8 Largest Cloud Computing SaaS Stocks Stagnant, On Average, MTD

An Introduction

Surprisingly, the sell-off/stagnation of the munKNEE Pure-Play Cloud Computing SaaS Stocks Portfolio continues despite the fact, according to Fortune Business Insights, that the global cloud computing SaaS market is projected to have a CAGR of 18.4% between now and 2032. That's an astronomical growth rate which should bode well for CC companies and, as such, is tracked on a regular basis in the munKNEE Pure-Play Cloud Computing SaaS Stocks Portfolio

What is Cloud Computing?

Cloud computing (CC) is the technique of processing, storing, and managing data on a network of remote computers hosted on the internet by cloud service providers rather than on a personal computer or local server using only as much compute power and storage as needed to meet demand. This theoretically allows for cheaper and faster computing because it eliminates the need to purchase, install, and maintain servers.

Cost Saving Implications of Cloud Computing Adoption

McKinsey estimates that cloud adoption could generate $3 trillion in global value by 2030 derived from:

- reducing operational costs ($311B) and reducing digital risk ($407B),

- generating new revenue. $612 billion comes from innovation-driven growth ($612B) and accelerated product development and hyper-scalability ($1.7T) and from

- emerging technologies, including new cloud-based business models and integration with technologies like 5G, blockchain, and quantum computing but, because they’re so new, their impact can’t yet be exactly quantified. (Source)

What is a Pure-Play Company?

As you would expect, a pure play company is defined as a company that concentrates all its efforts on a single line of business and, as such, tech giants like Google, Microsoft, and Amazon are not pure-play given their diversified business focuses.

What is SaaS?

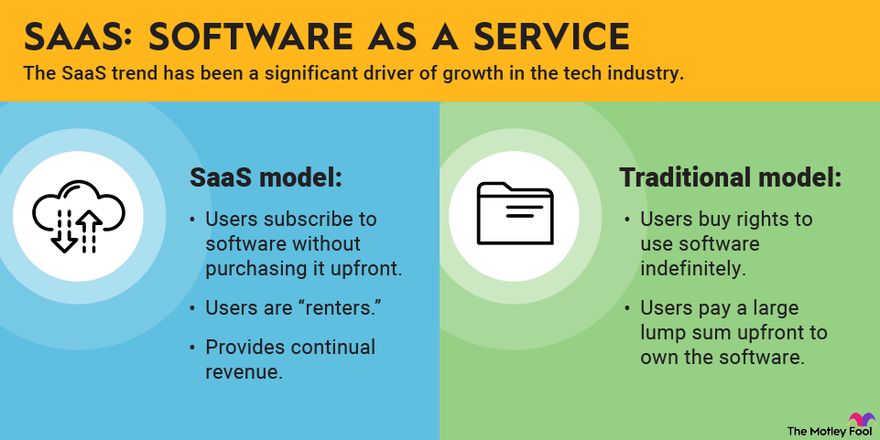

SaaS, also known as cloud application services, makes software available to users over the internet, usually for a monthly subscription fee. They are typically ready-to-use and are run from a users’ web browser which allow businesses to skip any additional downloads or application installations. SaaS accounts for 38.5% of cloud computing revenue. (Source) For more insightful information you are encouraged to read Cloud Computing 101.

Image source: The Motley Fool

What is the Price-to-Sales Ratio

The price-to-sales (P/S) ratio, which equals a company's market capitalization divided by its annual revenue, is often used as a valuation metric for SaaS companies in place of the P/E ratio. A higher P/S ratio denotes optimism among investors that attractive revenue growth will continue and that the revenue will eventually generate profits.

The munKNEE Pure-Play Cloud Computing SaaS Stocks Portfolio

Below is a list of the 8 pure-play Cloud Computing companies with market capitalizations of $20B or more presented in descending order of their performances since the end of July (MTD), their market capitalizations, their unique business model descriptions, their current price-to-sales ratio (and rank) and their latest news, analyses and commentary where available.

- Cloudflare (NET): UP 6.2% MTD

- Company Description: provides an integrated cloud-based security solution to secure a range of combination of platforms and offers website and application performance solutions

- Market Capitalization: $28B

- Forward Price-to-Sales Ratio: 15.0 ( Ranks #1)

- Most Recent News, Analyses, and Commentary:

- ServiceNow (NOW): UP 2.9% MTD

- Company Description: provides end to-end intelligent workflow automation platform solutions for digital businesses

- Market Capitalization: $172B

- Forward Price-to-Sales Ratio: 14.3 (Ranks #2)

- Most Recent News, Analyses, and Commentary:

- Workday (WDAY): UP 2.4% MTD

- Company Description: provides enterprise cloud applications to help its customers manage their business and operations

- Market Capitalization: $62B

- Forward Price-to-Sales Ratio: 7.2 (Ranks #8)

- Most Recent News, Analyses, and Commentary:

- Snowflake (SNOW): UP 1.2% MTD

- Company Description: offers Data Cloud which enables customers to consolidate data into a single source to drive meaningful business insights, build data-driven applications, and share data and data products

- Market Capitalization: $45B

- Forward Price-to-Sales Ratio: 12.6 (Ranks #4))

- Most Recent News, Analyses, and Commentary:

- MongoDB (MDB): UP 0.3% MTD

- Company Description: provides general-purpose database platforms worldwide and offers professional services comprising consulting and training

- Market Capitalization: $19B

- Forward Price-to-Sales Ratio: 9.7 (Ranks #5)

- Most Recent News, Analyses, and Commentary:

- Datadog (DDOG): DOWN 0.3% MTD

- Company Description: operates an observability and security platform for cloud applications

- Market Capitalization: $40B

- Forward Price-to-Sales Ratio: 13.3 (Ranks #3)

- Most Recent News, Analyses, and Commentary:

- HubSpot (HUBS): DOWN 1.9% MTD

- Company Description: provides a cloud-based customer relationship management (CRM) platform for businesses

- Market Capitalization: $25B

- Forward Price-to-Sales Ratio: 8.8 (ranks #6)

- Most Recent News, Analyses, and Commentary:

- Atlassian (TEAM): DOWN 11.5% MTD

- Company Description: designs, develops, licenses, and maintains various software products

- Market Capitalization: $41B

- Forward Price-to-Sales Ratio: 7.7 (Ranks #7)

- Most Recent News, Analyses, and Commentary:

Summary

The above 8 Cloud Computing stocks have only gone UP 0.4% MTD and are DOWN 12.0% YTD and have an average market capitalization of $59B.

Please note: If you Comment on this article (see below) you will automatically be entered in TalkMarkets' contest (register here) to win an Amazon Echo Show device which has a retail value of $229 and have the ability to engage directly with me and other commentators.

More By This Author:

There Is No AI Without These Mega Cap Tech Giants

Micro/Small Cap AI Stocks Portfolio Down 4% Last Week

These 7 Semiconductor/AI-Related Portfolios Roared Back This Week; Up 9%, On Average

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more