5E Advanced Materials Poised For Rerated Valuation As Critical Mineral Producer

Image Source: 5E Advanced Materials

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

The Trump administration has prioritized securing the U.S. critical mineral supply chain through executive orders, federal funding, and international partnerships to reduce reliance on foreign sources, particularly China. Key actions include expanding the official list of critical minerals to 60 items, which now includes copper and uranium, and accelerating domestic mining and processing permits on federal lands. The DOE is also investing nearly $1 billion in domestic production projects and forming a "minerals club" with allies to diversify the global supply chain. Other government funding is available through EXIM, DOW/DOD, and DFC.

As critical minerals and domestic supply chains come into focus, investors are increasingly interested in U.S.-based mining companies. One particularly interesting company is 5E Advanced Materials, a rare U.S.-based producer of boron that is looking to build out a full-scale in-situ leaching (ISL) operation for significant domestic boron production. As the company proves out the reliability and consistency of its production, secures offtake agreements with customers, and finances its ISL mine, I believe the stock could re-rate significantly higher. Boron should also see a favorable environment for demand in the next few years.

The Boron Market

What is boron and why do we care about it? Boron is a non-metallic element typically used in various advanced materials to increase performance, enhance strength and resist heat, increase conductivity, and increase chemical stability. There are hundreds of diverse applications for boron, and its use is considered irreplaceable. Common applications of boron include glass, insulation, fertilizer, semiconductors, advanced alloys (iron/steel, copper, aluminum), stealth technology, sports equipment, nuclear reactors (control rods and primary coolant neutron poison) and waste storage, lithium batteries, heat shields, neodymium magnets (NdFeB), fertilizer (nonsubstitutable micronutrient), and medicines. As such, the USGS (U.S. Geological Survey) Mineral Resources Program (United States Department of the Interior) recently added Boron to the 2025 list of minerals critical to national security.

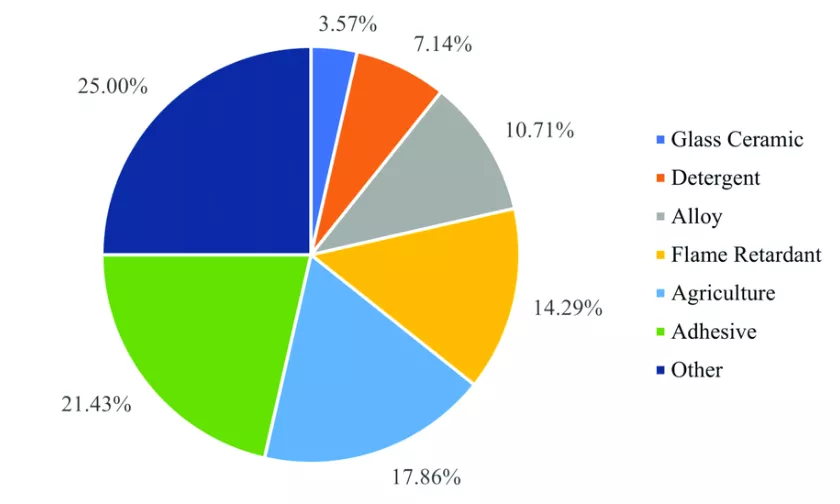

While consumption estimates vary and change over time, below is a pie chart that shows several key uses of boron. Glass and ceramics production demand a large portion of boron. Boron is used to make borosilicate glass, which is more resistant to thermal shock and chemical corrosion. This makes it ideal for cookware, laboratory equipment, and industrial applications like reinforcement fiberglass, electronic displays, and optical lenses. Semiconductor manufacturing is the dominant (80%) consumer of high-purity boron, where boric acid is used to make boron trichloride, which is used for etching and chemical vapor deposition for doping.

