A Brief Market Downturn Appears To Be Developing

Well, stocks had a pretty steep sell-off on July 19 with the S&P 500 falling by roughly 60 bps to finish the week at 2976. Pretty much back to where we were yesterday at 2 PM. Not surprising given it is the middle of July and a Friday.

Again, we are still in limbo as to which way the market goes from here. However, it seems that the trend is now starting to point to lower prices, potential 2940 or even 2915. But given the strong June performance, a minor pullback in July isn’t the end of the world. We will explore this more over the weekend.

(Click on image to enlarge)

Earning Coming In Better

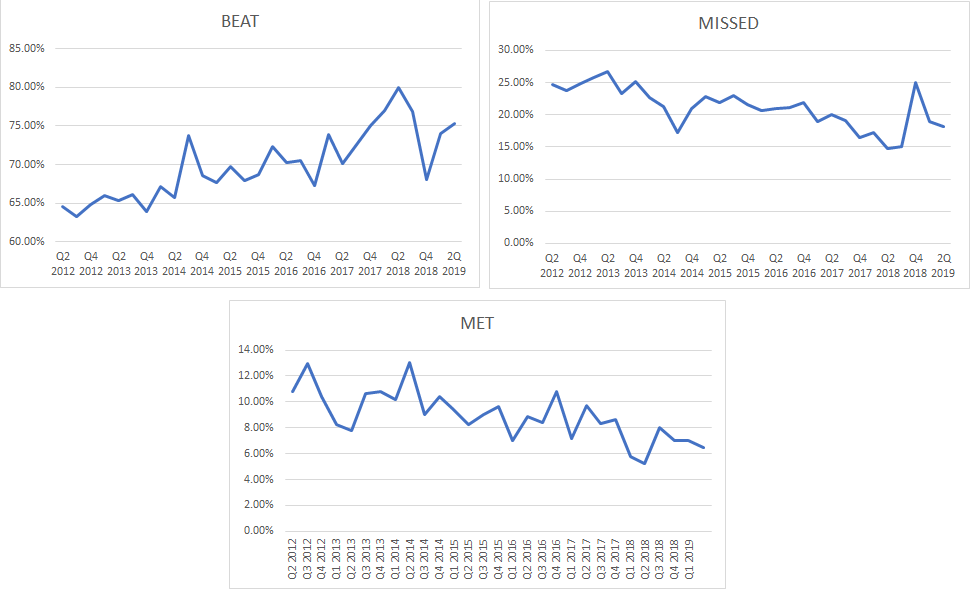

Anyway, Earnings are now pouring in with about 15% of the companies in the S&P 500 so far, and of those 75% have topped estimates, while 18% have missed, and 6.5% have met. Pretty much in line with the historical norm.

(Click on image to enlarge)

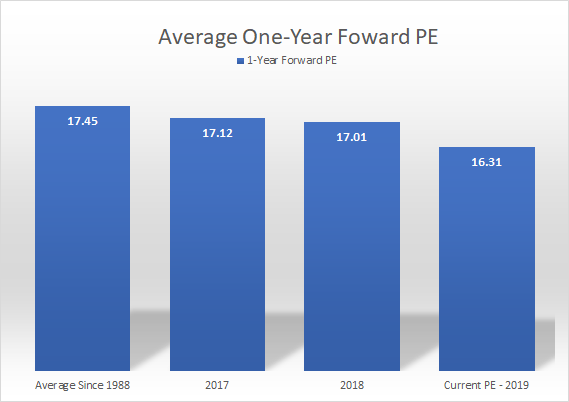

But more importantly, earnings estimates have been coming down, with 2019 now at $163.13 and 183.03 for 2020. It leaves the S&P 500 trading at roughly 16.3 times 2020 earnings estimates.

(Click on image to enlarge)

Which is still a fairly low earnings multiple for the index.

(Click on image to enlarge)

Sales and Margins

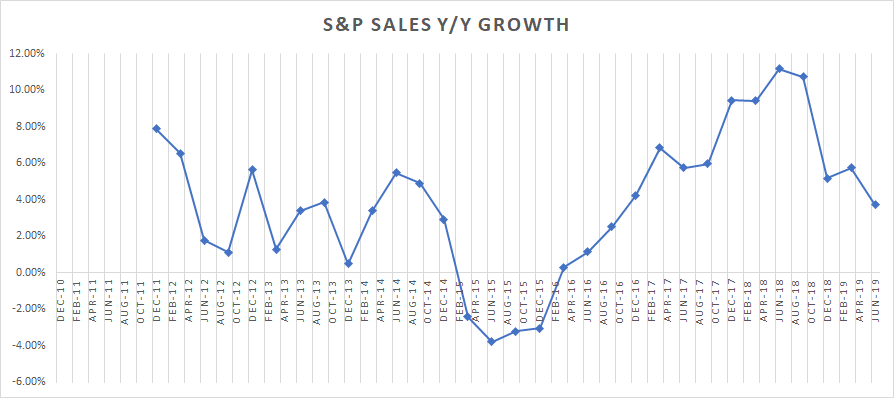

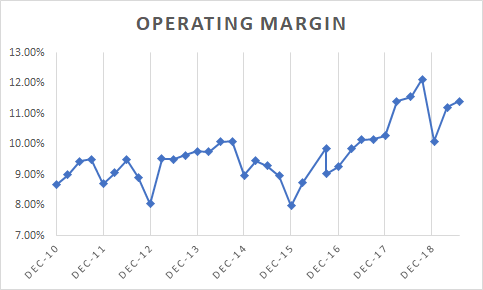

The one saving grace may come in the form of sales and margins. Revenue growth is up again this quarter by about 3.7%, while margins have expanded to 11.4% from 11.2% last quarter.

(Click on image to enlarge)

We are still early in the reporting season and results continue to come in better it could provide a second-half tailwind for stocks.

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice when the market changes. I am not right all the time and I do not expect to be. I ...

more

The weakness is expected as the economy slows and earnings got ratcheted down. That said, the effects are more subdued than expected and the market will do just fine during the summer. The big wildcard is what the Federal Reserve does. I disagree the closer to zero you go the more you should be willing to drop rates back to zirp for safety. If anything, they should delay raising rates for now and if the economy stabilizes raise again, especially in light of the fact the trade wars aren't over yet and MidEast tensions may raise oil prices. Inflation possibilities not presidential whimpering should influence them.

The weak market is caused more from trade tariffs than anything else, so Fed weakening just hides the effect of taxing the public without Congressional authorization which causes inflationary effects. This should discourage Fed easing, not encourage it.