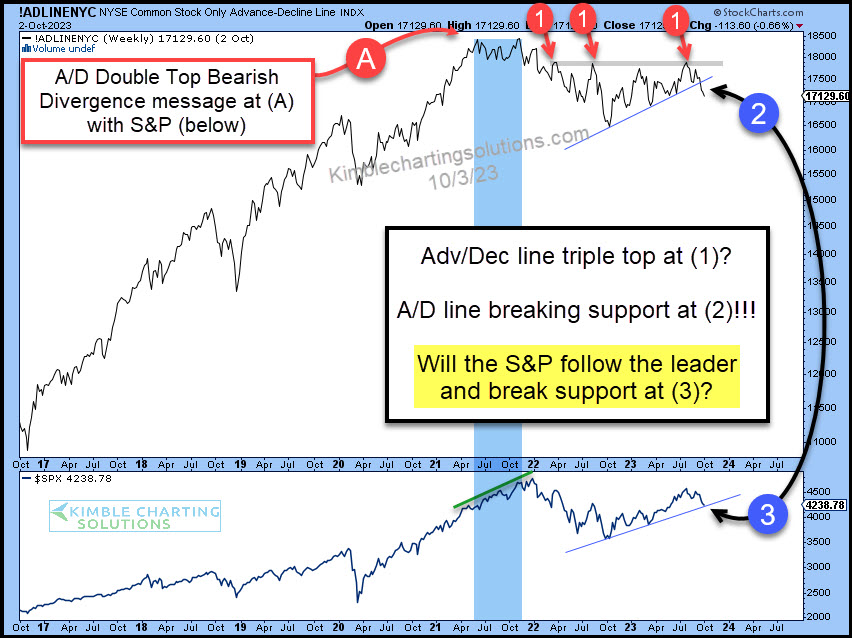

Advance/Decline Line Warns Investors With Triple Top Breakdown

We have been highlighting several market indicators trading at critical time/price areas over the past month or so.

And today is no different as we take a look at the Advance/Decline Line for NYSE common stocks. This is a very important measure of market breadth looking at the number of advancing versus declining stocks each day.

As you can see in the chart below, the Advance/Decline Line (A/D Line) created a double top (blue shade) before creating a triple top at (1). And now it is breaking down below support at (2). Yikes!

Looking at the lower pane in the chart, I humbly ask, “will the S&P 500 follow the leading indicator and break support at (3)???

Could the A/D Line be sending a new message to the markets with its breakdown at (2)?

(Click on image to enlarge)

More By This Author:

Utilities Breaking Down: Omen For Stock Market And Economy?

Are Junk Bonds Sending Bearish Message To Stock Market?

$40 Billion In Wrong Bond Fund Past 2 Years, Says Joe Friday

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.