A Year Of Friday Action

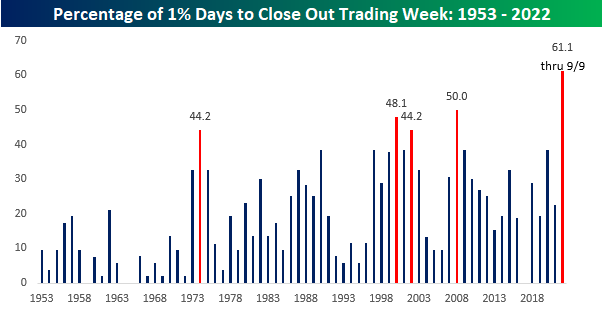

There’s still time left in the trading day which means that anything can happen, but the equity market is on pace to close out the week with a gain or loss of 1%+ for the 22nd time this year. Going back to 1953 when the five-trading day week started on the NYSE, there have only been four other years where the S&P 500 rallied or declined at least 1% on the final trading day of the week (there have been another six where there were 20). The only years where there were more 1% moves to close out the week were 1974 (23), 2000 (25), 2002 (23), and 2008 (26). Keep in mind, though, that while this year is just four off the record-high pace, there are still 16 weeks left in the year! The year is only two-thirds complete, but already Fridays have seen a lot of action.

To make more of an apples-to-apples comparison, on a percentage basis, 61% of all weeks this year have closed out with a one-day move of at least 1%. Granted, it’s not a full year of prices yet, but in prior years since 1953, there was never a year where the S&P 500 closed out the trading week with a gain or loss of at least 1% more than half of the time. In 2008, half of all weeks ended with moves of that magnitude while the percentage in 2000 was 48.1%, and 1974 and 2002 each closed out the week with 1%+ moves 44% of the time. These levels of volatility are a far cry from a year like 2017 when there wasn’t a single Friday that the S&P 500 rallied or declined 1%.

More By This Author:

Bulls Back Below 20% Once Again

Historic Small Cap Volatility

Apple On Iphone Announcement Days

Click here to learn more about Bespoke’s premium stock market research service.

See Disclaimer ...

more