Boron production currently operates in a near-oligopoly—two entities control 85% of boron supply: Turkey's Eti Maden and Rio Tinto's (OTCMKTS: RTNTF) U.S. Borax. 60% of the total boron supply is produced by Eti Maden, which is a Turkish government entity. This means that the United States may be reliant on Turkey if it wants to expand onshore chip manufacturing or produce its own boron carbide. In fact, the Department of Defense is actively investing in domestic boron-carbide capacity, as China currently supplies 80% of boron carbide globally. For investors, that policy backdrop usually translates into faster permits, concessional funding, and strategic offtakes for credible new entrants such as 5E.

On the other hand, the United States has Rio Tinto’s (previously U.S. Borax) operations in California, but the future of U.S. Borax is uncertain. Rio Tinto’s (NYSE: RIO) U.S. Borax (RTB Boron) division suffered a reserve downgrade in 2018, and it is estimated that their costs have increased about 60% since 2017. Additionally, their minerals division (Borates and Iron & Titanium businesses) are undergoing a strategic review, and analysts expect the borates and titanium businesses to be divested. Rio’s California borate mine is the largest production site in the world, and 5E could take up this demand, presumably with better costs.

In contrast to Rio Tinto’s U.S. Borax uncertainty, Turkey’s Eti Maden expanded output meaningfully in 2024 (a new Bigadiç facility went live and Turkish borate production was up ~36% YoY through August), underscoring its centrality to the market and production capacity potential.

From 5E Advanced Materials Website

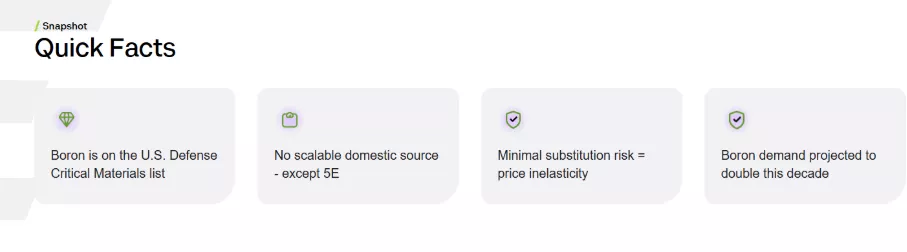

In conclusion, boron supply is critical for many decarbonization and productivity themes, including insulation and high-performance glass, permanent magnets, semiconductors, agriculture, and nuclear. Supply is also concentrated and slow to add, leading to price inelasticity. This combination arguably sets the stage for a favorable multi-year setup for boron.

5E Advanced Materials Summary

5E Advanced Materials, Inc. (Nasdaq: FEAM; ASX: 5EA) is a vertically integrated development-stage company dedicated to reshoring the U.S. boron supply chain through high-purity boric acid production. Its Fort Cady Borate Project in Southern California has begun initial production at pilot scale to demonstrate the output of its in-situ leaching operation for customers, which should help the company ink favorable offtake agreements and obtain financing for its first phase of full-scale operations.

5E had a difficult history as a public company. Originating from a 2017 Australian IPO, 5E listed on Nasdaq in March 2022, but faced turbulence, moving through three prior CEOs during current CEO Paul Weibel's CFO tenure, including an ex-Honeywell (Nasdaq: HON) executive who was ousted shortly after signing an August 2022 $60 million convertible note that destroyed shareholder value, amid EPA permit delays. Certain major shareholders stabilized the firm by acquiring debt in a January 2024 restructuring, slashing conversion prices from $16.90/share to $1.50/share and finally launching pilot mining (in-situ leaching) operations. Full note equitization by Christmas of 2024 gave the lenders 85% ownership, which was subsequently diluted to 75% via a May 2025 placement as well as a summer equity raise catalyzed by the company’s pre-feasibility study (PFS) publication. Since Weibel took over the CEO role in June 2024, a refreshed board including Curtis L. Hebert, and new hires including executives with borates experience, have brought the company another chance and a fresh start, albeit with a new investor base.

All the prior hardships aside, 5E has an American boron project nearing full-scale production that, if de-risked, can command a premium as it is a sovereign critical minerals producer and is aiming to supply high-purity boric acid. On top of this, boron suppliers appear to be set up for industry tailwinds, and 5E may have the only scalable domestic source of boron.

