Markets Sanguine Ahead Of Key Inflation Report

Might any of the following describe the Federal Reserve: data-dependent; inflation focused; determined? If you said “yes” to any of these, then you should be paying attention to tomorrow’s release of the Core PCE Deflator.

The Core PCE Deflator has long been considered the Fed’s preferred inflation gauge, as they believe it offers the best read on costs facing consumers. I’ll leave it to the economists to bicker about whether the Bureau of Economic Analysis, which compiles the PCE Deflator, or the Bureau of Labor Statistics, which compiles CPI does a better job. The bottom line, if Powell and his colleagues are watching this number, so should we.

The median estimate for the month-over-month rise is 0.4%, according to Bloomberg data. That would be a drop from the prior reading of 0.6%. Although the report is coming on the last day of March, it is February’s data. The inflation reports that arrived earlier this month showed a slow pace of rises than those that we saw in January’s data. Perhaps those were disinflationary, but they came on the heels of a skein of higher-than-expected January reports and were not enough to dissuade the FOMC from raising rates even while concerned with a banking crisis.

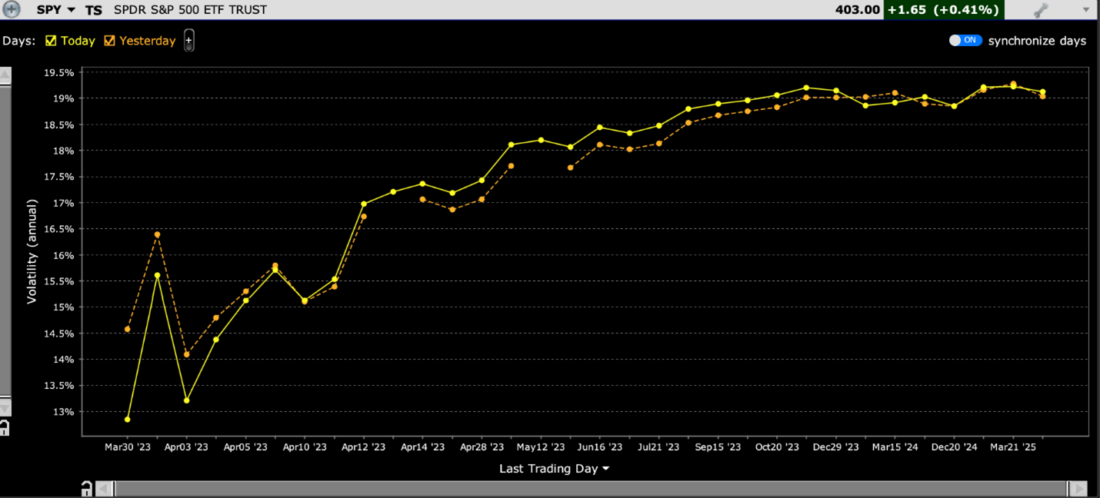

Considering the stakes, we might expect to see key equity options display some concern. Those would be expressed with higher implied volatilities. When looking at SPY options, we see a bump for options expiring tomorrow, but one can hardly consider them worrisome:

Volatility Term Structure for SPY Options – Today (yellow), Yesterday (orange)

(Click on image to enlarge)

Source: Interactive Brokers

The implied volatility for options expiring tomorrow actually declined slightly and are now pricing in a move of less than 1%.

Interestingly, we see the low levels persist through April 10, which would be the first day that markets can react to the next Nonfarm Payrolls Report. In a calendar quirk, the data will be released when US equity markets will be closed for the Good Friday holiday. Since it’s a market holiday, but not a Federal holiday, the government will be open when markets are not. This is hardly unprecedented – it last occurred in 2021. At that time, we were in a raging bull market, and stocks rose over 1% on both the day prior and the day afterwards, abetted by what was then the latest in a run of much stronger than expected payrolls.

For a number that could some clarity into the current market conundrum.The market expects Fed rate cut but the FOMC sees rates holding steady.If tomorrow’s PCE report comes in above expectations – or even in line – it would show inflation at a rate that is well above the 2% target.Might Fed Funds futures adjust to that new data point?It seems as though they should.

We are now in the enviable, but seemingly unsustainable position of expecting relative calm on the banking front but somehow expecting rate cuts that are precipitated neither by banking woes nor a hard landing recession.Perhaps we will get some important clarity toward some resolution of that seeming contradiction.But options traders seem to be expecting relative calm ahead of tomorrow’s quarter end instead.

More By This Author:

Fed Put Talk Resurfaces

A Quick Note About Financial Stress

Calm Markets And Cognitive Dissonance

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more