A Fed Pivot Won’t Fix Anything… Stocks Will Fall Another 30%

The financial markets are now experiencing their 3rd “the Fed is about to pivot” delusion.

Ever since the Fed started tightening monetary policy in March 2022, the financial media and social media have been abuzz with claims that the Fed will eventually “pivot,” meaning that the Fed will abandon its tightening and start easing by cutting rates or introducing Quantitative Easing (QE).

The argument here is that you should BUY STOCKS because once the Fed eases, stocks will erupt higher in a new bull market.

It’s complete and utter BS… and anyone who believes it will lose their shirts.

Why?

Because historically anytime the Fed stops tightening and begins easing, the markets don’t actually bottom for another 14 months.

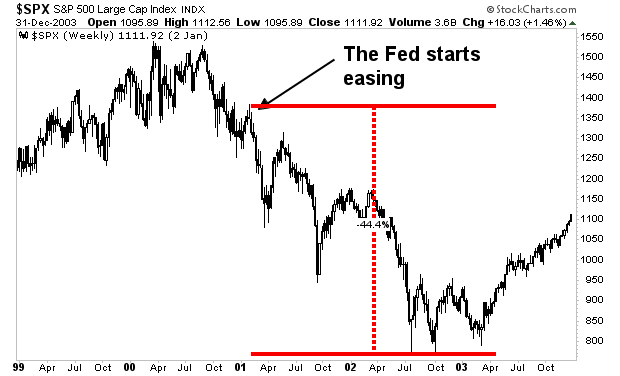

During the Tech Crash, the Fed started cutting rates in January of 2001. Stocks lost another 44% and didn’t bottom until October 2003.

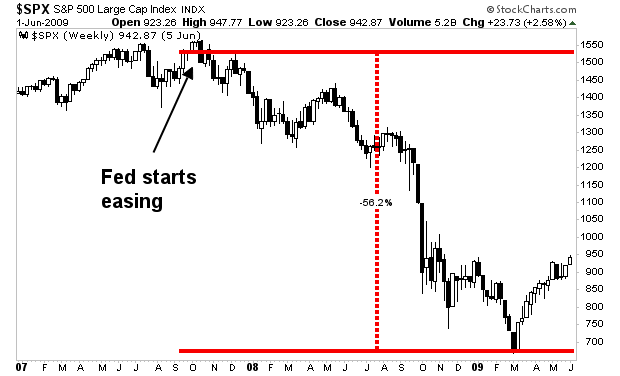

Similarly, during the Housing Crash, the Fed started easing in August of 2007. Stocks would go on to lose another 56% and wouldn’t bottom until March 2009.

So again, even if the Fed were to surprise the markets and CUT RATES in November, stocks will likely lose another 30% and not bottom for at least another year.

And bear in mind… the Fed HAS NOT said it will ease anytime soon… not even in 2023! So we are NOWHERE near a bottom in stocks.

More By This Author:

What Happens To Stocks When The 5th Largest Economy In The World Goes Bust?

Forget The UK. Have You Seen What Is Happening In Japan?

This Is Seriously Bad News For Stocks