9 Dividend Growth Stocks For A Rising Interest Rate Environment

As 2022 begins we find the stock market as measured by the S&P 500 extremely overvalued and vulnerable to rising interest rates. Historically, rising interest rates are bad for stocks generally. Currently, inflation is running rampant and at all-time highs. The general antidote to fight inflation is to increase interest rates. The Federal Reserve has indicated that interest rates could be risen 3 times or more in 2022. This makes the market trading at nosebleed valuations vulnerable. However, there are sectors and industries that are not trading at extreme levels. As I have often stated, it is a market of stocks, not a stock market. With this video, I will look at 9 dividend growth stocks that are high-quality, high yield, and available at unjustifiably low valuations. Furthermore, the stocks in this subsector are interest-rate sensitive. As interest rates rise, historical analysis has shown that the P/E ratios of companies in this industry rise in direct proportion to the increases.

Dividend Growth Stocks Portfolio Review

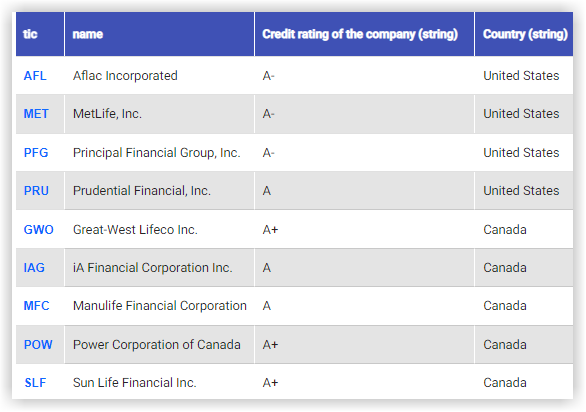

In this video, I will review: Aflac (AFL), MetLife (MET), Principal Financial Group (PFG), Prudential Financial (PRU), Great-West Life (GWO) iA Financial (IAG), ManuLife Financial (MFC), Power Corporation of Canada (PWCDF), Sun Life Financial (SLF).

Video length 00:21:01

Disclosure: Long AFL, PFG, PRU, MFC at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a ...

more