Airline Stocks Poised For A Strong Second Half In 2024

Image Source: Unsplash

As we move into the final stretch of 2024, many investors may be asking themselves: Is it time to give airline stocks another look? According to a new report from Bank of America (BofA), the answer might very well be yes.

Despite the turbulence the airline industry has faced in recent years—from pandemic shutdowns to winter storms to rising fuel prices—the winds may finally be shifting in the industry’s favor. With fuel costs easing and pricing power returning, there are several reasons to believe that now could be an ideal time to reconsider the sector.

Let’s walk through the reasons why BofA analysts believe airline stocks are ready to take off again, and why I agree.

Tailwinds for the Airline Industry

BofA points to four key tailwinds that could help the airline industry outperform in the coming months. These factors are worth paying attention to for those who might have written off the sector too soon:

1. Steady TSA Throughput Despite Lower Capacity

Data from the Transportation Security Administration (TSA) shows that flight demand has remained strong, despite airlines reducing their overall capacity. This is crucial because it indicates that people are still flying even though airlines are offering fewer seats. Less capacity combined with solid demand is typically a recipe for improved pricing power, which can support earnings.

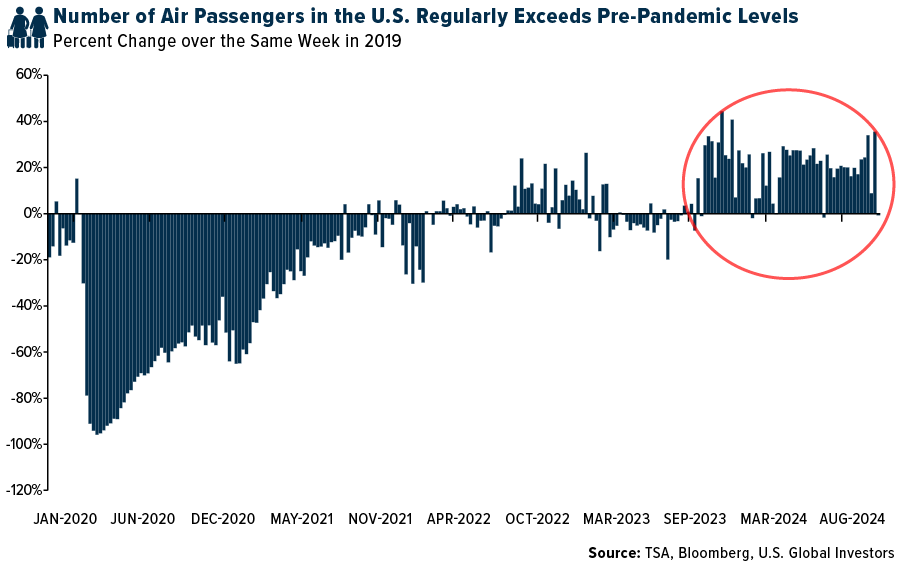

Today, the TSA regularly clears over 2.5 million people to fly every day, exceeding pre-pandemic figures, and in July, a new record was set when 3 million passengers were screened in a single day. As you can see below, passenger volumes in the U.S. now regularly exceed pre-pandemic levels.

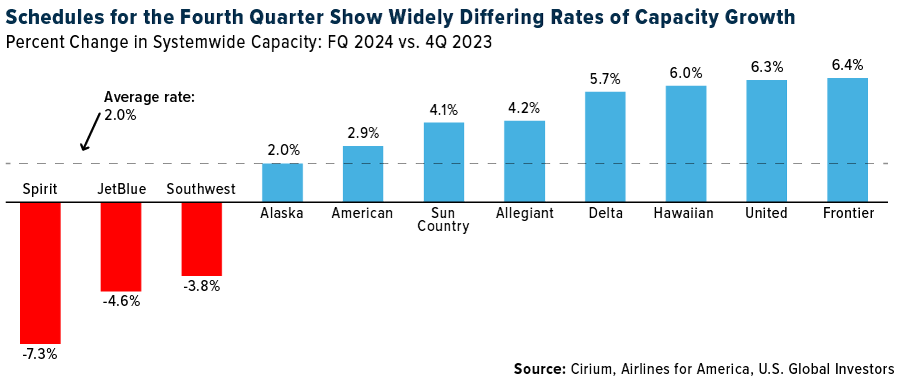

2. Decelerating Domestic Capacity

U.S. airlines are cutting back on domestic capacity. Why? The oversupply of seats during the summer months led to lower fares and compressed margins, even though travel demand was strong. By trimming capacity, airlines can drive up fares without chasing customers away. It’s a classic supply and demand play, and if demand holds steady, we could see a nice bump in revenue for airlines, especially as we move into the fall

