Alibaba Stock Is A Strong Buy Right Now

Alibaba (BABA) has been under intense pressure in recent months as the company's stock has declined by a whopping 36% from its all-time high ("ATH") in 2020.

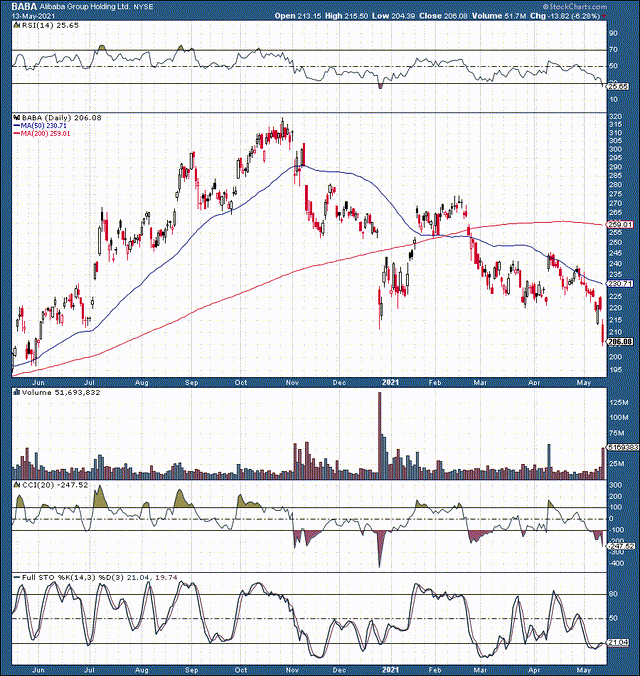

BABA one-year chart

Source: StockCharts.com

We can see that the past several months have been extremely difficult for the online giant. So, what's wrong with this stock? Is it worth to step in and buy shares now? What's likely to occur with Alibaba and its share price going forward?

Technical Image

Let's start with a technical breakdown. Alibaba's stock has been crumbling since late October 2020. BABA is down from about $320 to around $205, a massive 36% slide. Now, we see several indicators that suggest the stock is grossly oversold here. First, the relative strength index ("RSI") is all the way down to around the 25 level, indicative of extremely oversold market conditions. Next, we see the full stochastic below the 20 mark. Other technical indicators are illustrating a similar technical image. BABA has become notably oversold, a likely shift to a more positive momentum is approaching shortly, thus, price action should improve and move higher.

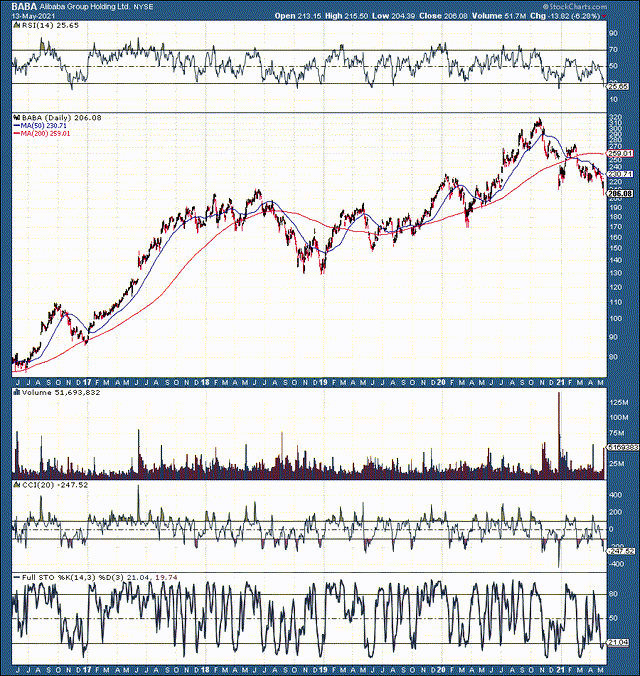

BABA five-year chart

While the one year chart is telling, it does not tell the entire story. Therefore, let's view the five-year chart as well. We can see that the RSI has dipped below 30 only several times over the last five years. Also, we see that just about every time after the RSI dips below 30 a notable jump in share price occurs. We're very likely around such a level again, after which a substantial appreciation in the stock should occur. Moreover, the move is likely going to be sustainable this time.

