Aldeyra Raises Additional Capital To Fund Dry Eye Treatment

Last week Aldeyra Therapeutics (ALDX) raised nearly $27 million in a secondary equity offering:

Aldeyra Therapeutics has closed its public offering of 3,957,500 shares of common stock, including the full exercise of underwriters' over-allotment. Net proceeds were ~$26.8 million.

The company will use the net proceeds to continue to develop lead compound ADX-102 which showed significant improvement in a midstage trial for the treatment of dry eye. ALDX bounced 70% in mid-September after news of its promising clinical study was released. The stock fell 20% on September 19th after the secondary shares were issued. I had the following observations on the capital raise.

Source: Shock Exchange

Fresh Capital Provides Flexibility

Aldeyra is focused on the development of products for inflammation, inborn errors of metabolism, and other diseases related to generated toxic and pro-inflammatory chemical species called aldehydes. The company's ADX-102 isunder development for the potential treatments of illnesses including, but not limited to: [i] allergic conjunctivitis, a disease related to rare allergic ocular diseases characterized by inflammation of the conjunctiva (membrane covering part of the front of the eye), resulting in ocular itching, excessive tea production and swelling; [ii] noninfectious anterior uveitis, a rare inflammatory eye disease that can cause blindness; and [iii] dry eye disease, an inflammatory disease characterized by insufficient moisture and lubrication of the eye.

While its products are under development Aldeyra is hemorrhaging cash. During the first half of 2016 the company suffered an operating loss of $5.3 million; free cash flow was -11.0 million. At that pace Aldeyra would have burned through its $25 million of cash marketable securities in little over a year. The capital raise doubles its cash hoard. It now has the flexibility to go it alone for likely another 18 to 24 months.

Aldeyra could ultimately seek a partner to help fund drugs under development. Usually smaller companies partner with big pharma like Merck (MRK) or Gilead (GILD) once a drug has shown promise in clinical trials and/or is close to receiving FDA approval. The current funding round gives Aldeyra the bargaining power to negotiate better terms with big pharma than it could have otherwise. It also gives the company the option of going it alone, and potentially securing more funding once ADX-102 shows promise in additional clinical stages.

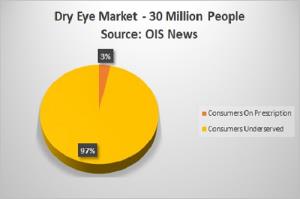

Dry Eye Market Offers Huge Upside Potential

There are about 30 million dry eye sufferers, yet only about 1 million have a prescription. There are 16 million dry eye sufferers in the U.S.; Allergan's (AGN) Restasis controls about 70% of the $1.8 billion U.S. market, while Shire's (SHPG) Xiidra contols just over 20%. The fact that so many people do not have prescriptions could represent an opportunity for a new entrant. Both Restasis and Xiidra cost around $5,000 per year - the high price could be make it unaffordable for many. The price for Restasis has doubled since 2008.

Restasis is a calcineurin inhibitor immunosuppressant indicated to increase tear production in patients whose tear production is presumed to be suppressed due to ocular inflammation. Meanwhile, Xiidra is the first prescription eye drop indicated to treat both the signs and symptons of dry eye. That could partially explain why Xiidra has taken share away from Restasis since it was introduced in the second half of 2016. Restas's Q2 2017 revenue fell 9% Y/Y and Allergan is trying to protect the patent by selling it to a Mohawk Indian Tribe.

Conclusion

ADX-102 could potentially make a splash if it can actually treat signs and symptoms of dry eye. A Phase 2b clinical trial in dry eye disease is expected early next year. The company will likely run trials with a larger patient group and seek the optimal dose that ADX-102 could be effective with minimal side effects. Cowen's Ritu Baral has a $14 price target (93% upside) on ADLX. I believe the stock could move closer to that price target once the Phase 2b clinical trial begins. ADLX is a buy.