A 25% Drop Shook Traders, But Shopify Still Points Higher

Image Source: Unsplash

Shopify (SHOP) looks set to enter the next quarter with solid momentum, and more importantly, its latest results suggest that this strength may not be merely temporary. The company delivered 31% year‑over‑year revenue growth. Also, it saw GMV accelerate across North America, Europe, and Asia, with Europe alone growing 42% on a constant‑currency basis. As a result, management now expects revenue to expand at a mid‑to‑high‑twenties pace next quarter, while gross profit should rise at a low‑twenties rate.

Taken together, these indicators point to a business benefiting from both resilient merchant activity and the compounding effects of its long‑term product investments.

Looking ahead, Shopify’s financial posture appears increasingly disciplined. The company plans to keep operating expenses at 38%-39% of revenue, and at the same time, it anticipates maintaining free cash flow margins in the mid‑to‑high teens. Consequently, investors can expect the stock to trade with a constructive bias as the company balances growth with expanding profitability.

If these trends continue, Shopify could enter the next quarters with a clearer path toward sustained margin expansion, stronger liquidity, and a valuation supported by consistent execution rather than speculative enthusiasm.

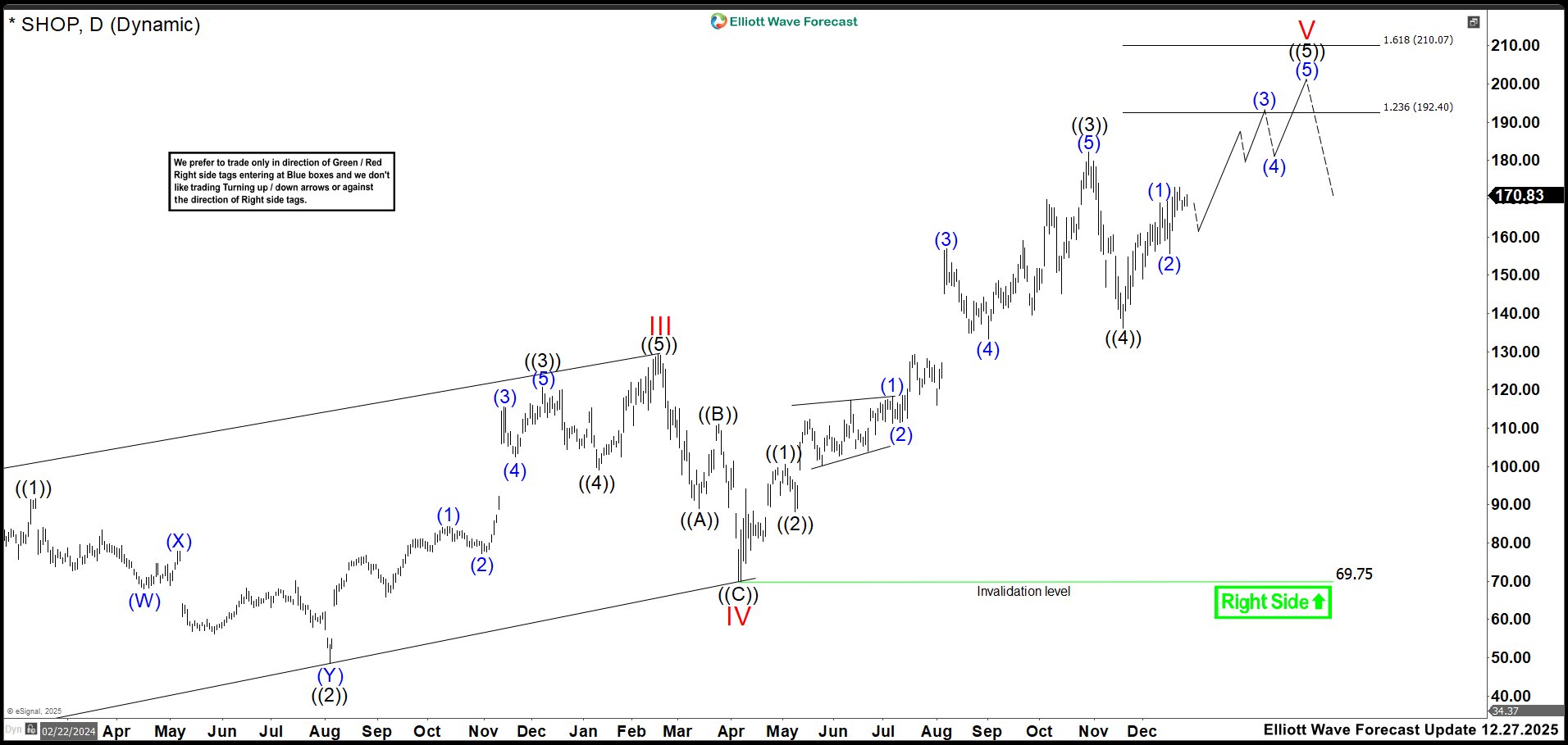

Elliott Wave Outlook: Shopify Daily Stock Chart for August 2025

(Click on image to enlarge)

In the previous update about the stock, Shopify had extended its rally. It formed a clean impulsive structure. The earnings gap hit resistance near the 154.61 mark, and we labeled that level as wave (3) of ((3)). From there, we expected to see more upside.

Waves 4s and 5s were set to unfold, pushing price into wave ((5)) of V. As a result, that advance had the potential to complete wave V of (I). After that, we anticipated a new correction. Wave V of (I) was projected to finish above the 166.30 level. Therefore, we avoided selling. We focused only on buying opportunities.

Elliott Wave Outlook: Shopify Daily Stock Chart for December 2025

(Click on image to enlarge)

This update shows that after completing wave (4), the stock's price resumed its advance in wave (5) of ((3)), reaching a high of 182.19 in October. Then, it faced a sharp correction, dropping 25% to the 136.18 low. This decline may have misled many traders into thinking a higher‑degree pullback had begun. However, that is not the case, because the bullish trend can still extend.

At this stage, we expect the market to build an impulse as wave ((5)) of V to complete the cycle that started in November. This move could reach the 192.40-210.07 zone, where we anticipate seeing strong selling pressure, at least enough to trigger a corrective reaction.

Even so, market conditions remain bullish, and we cannot rule out the possibility of further upside. Therefore, our strategy stays the same: buy the dips until the price reaches the next zone, and then evaluate the reaction from there.

More By This Author:

Why Traders Are Watching QS More Closely Than Ever?

CADJPY Elliott Wave: Blue Box Buy Setup Explained

AUDJPY Elliott Wave: Buying The Dips In A Blue Box

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more