We see that Alibaba's long-term trend is still intact. In fact, the recent declines look extremely similar to the drop in mid and late 2018. Alibaba declined by approximately 38% in roughly a six-month time frame then, very similar to the recent 36% six-month time frame drop. After the 2018 decline, we saw share price recover and proceed to new ATHs. We're very likely on the verge of a very similar move higher this time in my view.

So, Why the Declines?

Some of you may be asking "why the massive declines in the first place?". After all, this is not some small cap, this is Alibaba, and we're talking about market cap losses worth hundreds of billions of dollars. Well, there are multiple reasons, a sort of perfect storm, if you will. First, there was the Ant Group controversy, then there was China's "attempt" to crack down on Alibaba and other powerful tech firms, then the hedge-fund blow up, then concerns over U.S. regulations, Alibaba's fine, now the "bad earnings" report, and more.

One thing that all these factors have in common is that they are all transitory in my view. The Ant Group situation should get resolved, and let's not forget that the business is extremely profitable. China's increased regulation on its big tech should not have a lasting detrimental effect on Alibaba or the broader industry. There's little to no incentive for the Chinese government to harm its biggest and brightest technology companies. The Archegos blow-up is now old news. I haven't seen any evidence that suggests top Chinese firms like Alibaba will have issues complying with the latest regulations in the U.S. Alibaba's $2.8 billion fine has been paid, and while it may seem like a lot of money to you and I, the sum represents about 4% of Alibaba's 2019 domestic revenues.

Were Earnings Really that Bad?

Let's take a closer look:

- Fiscal Q4 revenues came in at about $28.6 billion, nearly a 4% beat over consensus estimates.

- Fiscal Q4 EPS came in at around $1.58, a slight miss of about 7%.

- Due to the $2.8 billion fine the company swung to a net loss in Q4.

- Excluding the fine, the company's operating income would have come in at around $1.64 billion for the quarter, roughly a 48% YoY rise.

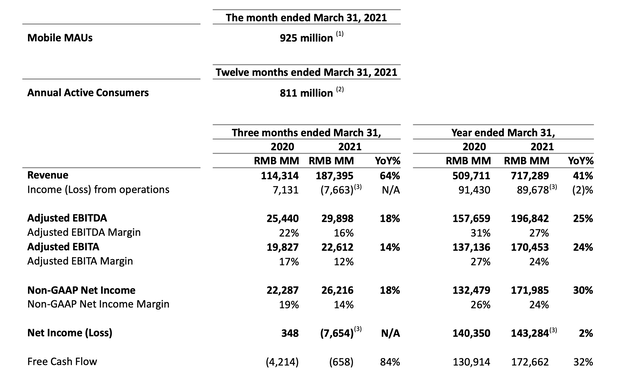

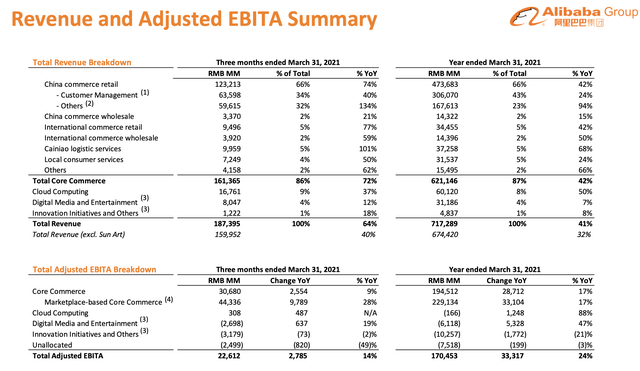

Q4 and Fiscal 2021 Highlights

Source: Alibaba.com

We can see that the company is steadily climbing toward 1 billion users. We see the huge 41% YoY revenue increase for the full year as well as the massive 64% YoY jump in revenues last quarter. As I mentioned earlier, Q4's operating loss was due to "the fine." This also is why we see a 2% YoY decline in operating income. In fact, excluding the fine, Alibaba would have produced an operating income jump of more than 18% on a YoY basis. We see strong double-digit gains in other profitability metrics. Also, we would have seen about a 15% YoY gain in net income once adjusting for the one time charges related to the fine.

