A Spiderman Quarter

As I write this, the first quarter of 2023 has not quite come to a close in the Western Hemisphere, but as of midday on March 31st, I think it’s fair to draw some conclusions about the three-month stretch that we’re about to finish.

If markets indeed climb a “wall of worry”, then most of the world’s equity markets can give Spiderman some competition. We began the year with a solid bounce from deeply oversold levels in December, heavily abetted by US tax-loss selling; saw a phenomenal early bounce thanks to one of the strongest “January Effects” in recent memory; watched that morph into a full-fledged risk-on market thanks to a brief flirtation with “disinflation” and abetted by the widespread adoption of “zero-dated” or “0DTE” options; and weathered a banking crisis. All of this was accompanied by record volatility in short-term yields. Yet here stock markets stand, at or near recent highs.

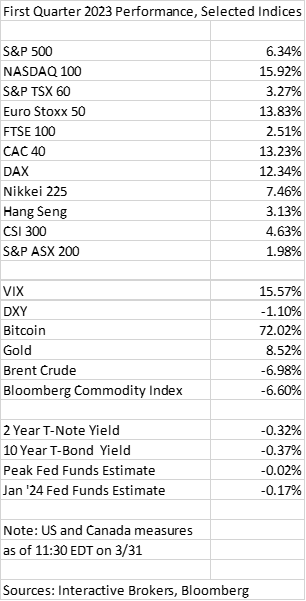

We all know that this has been a positive quarter for most global stock indices. The Nasdaq 100 and Continental European measures led the way, while more commodity-sensitive indices like those in Canada and Australia lagged. That hardly seems surprising in a quarter when commodities (other than gold) generally fell. Brent crude and the Bloomberg Commodity Index both fell by a bit less than 7%

Gold was a winner despite apparent progress in commodity price inflation. We have asserted that gold tends to act more like an anti-dollar than a true inflation hedge, but gold’s 8.5% rise far outpaces the dollar index’ 1% fall. It seems to be more related to investors looking ahead to central banks easing their inflation fights and looking for a safe landing spot during a banking crisis. Or maybe it is simply taking its lead from “digital gold” with Bitcoin up over 70%.

Despite the huge swings in interest rates that we saw during the quarter – US 10-Year Treasury yields ranged from 3.37% to 4.05%, while 2-Year yields had a staggering 3.77% to 5.07% range (!) – both of those rates finished the quarter about 35 basis points lower. Market estimates for both peak and year-end Fed Funds ended up in almost exactly the same place as they were when the year began.

There appears to be no shortage of potential worries to be conquered in the quarter ahead. Let's see if Spiderman can continue his climb.

More By This Author:

Markets Sanguine Ahead Of Key Inflation Report

Fed Put Talk Resurfaces

A Quick Note About Financial Stress

Disclosure: DIGITAL ASSETS

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to ...

more