Aftershocks Continue – Looking For Volume & Great BBQ

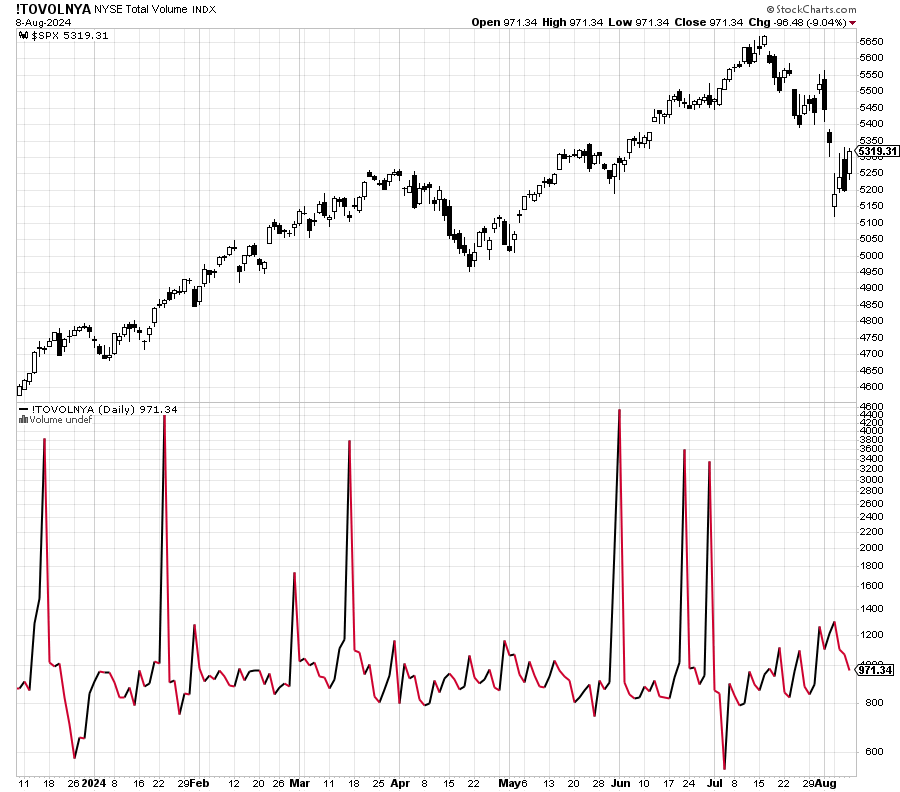

After Monday’s earthquake, we saw a solid aftershock on Wednesday as stocks gave up a big bounce back gain to close moderately lower. Thursday reversed the reversal with 85% of the trading volume coming on stocks going up on the day, a good sign. However, as you can see in the chart below all the way on the right, the rally has come on diminishing volume which is a warning sign. Another “however”, this is not unusual. It’s the next rally where it matters more.

Obviously now people ask if the bottom is in. As I said the other day, I absolutely do not believe that the stock market is going right back to new highs. The earthquake needs to settle down and get through the aftershocks. I do believe that the vast majority of the downside has been achieved, but that doesn’t mean the the lowest low is in. We will have to take one step at a time.

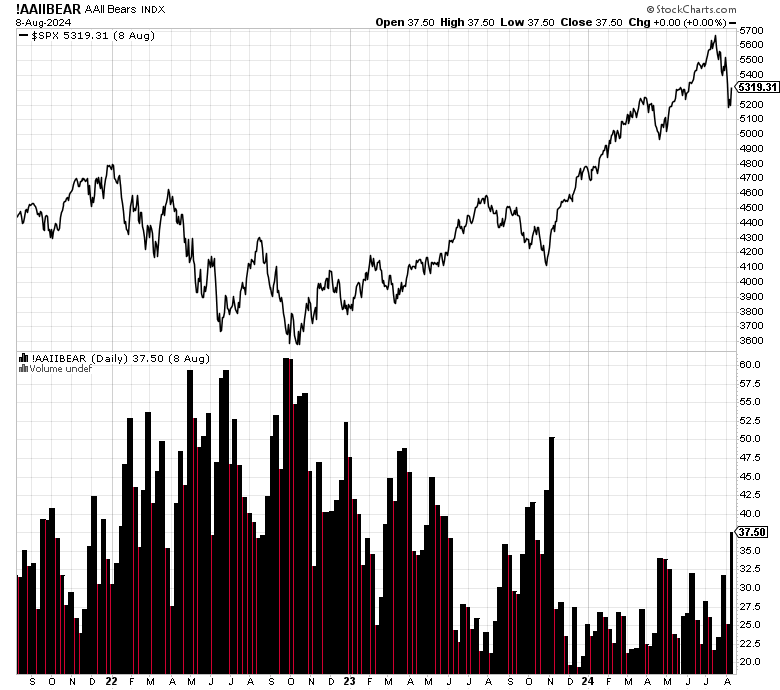

Take a look at the number of bears in the AAII weekly sentiment survey below. They just screamed higher after the decline which is a good thing. Obviously, they are nowhere near the bear market low levels of 2022, but this decline hasn’t even hit 10% like last October. Seeing bears climb among individual investors is a step in the right direction.

The last weekend of travel baseball is upon us and D’s team gets to play locally for the first time. I won’t miss the drives to RI, NY and MA. This past week we did a quick trip to Missouri to visit the Royals and Cardinals. We are trying to see every stadium by the time he goes to college.

Upon landing in KC, we did what any respectable foodie would do in 106 degree heat. We headed straight to the top rated BBQ place in the area, Joe’s, which happens to be part of a gas station.

On Wednesday we sold PCY and EMB. On Thursday we bought TLT, RYGBX, AHTFX and more levered NDX.

More By This Author:

Monday Was An Earthquake – Aftershocks Coming And Then All-Time Highs

Bulls Wounded – New Lows Coming Soon

The Down And Outs Are Up & In – Huge Week Ahead

Please see HC's full disclosure here.