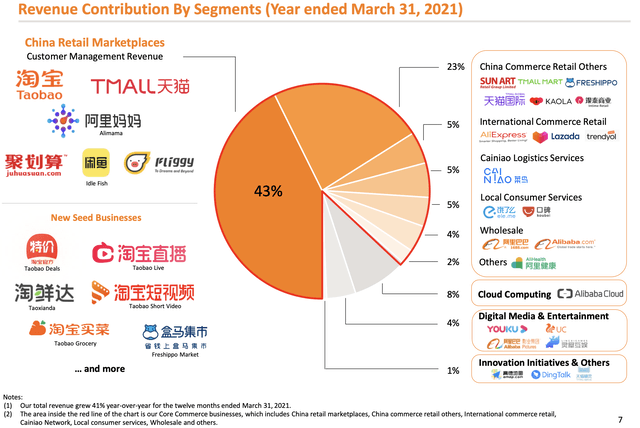

The core commerce segment continues to account for the lion's share of the company's revenues, roughly 87% for the year. Moreover, 66% of total revenue was derived from the domestic Chinese commerce businesses. Revenue growth was very robust, roughly 42% for both China commerce, and core commerce. Cloud computing accounted for about 8% of total revenues, and grew at around 50% for the year. Other, less important segments showed slight YoY growth but combined accounted for only about 5% of total revenues.

In general, we see that the company continues to put up very strong growth numbers and should remain highly profitable as well. Additionally, Alibaba's robust growth should persist for multiple years, and the company is likely going to become increasingly more profitable going forward.

The Bottom Line: What We Have After All This

What we have after all this is a great growth and value company that's extremely cheap right now. Remarkably, Alibaba is trading at around 18.8 times this fiscal year's EPS estimates. If we go out to next year (fiscal 2023), Alibaba is trading at just 12.6 times consensus EPS estimates, and if we look out at 2025 consensus figures, the company is trading at a P/E of just 10. Now, this is all while this year's revenue is expected to grow by over 30%, next year's revenue by 20%, and then by close to 20% for several years after that. Moreover, all or most of the "bad" news already is priced into the stock, and shares are likely going to start their move higher from here. In fact, the current dynamic is extremely similar to what was observed in late 2018, when fears over the U.S./China trade war led to a 38% decline. However, soon thereafter shares recovered and moved up by around 150% in fewer than two years. We could see a similar phenomenon this time as well, where Alibaba's share price moves up by around 100%, to roughly $400-420 over the next 1-2 years.

Alibaba is Not Alone

Other high quality Chinese companies and ETFs have also fallen victim to recent market volatility and overreaction.

Some of our favorite names include:

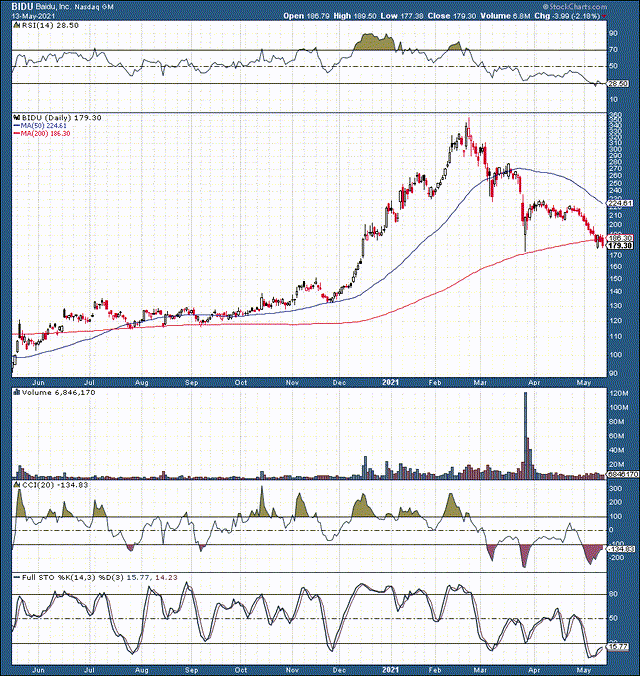

Baidu (BIDU)

Baidu is massively oversold and undervalued here. The stock is down by more than 50% from its high in February. This is one of the top tech giants in China, and right now it's trading at only about 14.5 times 2022's projected consensus EPS estimates. Baidu is anticipated to show revenue growth of over 13% in 2022.

