Forget The UK. Have You Seen What Is Happening In Japan?

Aaaaaaaaannnd another country is losing control of its financial system.

We’ve already assessed the fact that the financial system of the United Kingdom (U.K.) is in the process of imploding. The British Pound and yields on British government bonds have collapsed in the last month, resulting in the country’s central bank, the Bank of England, (BoE) launching an emergency, unlimited Quantitative Easing (QE) program.

The last time the BoE was forced to do this was during the pandemic crash in March 2020. We’re now over two years out from that and the BoE just had to launch another emergency QE program because the financial system is so addicted to central bank interventions that the BoE can’t even begin to shrink its balance sheet without triggering a currency/ bond crisis.

Bear in mind, we’re not talking about Uganda or some other emerging market here… we’re talking about the fifth largest economy in the world… and one of the major currencies for trade.

However, the U.K.’s problems pale in comparison to those of Japan.

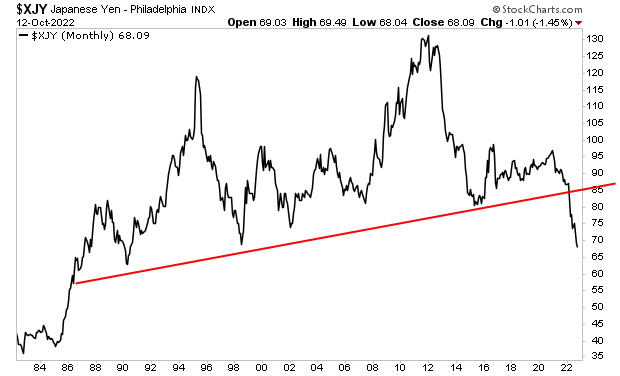

The Japanese Yen is collapsing, falling to the lowest levels since the early-‘90s.

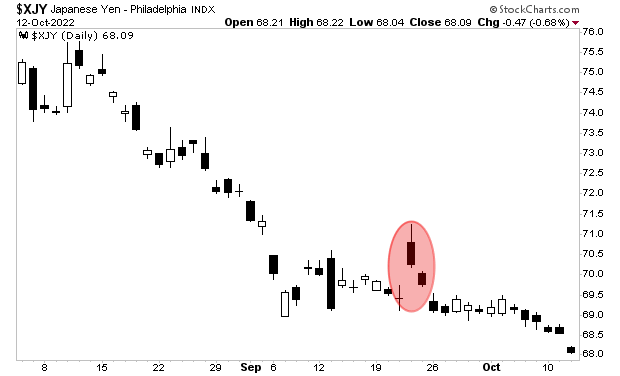

The situation became so dire in late September that the Bank of Japan (BoJ) was forced to intervene to buy its own currency for the first time since 1998.

The Yen bounced for one day and then rolled over to new lows.

Yes, we’ve reached the point at which a MAJOR central bank announces that it will be intervening directly in its currency market… and the impact lasts one day.

See for yourself.

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2022, entire countries will do so.

More By This Author:

This Is Seriously Bad News For Stocks

Stocks Are In La La Land… Just Like They Were Right Before Lehman

Warning: the Fed Didn’t Pivot Yesterday - If Anything It Doesn’t Need to Anymore