Why Traders Are Watching QS More Closely Than Ever?

Image Source: Unsplash

QuantumScape (QS) enters the next quarter at a pivotal moment. The company moves from lab‑scale development to real‑world validation after shipping its B1 sample cells, a key milestone noted in recent reports. This step strengthens its long‑term case for solid‑state battery leadership as it improves energy density, charging speed, and safety. Even so, QuantumScape remains pre‑revenue and continues to refine its manufacturing processes. These processes still face cost and scalability challenges. In addition, its partnership with a top‑10 global automaker adds credibility, yet investors should still expect volatility as QS moves through capital‑intensive phases.

From a market perspective, analysts hold a cautious view for the next 12 months. They maintain a consensus “Sell” rating and set an average price target near $9, which suggests possible downside from current levels. As a result, the stock may react more to execution risk and broader EV sentiment than to fundamentals, since the company lacks near‑term revenue catalysts. While a breakthrough in solid‑state commercialization could spark momentum, the more realistic outlook points to steady and gradual progress. Therefore, traders should view QS as a speculative technology play where timing, risk tolerance, and shifting narratives matter most.

Elliott Wave Outlook: QuantumScape (QS) Weekly Chart July 2025

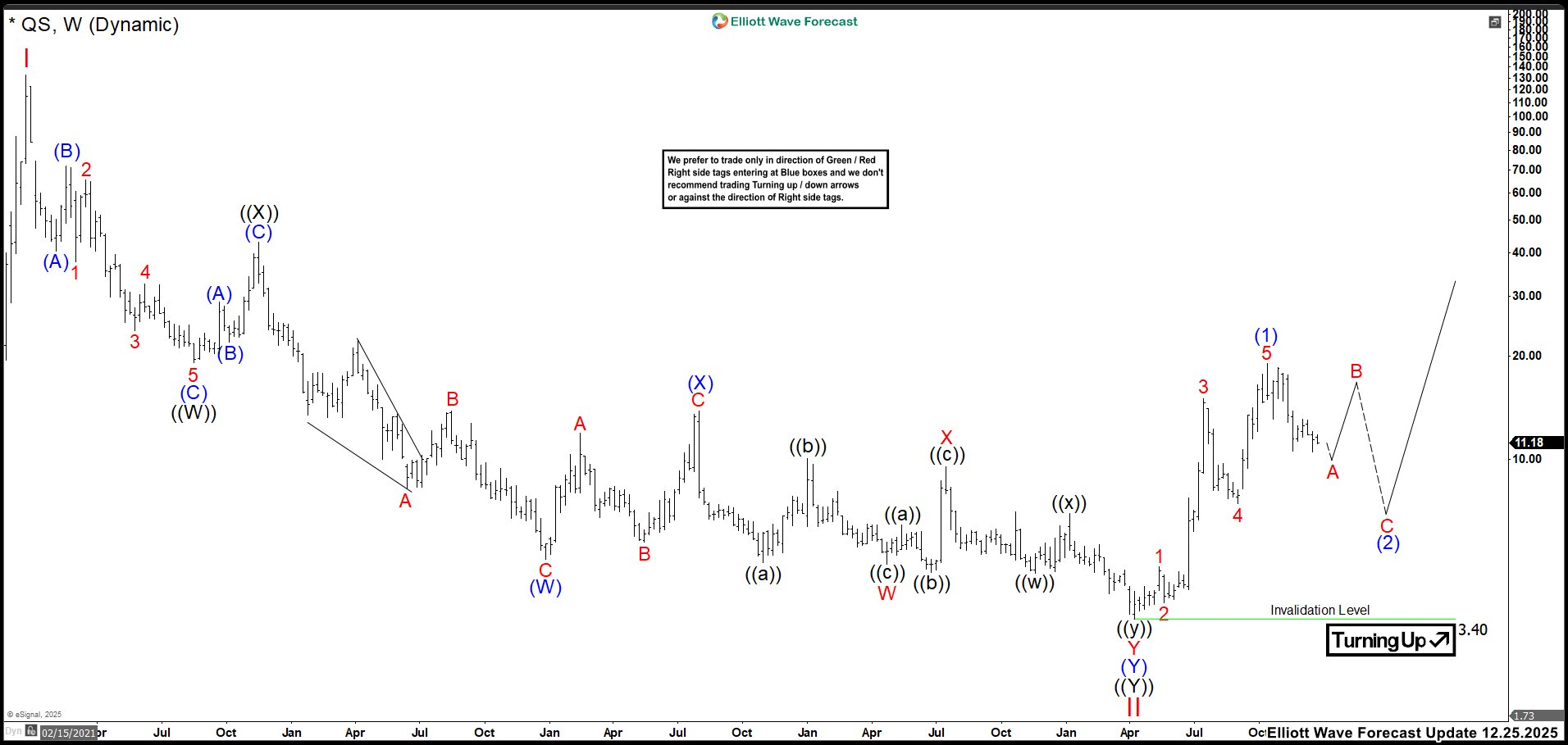

In July, QuantumScape (QS) completed a major pullback that marked the end of Wave II at the 3.40 low. Shortly after, the price broke above 9.52 and then 13.86, which strongly signaled that the bearish cycle had likely ended and a new upward phase had begun. As a result, the market appeared to be forming an impulsive structure, identified as Wave (1). However, it was still too early to confirm where Wave (1) will finish, so traders should stay alert and watch for a clean, high‑probability pattern.

Once Wave (1) completes, the chart should transition into a corrective move in 3, 7, or 11 swings to form Wave (2). After that, the next bullish leg can develop. This entire outlook remains valid as long as the price holds above the 3.40 low.

Elliott Wave Outlook: QuantumScape (QS) Weekly Chart December 2025

At the end of the year, Wave (1) ended at the 19.07 high back in October, and the chart then shifted into a corrective phase as Wave (2) began. We believe Wave (2) could drop into the 6–7 dollar zone before the rally continues above 19.07. However, whether the price makes one more low to complete Wave A of (2) or not, we still expect a rebound as Wave B. This bounce could reach the 15–17 area before the chart resumes its decline into Wave C of (2). Ultimately, only a break above the Wave (1) high would confirm that Wave (2) has already finished and that QS has started a new bullish cycle.

More By This Author:

CADJPY Elliott Wave: Blue Box Buy Setup ExplainedAUDJPY Elliott Wave: Buying The Dips In A Blue Box

AIZ Trade Setup: Buyers Launched From Blue Box Aiming $250

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more