There Is No AI Without These Mega Cap Tech Giants

Image Source: Unsplash

Introduction

The worldwide AI market is expected to grow at a 19% CAGR between now and 2026 reaching $900 billion by then, according to market research firm IDC and that has led to a surge in investments and acquisitions by US-based "Mega-Tech" giants such as Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and META (META) - the constituents in the munKNEE +$1T Market Cap Portfolio - to avoid falling behind in the generative AI boom.

There Is No AI Without Big Tech

Put bluntly, there is no AI without Big Tech. Almost every startup relies on the computing infrastructure of Microsoft, Amazon, and Google, in particular, to train their systems, and on those same firms’ vast consumer market reach to deploy and sell their AI products and, thanks to platform dominance and the self-reinforcing properties of the surveillance business model, they own and control the ingredients necessary to develop and deploy large-scale AI. They also shape the incentive structures for the field of research and development in AI, defining the technology’s present and future. (Source)

Big Tech AI/ML Acquisitions & Collaborations

10 "Big Tech" companies have acquired a total of more than 100 artificial intelligence (AI) and machine learning (ML) companies since 2017 according to a new PitchBook report (see here) and these acquisitions allow the Big Tech companies to:

- acquire cutting-edge technologies,

- attract top talent,

- eliminate potential competitors.

- expand into new markets,

- diversify their offerings.

In addition to acquisitions, strategic collaborations have also played a crucial role in Big Tech’s AI strategy with Amazon’s partnership with Anthropic, a leading AI research company, being a notable example. This collaboration highlights the importance of generative AI in shaping the future of technology. Companies are increasingly focusing on generative AI as a key area for innovation, with applications ranging from improving user experiences to creating new business models.

Summary

As AI continues to evolve, we can expect to see more acquisitions and strategic collaborations in this field. Companies that successfully integrate AI into their operations and products will likely maintain a competitive advantage, shaping the future of technology and influencing global economic trends.

The +$1T Mega Cap AI Portfolio

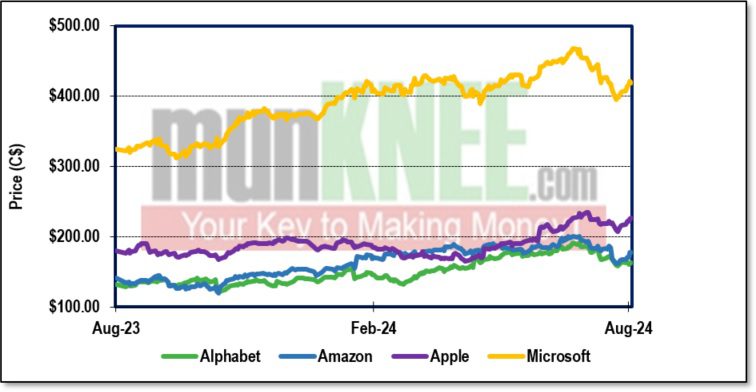

The stock price performances of the 6 constituents in the munKNEE +$1T Market Cap AI Portfolio are highlighted below for last week, in descending order, and YTD, along with their market capitalizations and any pertinent news, analyses or commentary on them.

- Nvidia (NVDA): UP 18.9% last week; UP 151.6% YTD

- Market Capitalization: $3.12T

- Latest news, analyses or commentary:

- Nvidia Near All Time High Ahead Of Earnings; Is It A Buy Or Sell Now?

- Amazon (AMZN): UP 6.1% last week; UP 16.5% YTD

- Market Capitalization: $1.86T

- Latest news, analyses or commentary:

- Apple (AAPL): UP 4.5% last week; UP 17.4% YTD

- Market Capitalization: $3.41T

- Latest news, analyses or commentary:

- Microsoft (MSFT): UP 3.1% last week; UP 11.3% YTD

- Market Capitalization: $3.11T

- Latest news, analyses or commentary:

- Meta Platforms (META): UP 1.9% last week; UP 49.0% YTD

- Market Capitalization: $1,33T

- Latest news, analyses or commentary:

- Alphabet (GOOGL): DOWN 0.4% last week; UP 16.7% YTD

- Market Capitalization: $2.04T

- Latest news, analyses or commentary:

FIGURE 2: Stock Chart (1-Year)

Source: S&P Capital IQ

Other Developments

Chipmaker Advanced Micro Devices (AMD) plans to buy computer hardware design firm ZT Systems for $4.9 billion in a move to better compete with artificial intelligence systems powerhouse Nvidia (NVDA). Source

More By This Author:

Micro/Small Cap AI Stocks Portfolio Down 4% Last Week

These 7 Semiconductor/AI-Related Portfolios Roared Back This Week; Up 9%, On Average

Canopy Growth Q1 Financials Show Major Reduction In Net Loss

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more