“A” Significant Low Is In For Stocks – “THE” Bottom Likely 4-8 Weeks Off

Image Source: Pexels

When we left off on Wednesday morning which seemed like a year ago, I showed a number of charts that were supportive of the stock market finding “A” bottom earlier this week. I didn’t then and still question whether we’ve “THE” bottom. I doubt it unless the Fed comes in with the nuclear weapons like they did on April 6th 2020.

Wednesday’s rally was one for the ages. The stock market rallied more in three hours than the average one YEAR return. 16 times more stocks went up than down. In my 35 years doing this, that was one of the most vicious short-covering rallies I can recall. Only a day or two in 2008 and 2020 come close to April 9th, 2025.

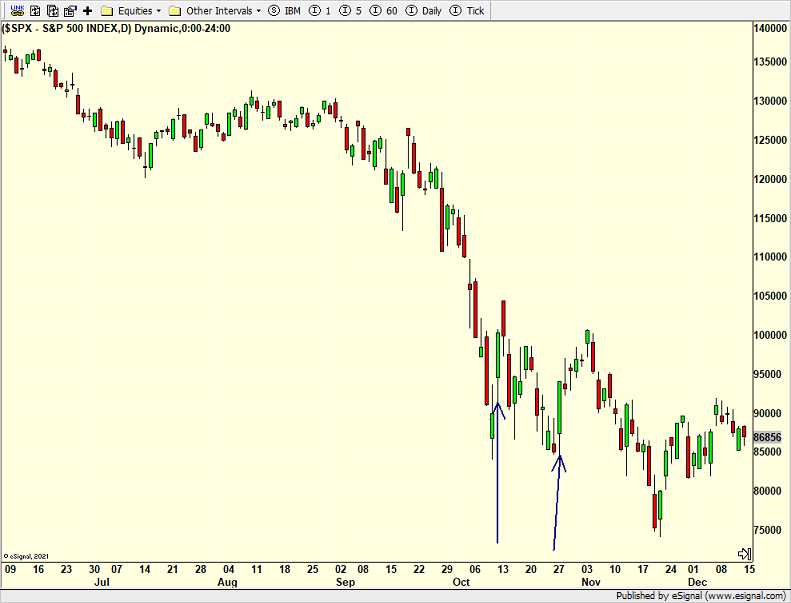

Below is a chart of 2008, and I have drawn arrows on other insanely up days for stocks. Notice that they came after a massive plunge in the stock market and the rallies were short-lived. Behavior like this is most often seen during bear markets and usually not at the exact low point.

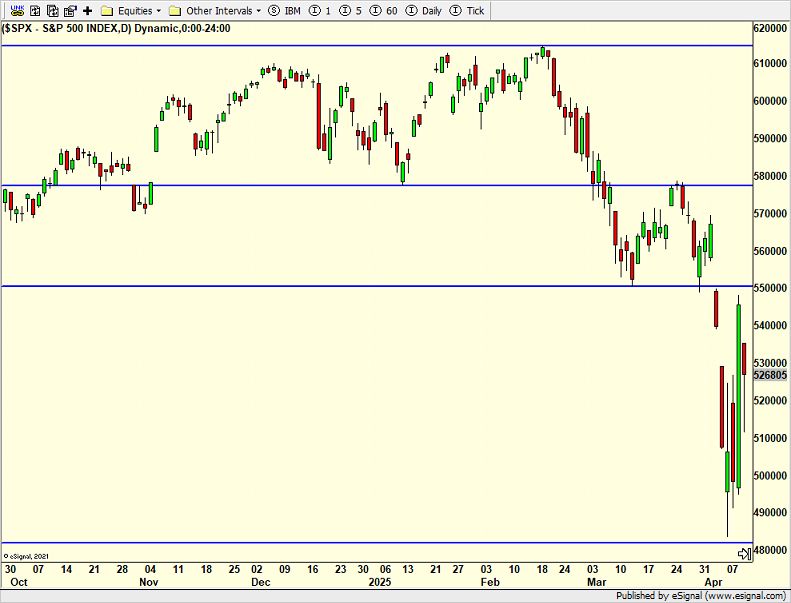

Today’s S&P 500 is below. The bottom two horizontal, blue lines best depict my thoughts over the next 4-8 weeks. I think the stock market will stay in a very wide 15% range, go up and down and not let bulls nor bears get too comfortable. In other words, there will be little intermediate-term fun to be had until perhaps June.

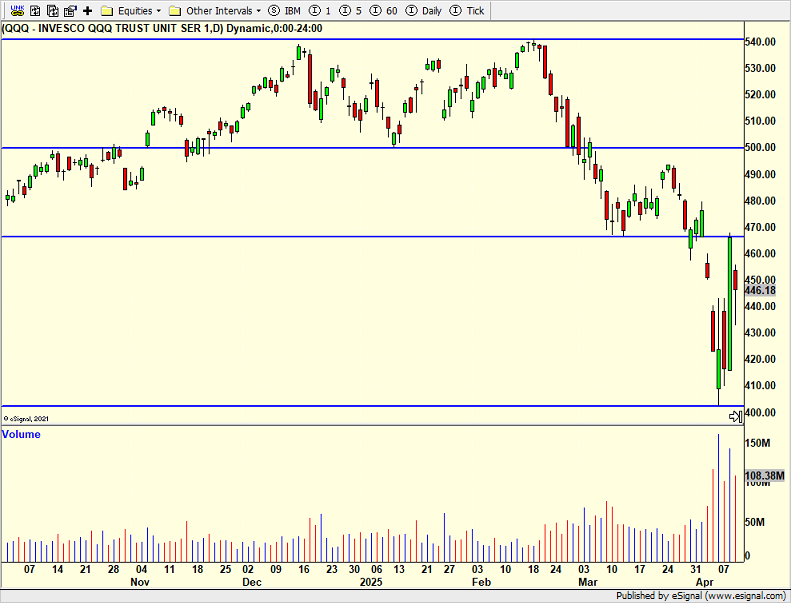

I wanted to throw in another chart that indicates the market is bottoming. It is an update of the QQQ (Nasdaq 100) chart with volume on the bottom. 160M+ shares traded in one day. Highest since January 2022 which was not the final bottom and even exceeded the COVID Crash. This supports my thesis that the highest intensity of the decline has been seen, but probably not the final low which may around levels from last week or slightly lower.

Overall, I think a theme of buying big down days and pruning big up days should work over the coming 4-8 weeks. Ultimately, it will fail when stocks are ready to run higher again in late Q2 and Q3. And while I don’t think we’re looking at new highs in Q3, I do think late Q4 or early Q1 2026 is feasible.

On Wednesday, we bought SDS and sold SSO. On Thursday, we bought more MQQQ, UWM, and QLD. We sold SDS.

More By This Author:

Volatility At Historic Highs – Comparing Other CrashesMarket Correction Turned Into A Waterfall Invoking 2022 & 2020 – Zone For A Bottom Opens This Week

Stock Market Bottom Could Be In As Tariffs Begin

Please see HC's full disclosure here.