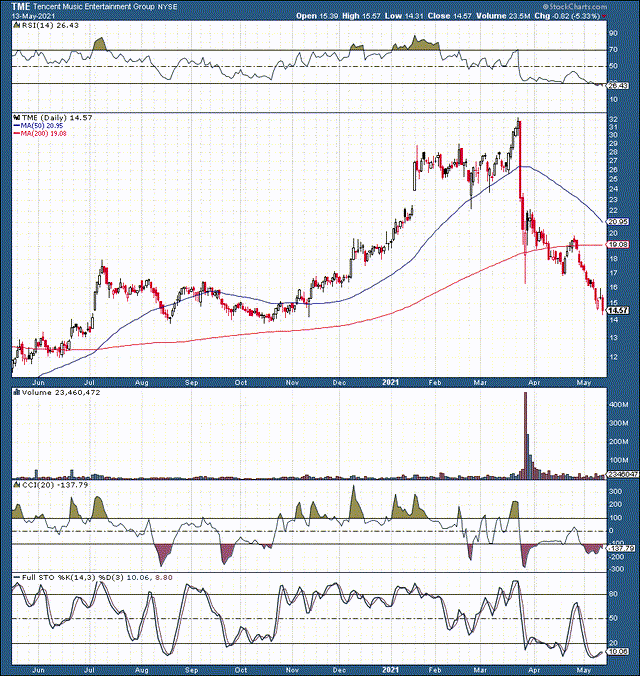

Tencent Music Entertainment (TME)

TME was one of the worst hit stocks following the Archegos hedge fund meltdown. We see roughly 55% declines from the top here. Moreover, the bleeding continued after hedge fund liquidation should have subsided. Right now, this name looks massively miss-priced by the market. The company trades at about 22 times next year's projected EPS estimates, and is anticipated to show robust double digit revenue growth for several years (5-10) going forward.

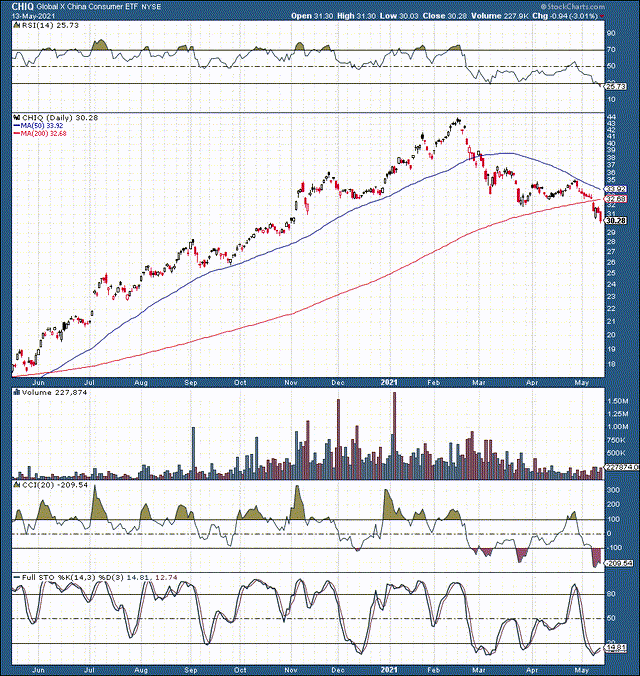

Global X China Consumer ETF (CHIQ)

CHIQ is comprised of the top consumer related companies in China. Its top 10 holdings include:

CHIQ is down by about 32% from its high earlier in the year. Many names in this ETF have fallen victim to heavy selling due to various concerns surrounding Alibaba and the broader Chinese segment.

