A Uranium Trade That Could Generate 233% Returns

Most investors tend to think about solar, wind, and hydrogen fuel when it comes to green energy investing. It tends to come as a surprise that nuclear energy is also green. This is because nuclear power essentially produces zero emissions. And in the era of serious concerns over climate change, “zero emissions” is a huge deal and nuclear energy can plan a part in the solution.

Nuclear energy is also the most efficient type of energy on the planet. A small amount of raw material can result in massive amounts of nuclear energy electricity generation. That raw material is uranium, at least to start with—it’s treated and enriched and eventually may become plutonium.

Investors traditionally haven’t considered nuclear power to be green because of high-profile accidents (meltdowns) and the negative publicity of nuclear waste. However, new nuclear reactors are orders of magnitude safer than those issue-plagued plants of the past. What’s more, nuclear waste is tiny, safe storage and disposal methods are already known.

While nuclear reactors are expensive to build, they make for an intriguing stopgap (or even long-term solution) to reduce carbon emissions. While it may be cheaper, in the long run, to focus on technological improvements in solar and wind (among others), it’s hard to argue that uranium-based power shouldn’t be at least part of the solution.

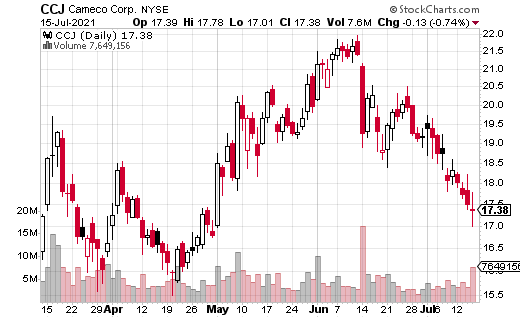

The largest publicly traded uranium producer is Cameco (CCJ), a Canada-based $7 billion company with around $1.5 billion in annual revenues. Recently, a trader made a large bullish bet on CCJ that could pay off with sizeable returns.

More specifically, the trader purchased a call spread on CCJ expiring in September. A call spread (or vertical spread) is when the trader buys the call closer to the stock price and sells a call further away. This strategy will cap the potential gains from upside movement but will lower the cost of making the trade.

In the CCJ trade, with the stock price at $17.11, the trader purchased the September 17 call while simultaneously selling the 20 call in the same expiration. The total cost of the trade was $0.90 cents, meaning max loss on the trade is $90 per spread if the stock closes below $17 at September expiration.

Conversely, max gain is the width of the spread (3) minus the amount paid ($0.90), or $2.10 if CCJ is at $20 or above at September expiration. In percentage terms, that’s a 233% gain.

The spread was executed 13,500 times with a potential max loss of $1.2 million and max gain of $2.8 million. At that magnitude, it’s likely a fund or institutional investor executed the trade. Generally, it’s a good signal for CCJ bulls that the stock has at least some upside potential over the next couple of months.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more

I'd be selling the $17.50 calls weekly instead collecting a fatter premium.

He needs the $CCJ to close at $17.90 by September just to break even. That's just stupid on a downtrend. Should sell weekly naked calls at $17.50 to get some of that premium back.

We are going to break $16 and go to $15 handle at minimum so why does the guy even execute the trade at $17.11? It's stupid