5E Boron Production Investment Snapshot

New Process Operations

The company’s value is expected to be bolstered by improved process technologies, including chilled crystallization instead of evaporative crystallization of boric acid. The company’s CEO, Paul Weibel, explained these improvements on the Q4 2024 earnings call.

“Two meaningful changes we have incorporated into our commercial design include a change to the method of crystallization and the temperature of our mine water injection solution. Since commencing mining operations in January 2024, we now have a higher degree of confidence in the resource and our achievable head grade. Further, we believe we can increase our head grade to higher levels by increasing the temperature of our mining solution. This increase in our solution temperatures will also decrease residence time, leading to a more efficient process. Essentially, our data has determined that it is less expensive and more efficient to heat the solution compared to blowing off and evaporating water. This has provided us the opportunity to modify our crystallization method from evaporative to chilled crystallization. Chilled crystallization has multiple benefits that are worth highlighting. First, the amount of energy required will be much less. And initial energy balance estimates a 60% reduction in natural gas consumption relative to evaporative crystallization, which will drive a lower structural OpEx. Further, this provides us with the opportunity to use less Hastelloy steel in our crystallizer design, which will in turn reduce the overall capital cost by utilizing less expensive materials of construction. Another area of optimization is our mine plan, where we believe we can reduce the overall levels of sustaining CapEx up to a factor of 10 by implementing horizontal wells and sidetracks. Our horizontal well program has been externally vetted and to increase confidence levels, we plan to test horizontal wells in the upcoming fiscal year. Additionally, we continue to critically examine our potential byproduct credits. We have confirmed lithium chloride exists in our solution today, and we are monitoring the increases in concentrations of lithium and calcium to determine the optimal recovery technology. Finally, we continue to investigate calcium chloride and assess this as a byproduct relative to gypsum, and we are actively looking to explore partnerships with existing producers and technology providers.”

Instead of heating the produced solution to boil off water and increase boric acid concentration before crystallization, the company can produce a hot solution that is high enough in boric acid (BA) concentration to crystallize via chilling (where BA is precipitated as a solid when BA solubility decreases with decreasing temperature). These production process improvements are low risk in my opinion (as opposed to the moderate-risk production-scale leaching), but are assumed in the company’s PFS. Byproduct production viability (i.e. lithium and calcium salt) are not included, and company recently decided to produce calcium chloride in addition to gypsum as a byproduct to improve their project economics. The incorporation of calcium chloride (CaCL2) as a by-product in addition to gypsum provides greater optionality to maximize returns. To produce calcium chloride, 5E will utilize more HCl in its manufacturing process. Depending on the raw material input costs of sulfuric acid versus HCl, and the sales price of gypsum and CaCl2, there is optionality in the process to have optimized economics based on market prices of raw material inputs and by-product revenues.

Valuation

5E Advanced Materials’ project has a $725m NPV7 (pre tax IRR of 19.2%) according to their August 2025 PFS, which only takes into account phase 1 (production of 136.5k ST BA) of their multiphase production operation. Phase 1 has a ~US$469M after-tax NPV7 with a post tax IRR of 16%. Phase 2, on the other hand, is expected to add another 180,000 short tons of boric acid, along with 2,200 short tons of lithium carbonate. To simplify, let’s assume phase 2 roughly doubles the mine’s value.

In terms of multiples, it is reasonable to use a P/NPV ratio of 0.2-0.5x for exploration stage (mineral reserve estimates, preliminary economic analysis (PEA)), 0.5-0.8x for feasibility studies (pre-feasibility study (PFS), feasibility study (FS)) and construction, and 0.8-1.5x for production stages.

