A Contrarian Take On Crypto

The Dot-Com Bubble Analogue

A point we've made previously (Partying Like It's 1929) is that the crypto bubble is similar to the dot-com bubble of the late 1990s for a few of reasons:

- Like the dot-com bubble, the crypto bubble is centered on transformative disintermediating technology. Dot-com had ecommerce eating physical retail; crypto has the blockchain eating centralized finance.

- As with the dot-com bubble, the crypto bubble features crazy valuations and investors buying stuff that will go to zero.

- Just as the dot-com bubble nevertheless spawned future oligopolistic giants, so too will the crypto bubble.

Now one observer has cast some doubts on our first reason, that the blockchains powering crypto are transformative technology. His objection is based on the lack of real world applications for both, a dozen years after the initial launch of Bitcoin.

Moose Photos/Pexels

Crypto As Microsoft Pre-Windows

In a thread on Sunday, Twitter user "Reaper" posted a series of provocative questions about crypto and Web3, which is the idea of a decentralized internet based on blockchains:

It’s like year 12 of crypto and it’s still unusable except to buy imaginary digital items online, and somehow even that requires 9% fee. Someone in Web3 explain this to me like I’m 5.

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 27, 2021

Now imagine if everyone had a computer running DOS. There was no software for it. Except a screen saver that told you the current price of DOS. All you could do with them was sell them to others for the current price on the screen. This thing rules. I love this!

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 27, 2021

- Early On every social network

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

- early on Android

- Pitched massive gaming revolution / market size potential to CEO of Kaplan Schweser in 2006

- pitched match / online dating potential to anyone who would listen in 2012

- Early Netflix and cord cutting

- Early Uber

- Early to VR (2014). Though if you count virtual boy (dumb) 1995?

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

- fitness tracking / devices. Fitbit, jawbone, withings,

- Every internet marketplace I was one of the first 1-2% of customers. Airbnb, Etsy, drizzly, food delivery of all sorts.

- smart home shit

- car devices

Remember when iPhones sucked? It’s true. They sucked for a giant reason: You had to buy music on them. With androids you could steal music. 3g wasn’t fast enough to stream reliably and streaming was just ok (slacker / pandora radio apps). + not enough good apps on iOS.

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

Guess what: I SWITCHED TO iPhone. From android. You crypto fucks. Because the problems were solved and this was a better solution.

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

Now: Tell me why the fuck someone would switch from Venmo, chase sapphire tap to pay, or even physical cash to you’re stupid impossible nonsense.

Get off the fucking internet. And go build your product instead of jerking off to it all day.

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

When it’s better faster cheaper safer than the current financial transaction products. Come back and show it to me. Not a preschool crayon drawings of a make believe app.

Sadly the truth is, when you give someone all the money and they can cash out before they build the product, there isn’t an incentive to build the product anymore.

— Reaper ☠️ 🏴☠️ (@ItsReapAgain) November 28, 2021

Incentives, who’da thunk.

The last tweet he added there as proof that he was an early adopter of crypto.

It's possible there are useful real world applications this fellow just doesn't know about, but an early adopter like him not being aware of those applications tells us something about how popular they've been. It seems fair to say that, up until now, the chief attraction of crypto is that the biggest market cap coins have gone up in value a lot.

Investing With This In Mind

As we've said before, we don't know when the crypto bubble will pop, though an astute prognosticator we follow (one whose predictions on COVID proved accurate) has said it might pop early next year.

I am now pretty sure this will happen.

— Anatoly Karlin 🦇🔊 (@akarlin0) November 7, 2021

New ATHs of $BTC ~$80k (Dec), $ETH ~$10k (Jan), then February crash is my best guess. https://t.co/n5Uk7M3zIo

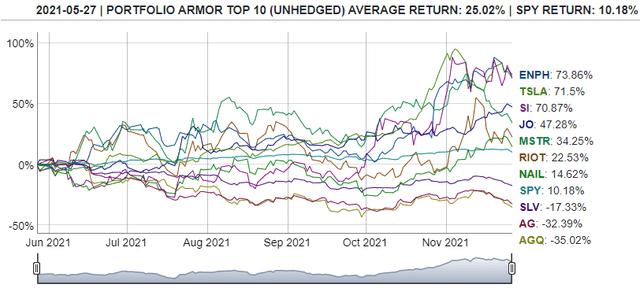

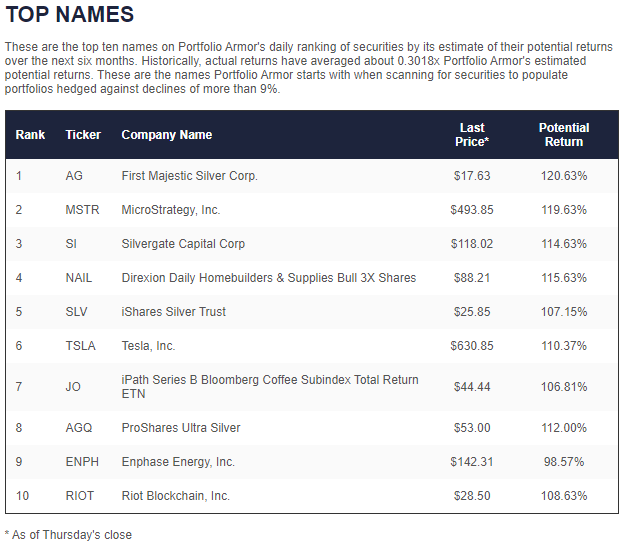

Our approach to this uncertainty has been two-fold. First, focus on the next six months, and estimate which names look likely to do well over that time frame. Our system runs those estimates every day the market is open, and posts its top ten names on our website and our iPhone app. This was its top ten six months ago. As you can see, it included a few crypto names: the Michael Saylor's Bitcoin-hoarding software company MicroStrategy (MSTR), the crypto bank Silvergate Capital (SI), and the Bitcoin miner Riot Blockchain (RIOT).

Screen capture via Portfolio Armor on 5/27/2021.

Over the next six months, all three crypto names did well,

But if crypto crashes in February, as our friend Anatoly Karlin predicts, crypto names in our recent top names cohorts will get hammered. That leads to the second aspect of our approach: hedge, in case we end up being wrong. One requirement for inclusion in our top names is that each security can be cost-effectively hedged.

Disclaimer: