A Look At The Financial Sector’s Weighting

At its YTD high back on February 7th, the S&P Financial sector ETF (XLF) was up more than 8% on the year. Since that high, the sector has fallen more than 13% and is now down more than 6% YTD.

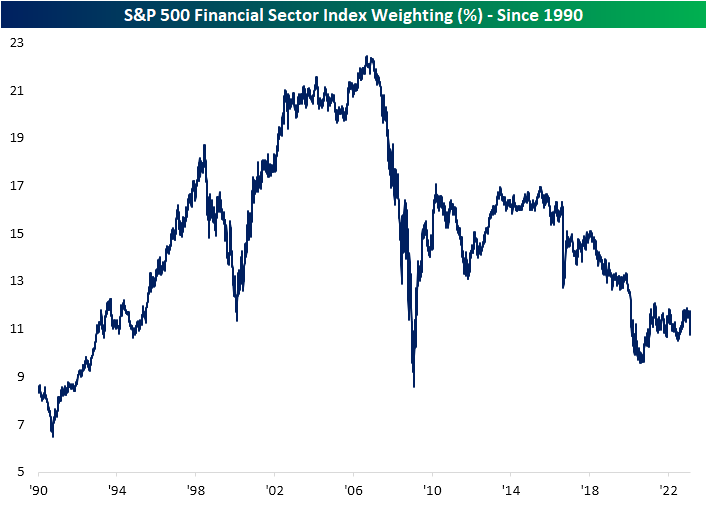

With systemic risk in the Financial system making front-page headlines again, we checked in on the sector’s weighting in the S&P 500 to see how it compares to where things stood back in the mid-2000s ahead of the Financial Crisis. Below is a look at the Financial sector’s weighting in the S&P going back to 1990. As of this writing, the Financial sector has a weighting of 10.73% in the S&P. That’s down a full percentage point from where it was at the end of February.

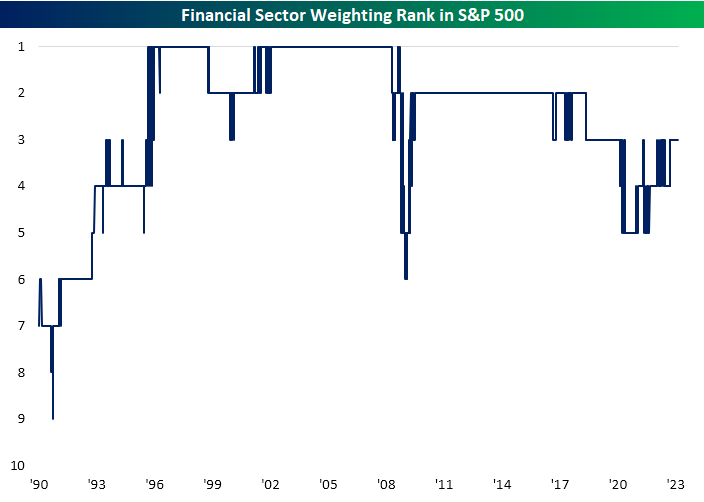

What’s interesting to note is how much smaller the sector is today compared to its weighting back in early 2006 when we were on the cusp of the Financial Crisis. At its peak in early 2006, the sector’s weight in the S&P had ballooned to 22.4%, which made it the largest sector of the S&P at the time. When the Financial sector, which is a sector meant to service the rest of the economy becomes the largest sector, something’s off! Of course, the Financial Crisis following the bursting of the housing bubble of the mid-2000s corrected this problem, as the Financial sector’s weighting fell from north of 22% down to south of 9% when the bottom was finally put in back in early 2009. During this latest bout of issues for Financials, the sector is still big enough to be the third largest sector in the S&P behind Tech and Health Care, but it’s not nearly as “weighty” as it was before the Financial Crisis, and its weighting has actually been trending lower for the last 7-8 years.

More By This Author:

Don’t Forget About CPI

March Volatility Emerging

This Doesn’t Happen Often

Click here to learn more about Bespoke’s premium stock market research ...

more