Since 5E is still trying to obtain financing for the project, I’ll use a conservative multiple of 0.5x of the $725m NPV for a current value of $362.5 million. Using the current outstanding shares of 22.44 million, that represents a share price of $16.15/share, a target somewhat above analyst estimates of between $7 and $9.25 (Maxim and HC Wainwright, respectively). This is a bit of an aggressive price target for now, but if the company can get on track with financing and construction and effectively mitigate any future delays, I think FEAM shares could be re-rated higher, whereas more delays will de-rate the shares further.

Looking forward, as the company reaches production in several years, investors could value the company either on 1.5x the $725m NPV, or 0.8x the $1.45 billion NPV of the expanded mine (i.e. including Phase 2), for a total value of $1.09-1.16 billion. Assuming shares outstanding inflate to around 40 million at that time, shares could be worth around $29 each. As such, the company could be a near ten-bagger in several years’ time (7.5x). Assuming this takes 5 years, that is a ~50% CAGR in share price. The company also recently released a large increase in its measured and indicated resources, including 170% and 165% increases in H3O3 and LCE (lithium carbonate equivalent), and those increases are not reflected in the PFS used for this valuation. With the updated resource, 5E boasts the largest borate resource in the U.S.

Competition

Boron deposits are very rare, but there are several other sites in progress. There are several other promising, somewhat large projects progressing globally, some of which are in the United States and have also seen governmental support. A table below details some of the future boron producers along with their project’s status and forecasted annual production.

|

Project Name, Company |

Location, Start Date |

Status |

Forecast Annual Production |

Notes |

|

Fort Cady Boron Project (Phase 1) |

California, USA |

Pre-feasibility complete; FEED underway; FID/financing targeted for mid-2026 |

>136,000 tpa boric acid |

Scalable U.S. source; 39.5-year mine life; reserves of 5.4 million short tons boric acid; high-purity |

|

Rhyolite Ridge Lithium-Boron Project Ioneer Ltd. (Nasdaq: IONR) |

Nevada, USA 2028 (initial) |

Permitted (Oct 2024); construction financing advancing; leach optimizations |

126,700 tpa boric acid (co-product with lithium) |

82-year mine life; boron ~25% of revenue; lithium primary (22,400 tpa LCE avg.). $1.37B NPV8 (post-tax), very low on cost curve. Updated to $1.89B on optimization and new mine plan. |

|

Bonnie Claire Lithium-Boron Project Nevada Lithium Resources Inc. (OTCMKTS: NVLHF) |

Nye County, Nevada, USA 2028 -2029 |

PEA completed (Aug 2025); advancing to feasibility |

129,000 tpa boric acid (co-product with 62,000 tpa LCE) |

61-year mine life; inferred resources expanded (25.6 Mt LCE at 3,085 ppm Li lower zone, Oct 2025); pre-tax NPV $1.2B (2025 PEA at $15,000/t LCE, $700/t boric acid) Low capex (~$450M); boron enhances economics amid critical mineral status. |

|

Piskanja Boron Project Boron One Holdings Inc. (TSXV: BONE.V) (OTCMKTS: ERVFF) |

Baljevic, Serbia 2027 -2028 |

EIA completed (May 2025); advancing exploitation field permitting (Sep 2025 update); bench-scale testing successful (Nov 2024) |

258,000 tpa B2O3 concentrate, 25,000 tpa boric acid |

16-year mine life; measured resource 1.39 Mt @ 35.59% B2O3. Pre-tax NPV $607M (2022 PEA), IRR 42%; low capex (~$170M); EU/Asia exports. |

Notably, Ioneer (primarily a lithium company) trades at a $314 million (USD) market cap despite a $996 million loan guarantee from the DOE for Rhyolite Ridge. Ioneer trades around a $300 million market cap (USD). Their relative valuations are comparable.

