80% Off! This Sale Isn't Black Friday: It's Plant-Based Food Stocks YTD

Image by Sean Hayes from Pixabay

In my article last week I wondered out loud, "How much further are the largest plant-based food stocks likely to decline?" Here's the latest update as to the most recent performances of the stocks in the munKNEE Plant-based Food Stocks Index.

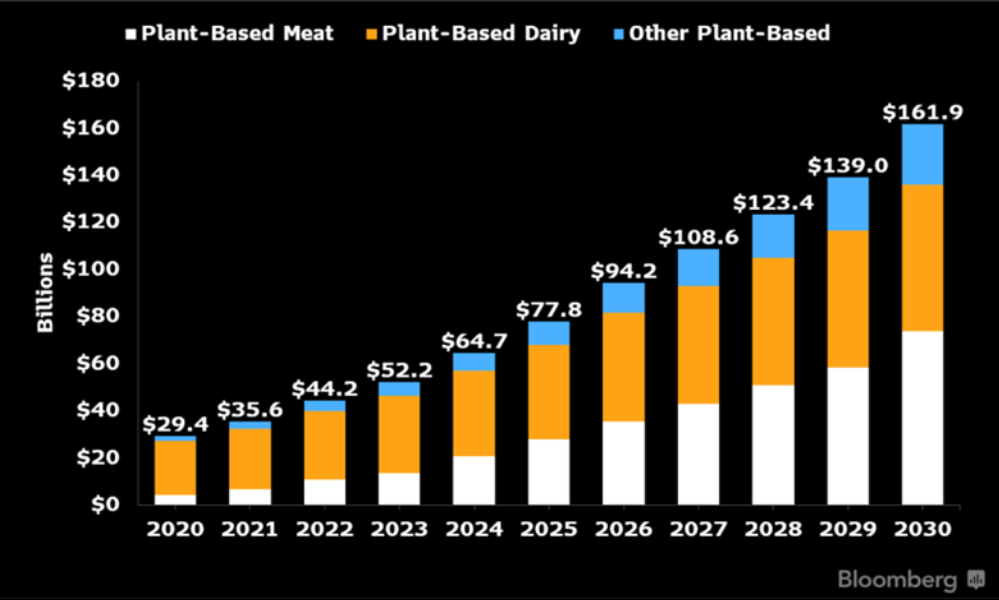

A mid-2021 study by Bloomberg Intelligence entitled Plant-Based Foods Poised for Explosive Growth reports that the plant-based foods market could make up to 7.7% of the global protein market by 2030 (i.e. $162 billion) with meat and dairy alternatives obtaining 5% and 10% of their respective global market shares by then. Supposedly there are multiple drivers supporting the rapidly growing plant-based food industry, and because of this, more growth is expected in the near future. (Read: 10 Things Investors Should Know about the Plant-Based Foods Market.)

Meat replacements (meat alternatives products made from plants that resemble the taste and texture of meat) and cultured meat (also referred to as clean, cultivated, or lab grown meats, is a genuine meat product that is produced by cultivating animal cells in a controlled environment without the need to harm animals) should overtake the conventional meat market which is expected to grow overall by roughly 3% by 2040 as a result of population growth - with cultured meats reigning supreme overall with a 41% annual growth rate (CAGR) between 2025 and 2040. As consumption shifts, conventional meat supply is expected to decline by more than 33% to just 40% of all global meat supply by 2040, compared to 90% in 2025. (Read: The Evolution of the Global Meat Market, Jan. 2022).

Surprisingly, in spite of the research stating that the plant-based food market is growing at impressive rates, the plant-based alternatives to conventional meat and animal products are hardly flying off the shelves (Read: Why the 2020s Are A Watershed Decade for Plant-Based Alternatives, Feb. 2022).

You would think with all the hype that there would be many companies in the plant-based food sector, but there are very few such companies that are publicly traded. There are even fewer that are pure-play (i.e. true consumer packaged goods companies that only research, develop, process, market and distribute their products to grocery retailers) as opposed to companies researching, developing and selling plant-based proteins for the industry and major grocery retailers with their own plant-based brands) and even fewer that have a market capitalization of at least $50M. In fact, our research suggests that there are only 5 companies that meet that criteria; those are the constituents of our munKNEE Plant-Based Food Stocks Index.

Below is a summary of the financial health of each of those 5 companies. Each constituent's latest quarterly financial report (source) shows that they ALL have:

- negative net operating cash flows but all but one (OTLY) have shown some improvement over the previous quarter;

- negative net profits and just one (OTLY) has shown some growth over the previous quarter;

- negative earnings before interest depreciation and amortization (EBITDA) but two (OTLY & BYND) have shown some improvement over the previous quarter;

- negative EBITDA margins but two (OTLY & BYND) have shown some improvement over the previous quarter.

In addition, the extent to which each company is likely to encounter financial stress and/or bankruptcy in the next 2 years compared to its peers according to their Altman Z-Scores (as sourced from macroaxis.com) is also provided below.

How well the constituent stocks performed this week, in descending order, so far this month of November (4 weeks), and YTD, are as follows:

- Guru Organic Energy(GUROF): No Change in the last 4 weeks and remains DOWN 66.3% YTD

- a Montreal, Canada beverage company launched in 1999, when it pioneered the world’s first natural, plant-based energy drink

- has a 26% chance of encountering financial stress in the next 2 years (source).

- Beyond Meat (BYND): DOWN 5.4% this week, is DOWN 18.0% in the last 4 weeks, is now DOWN 80.5% YTD

- seeks to replicate the look, cook, and taste of meat. Its products are sold in the meat case of retail food stores across the U.S. and Canada and 83 other countries

- has more than an 86% chance of encountering financial stress in the next 2 years.

- Else Nutrition (BABYF): DOWN 12.5% this week, is DOWN 17.6% in the last 4 weeks, and is now DOWN 52.8% YTD

- an Israel-based food and nutrition company focused on developing innovative, clean, and plant-based food and nutrition products for infants, toddlers, children, and adults.

- has a 28% chance of encountering financial stress in the next 2 years.

- Oatly Group (OTLY): DOWN 17.9% this week, is DOWN 35.2% in the last 4 weeks, and is now DOWN 79.9% YTD

- the world’s largest oat drink company catering primarily to customers in Sweden, Germany, the United Kingdom, Netherlands, Finland, and North America

- has a 41% chance of encountering financial stress in the next 2 years.

- Tattooed Chef (TTCF): DOWN 28.8% this week, is DOWN 65.9% in the last 4 weeks and is now DOWN 89.6% YTD

- offers a broad portfolio of plant-based food products that are available in the frozen food sections of national retail food stores across the United States

- has a 25% chance of encountering financial stress in the next 2 years.

In total, the munKNEE Plant-Based Food Stocks Index went DOWN 8.0% this week, has gone DOWN 24.3% in the last 4 weeks, and is now DOWN 79.95% YTD.

Has the sector finally reached bottom? Is it time to buy? Let's wait and see how well the sector fares in the weeks ahead first.

More By This Author:

British American Tobacco Company Buys Into An American MSO Cannabis

Cannabis Category Performances Ranged From +2.6% To -5.8% Last Week

American MSO Stocks Index Up Considerably - Is The Bottom Finally In?

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

Can only go up from here...plant based is the future!