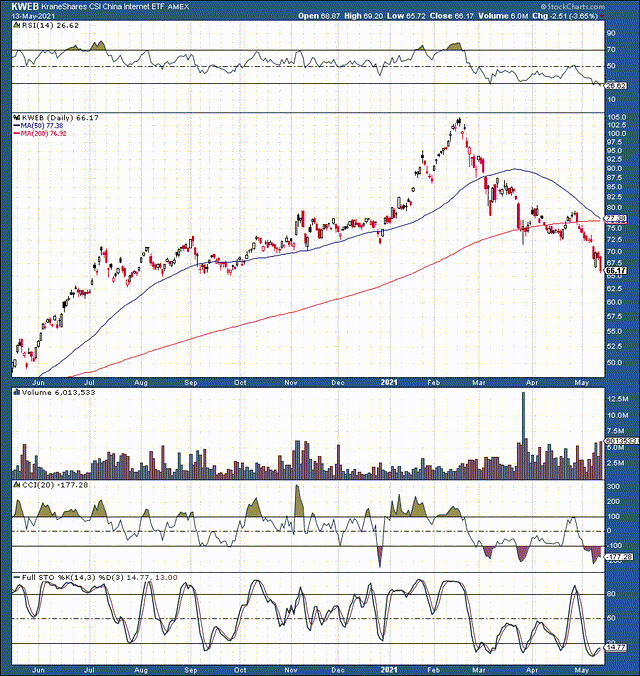

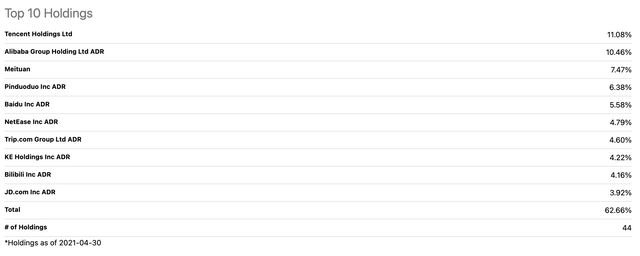

KraneShares CSI China Internet ETF (KWEB)

KWEB is comprised of top internet companies in China. Its top 10 holdings include:

This ETF has cratered by around 37% from its top, likely creating a very attractive opportunity to go long this basket of some of the best companies in China.

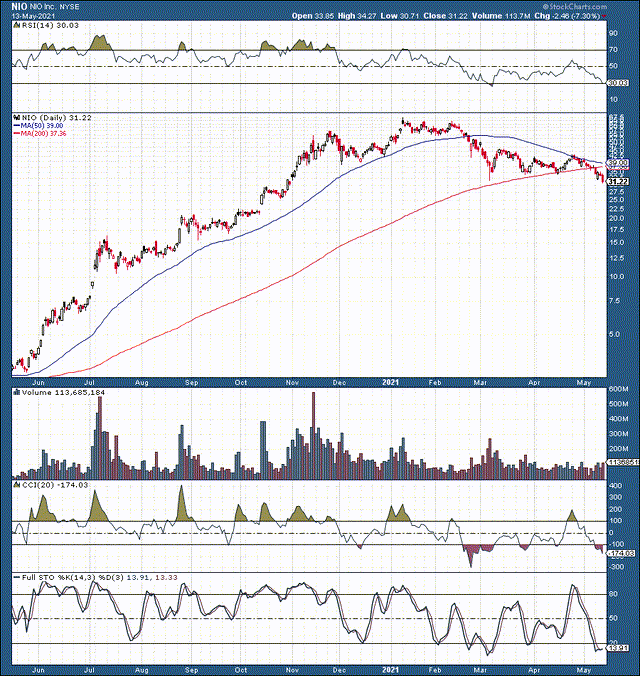

Nio (NIO)

Nio is down by nearly 55% from its top. Shares are massively oversold now, and look like they are bottoming out with the broader China segment. Nio is a top EV producer in China with enormous revenue and earnings growth potential. While the company had just $2.51 billion in revenues in 2020, its revenues are projected to reach around $22 billion in 2025. This illustrates massive growth, and the company's stock is likely to appreciate notably from here.

Disclosure: I am/we are long BABA, BIDU, NIO, KWEB, CHIQ.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to ...

more