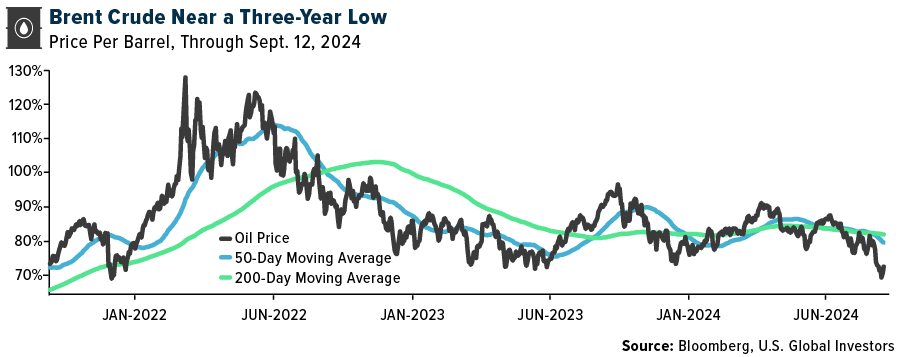

3. Lower Fuel Prices Boosting Earnings

Fuel is one of the biggest expenses for airlines, accounting for 20% to 30% of their total costs. After a period of rising fuel prices, we’re now seeing some relief, which is great news for the airline industry

BofA has raised its earnings estimates for several airlines, including United and Alaska Airlines, due to recent declines in fuel prices. Lower fuel costs, combined with higher ticket prices, could help airlines retain profitability and possibly beat earnings expectations in the fourth quarter.

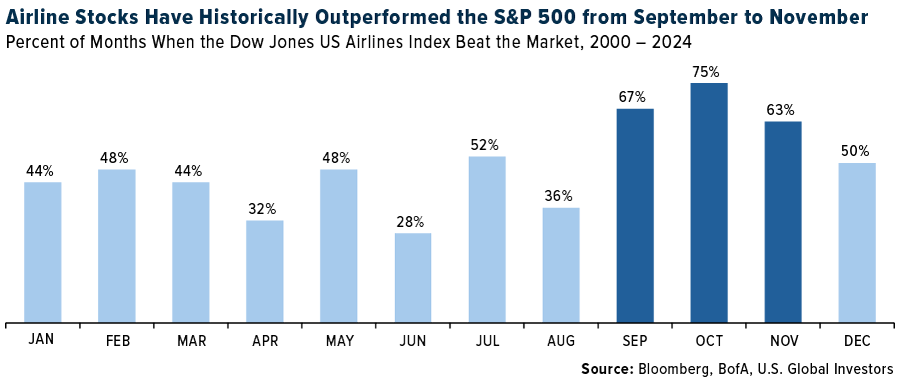

4. Seasonal Outperformance in the Fall

Historically, airlines tend to outperform in the fall. According to BofA’s analysis of the Dow Jones U.S. Airlines Index since 2000, the second half of the year has typically been the stronger half for airlines. The industry has outperformed the S&P 500 in three of the last six months of the year—namely September, October and November. If history is any guide, investors who get in now could see some attractive returns by the end of the year.

Airlines Are Playing the Long Game

Beyond the immediate tailwinds, the airline industry is positioning itself for long-term success. Carriers have been using their cash flow to make critical investments, such as expanding their workforces, renewing their fleets and upgrading their IT systems.

And they’re doing this while paying down debt. U.S. airlines had $143 billion in debt on their books at the end of 2023, down from $168 billion at the end of 2021, according to BofA. That’s still higher than pre-pandemic levels, but it’s a significant improvement and a sign that the industry is serious about managing its balance sheets.

Airlines are also retiring older, less efficient aircraft and replacing them with newer, more fuel-efficient models, which should help reduce operating costs even further. In March, American announced it would be purchasing 260 new aircraft from Boeing, Airbus and Embraer to meet growing demand. This came after United’s October 2023 announcement that it would be buying 110 aircraft from Boeing and Airbus.

Airlines Adjusting to New Realities

As much as we love to think about air travel as a simple business of getting people from point A to point B, it’s a lot more complicated than that. Airlines need to strike a balance between offering enough seats to meet demand and keeping prices high enough to make a profit.

Delta, for example, moderately raised its full-year expectations to between $5 to $7 per share, despite some challenges earlier in the year, including the CrowdStrike hack. Alaska has also raised its earnings outlook thanks to strong summer demand and lower fuel costs. Even budget carriers like Frontier are seeing better-than-expected margins on capacity cuts.

In my view, the ability to adjust and adapt is what makes the airline industry an interesting investment opportunity right now. The airlines that can best manage their capacity, keep their costs under control and maintain pricing power will be the ones that outperform.

A Value Play in the Making

For value-conscious investors, the airline industry could be particularly appealing right now. Airline stocks are trading at attractive price-to-earnings ratios compared to other sectors, and given the potential for earnings growth in the fourth quarter and beyond, this could be an interesting time to consider adding airlines to your portfolio.

As always, timing is important. With steady TSA throughput, decelerating domestic capacity, falling fuel prices and seasonal trends all pointing toward a strong second half for the airline industry, now may be the perfect opportunity to climb aboard.

More By This Author:

Manufacturing Weakness Could Signal Trouble For The Economy

The Contrarian Opportunity In Gold Stocks Today

The Growing Threat Of Government Overreach In Digital Spaces