While there is competition, 5E is mainly producing boric acid, which has 1.2Mton global supply currently and is expected to increase at ~4-6% over the next decade, and it appears that modest supply will help alleviate some of that demand growth. Notably, 5E

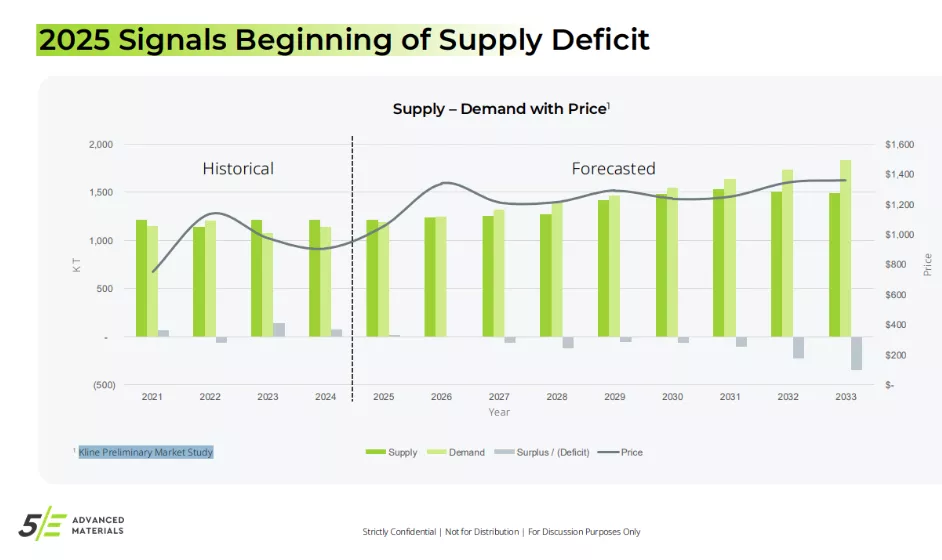

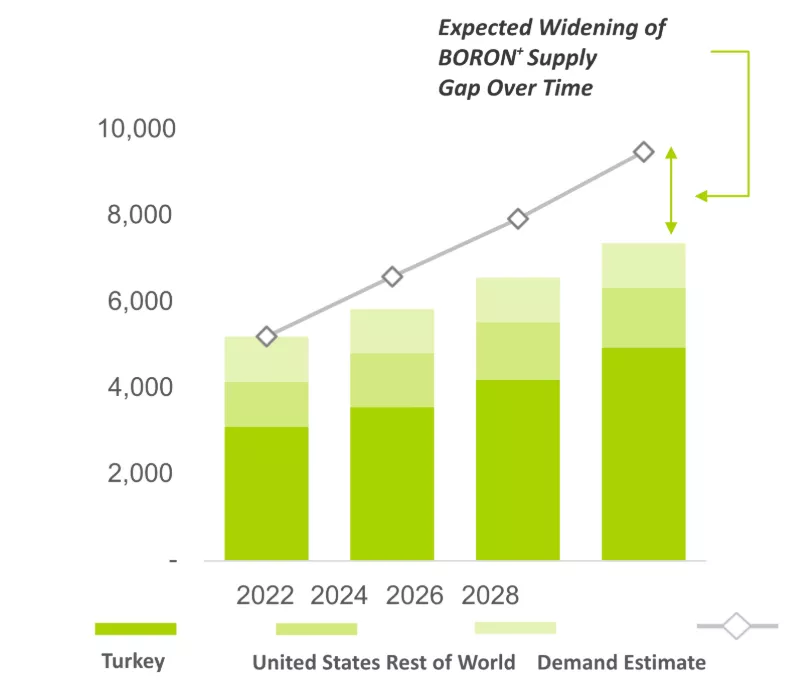

The company also cites forecasts for a fairly large supply gap over the next few years as the plethora (hundreds) of use cases for boron demand more and more product and as new project supply lags demand as it comes online.

