24.92 | $28.90 | $33.81 |

| P/E Ratio | 16 | 18 | 20 | 22 | 25 | 22 | 23 | 24 | 25 |

| Price | $155 | $211 | $286 | $375 | $516 | $477 | $573 | $694 | $845 |

Source: Author's Material

I'm essentially using consensus estimate figures here and a relatively low P/E Ratio. I'm gradually factoring out the risk premium that is currently suppressing the share price tremendously. Also, when Alibaba was trading around $320 early in the year, its P/E ratio climbed above 30. Therefore, my estimates of a top-end P/E ratio of 25 are pretty modest. Still, we see a likely stock price appreciation to around $850 by approximately 2030, roughly a 450% gain from current levels.

The Bottom Line

Alibaba's stock has been hammered relentlessly in recent months, and I believe that the bottom got put in several days ago. Despite continued uncertainty, the massive risk premium should start to get priced out of the shares as we advance. Alibaba is not going out of business, and the CCP has no viable reason or incentive to nationalize big tech companies in China. Alibaba's valuation is approaching absurd levels, as shares would need to quadruple to even compete with Amazon's valuation. Once China's regulatory risks subside, Alibaba should return to a more reasonable valuation of 20-25 times P/E or higher. Therefore, this is likely an excellent time to initiate long positions, or dollar cost average if you're long Alibaba's stock already.

Risks Exist

Alibaba may not be suitable for every investor. While the probability for significant downside is relatively small in my view, it exists, and the way up toward substantially higher prices may be a long road. The likelihood for nationalization or something notably draconian from the CCP is low, less than 1% in my view. Nevertheless, the risk exists, which is the primary reason why Alibaba's shares are down so much. Many investors, especially fund managers, cannot tolerate the minimal risk exposure to possible CCP involvement. Due to this phenomenon, Alibaba's shares are on sale right now, but not without risk.

Disclosure: I/we have a beneficial long position in the shares of BABA BIDU TME KWEB NIO either through stock ownership, options, or other derivatives.

Disclaimer: This article ...

more