A New Paradigm For Traders

Image Source: Unsplash

Every market participant operates within a framework, whether they recognize it or not. That framework determines what information matters, what gets ignored, and how decisions are made when certainty is unavailable.

Traders and long-term investors often work from very different frameworks. Neither approach is inherently superior, but they address different problems. For me, trading has always been more intuitive because it begins with a realistic assumption: the future is unknown.

Long-term investors often believe they can identify the eventual winners in emerging technologies. They study products, management teams, balance sheets, and industry trends, then project those factors forward. History suggests this is far more difficult than it appears.

In the 1980s, investors believed Commodore would dominate personal computing. Personal computers reshaped the world; however, Commodore did not survive the competition. In the 1990s, Motorola was widely viewed as the future of mobile communication. Cell phones transformed daily life, but Motorola lost its market leadership long before smartphones redefined the market.

The pattern is consistent. Technology evolves. Competition intensifies. Early leaders are displaced. Assuming that one can reliably identify the ultimate winner in a rapidly changing space is less analysis than confidence in foresight.

That is not criticism. It is a recognition of the limits of information.

Accurately identifying long-term winners requires technical expertise, insight into management execution, an understanding of capital allocation, and reliable forecasts of consumer behavior. Even large institutions struggle with the task. Individual investors face an even steeper challenge.

Traders approach the market differently. They do not attempt to predict which technology will dominate years from now. They recognize that markets continuously reprice expectations long before outcomes are known. Their objective is not to be right about the future, but to respond correctly to what is happening now.

This distinction matters.

Many people are taught from an early age that investing means analyzing financial statements and identifying good companies at attractive values. In practice, those concepts are subjective. What qualifies as value changes. What defines a good product evolves. As a result, many long-term investors remain committed to positions even as prices decline dramatically.

Traders operate under a stricter standard. Price behavior is the final arbiter. Stocks that are being accumulated rise. Stocks that are being distributed fall. Financial statements exist, but they are secondary to how participants are actually positioning themselves.

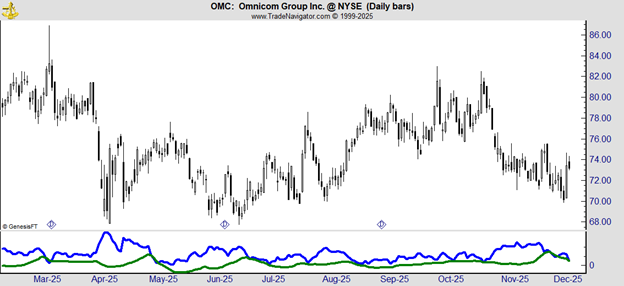

This is where my Income Trader Volatility indicator fits.

ITV was developed to operate within this trading framework. It does not attempt to evaluate products or forecast industry leadership. It measures how volatility behaves inside individual stocks, which is another way of measuring how emotion expresses itself through price. When volatility expands beyond what history suggests is sustainable, conditions for a reversal begin to form. When that pressure releases, price adjusts.

Earlier this month, Omnicom Group Inc. (OMC) provided a clear example of this process. The indicator identified a volatility extreme that signaled a potential transition. That signal was not based on a forecast, an earnings narrative, or an opinion about the advertising industry. It was based entirely on measurable behavior.

The following day, as volatility normalized, the indicator generated a sell signal. The trade captured a gain of roughly 5.5% in one day.

That outcome was not the result of predicting Omnicom’s future. It was the result of responding to an emotional overshoot and its resolution.

These are the types of opportunities the indicator is designed to identify: short duration moves driven by positioning and psychology, not long-term narratives. A one-day gain of 5.5% may not sound groundbreaking, but several such gains will add up.

This framework can feel uncomfortable for those conditioned to believe that understanding a company deeply is required to trade it successfully. But trading is not about conviction. It is about execution.

Profit and loss matter more than predictions. That is not cynicism. It is discipline.

A new paradigm does not dismiss innovation or business fundamentals. It recognizes that markets move on emotion, expectations, and positioning long before outcomes are known. Measuring those forces directly is often more reliable than trying to outthink them.

That is the framework I trade from. And it is the foundation of the indicator I rely on every day.

More By This Author:

This Trading Edge Ignores Headlines And Preserves Your Gains

Unlock Trading Edges Hidden Inside Market Chaos

This Subtle Shift In Volatility Reveals New Opportunities

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more