Forecasted Boron Demand Gap, 5E Advanced Materials Website (Source: Credit Suisse Equity Research)

Financials

To complete Fort Cady’s Phase 1, it is estimated that the company needs a total of ~$435 million to start operations, but Export-Import (EXIM) Bank of the United States, which serves to help finance critical projects like this boron production facility, signed a non-binding letter of intent to finance $285 million of this project. Presumably, the company needs to secure offtake agreement which should help it obtain debt financing for the project buildout as product demand is proven. In other words, offtake agreements help reduce risk for lenders for debt financing. But customers signing offtake agreements will want to know that the project can be financed and built. So both of these items (offtake agreements, debt financing) need to kind of happen in tandem. The EXIM letter of intent, in my opinion, is a nice vote of confidence for the company that may help the commercial/financial agreements come together.

5E has -$41.5 million in TTM operating income, with -$29.4 million in TTM net income, according to their most recent 10-Q (ending September 30th, 2025). A lot of this is depreciation and amortization, so their cash burn is currently closer to $4-5 million per quarter. While this is a concerning burn rate because the company’s cash position is only $5.5 million, as long as management secures bankable offtake agreements in a timely manner, the cash burn should not be a grave concern. Additionally, management has options at $6.72/share, and all the warrants are exercisable at ~$17-18. Therefore, there is no current option or warrant overhang, and management has significant incentives aligned with shareholder value.

Risks

Financing is a major risk to this project, as it is for any small company looking to start up major mining operations. 5E is aiming to secure commercial offtake agreements at prices above the market, presumably due to their location and their boric acid purity.

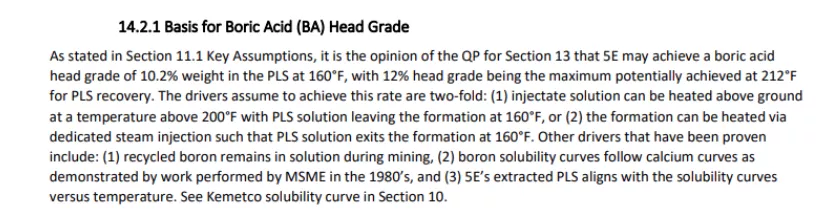

Additionally, their technical report assumes a higher head grade of boron than they are currently producing. This head grade will need to be improved to near 9.5% for the company to reach its full value. This can be achieved by heating the injected solution above ground or by injecting steam into the formation. Both options address the endpoint of the pregnant leachate solution exiting the ground at 160 degrees Fahrenheit, as increased temperature allows for higher total solubility of solute such as boron. This should be achievable, but still needs to be done and is therefore a risk.

Section 14.2.1 of Fort Cady August 2025 PFS

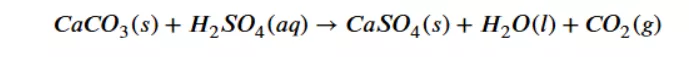

The company’s leaching process is also a moderate risk, in my opinion. While this process could be considered straightforward, investors will likely not consider it derisked until high-volume, high-concentration boric acid is consistently produced. After all, other in-situ leaching operations have encounteredd difficulties. Gunnison Copper’s (OTCMKTS: GCUMF) in-situ leaching operation (copper production) ran into issues with CaSO4 clogging their wells since they were primarily using H2SO4 acid (which adds more sulfate into the well), and their geology had heterogeneous fractures, faults, and variable permeability in sandstone aquifer, which resulted in a poor sweep efficiency. When sulfuric acid H2SO4 reacts with most carbonates, it produces a metal sulfate, carbon dioxide CO2, and water H2O. However, the reaction can be hindered with certain carbonates, like calcium carbonate CaCO3, because an insoluble layer of CaSO4 (gypsum) forms, which can "armors" the remaining carbonate and stops the reaction from completing.

Additionally, the generated CO2 can impair flowback. Due to these acid-consuming issues which impeded flowback that was amplified by complicated stratigraphy, Gunnison later pivoted to open pit mining but retains its permits for in situ recovery as an option.

On the contrary, 5E’s Fort Cady Boron project is a simpler stratigraphy (less faulting), which supports better fluid distribution and expected sweep efficiency. 5E also uses HCl instead of CaSO4, which should produce calcium chlorides in solution as opposed to gypsum (CaSO4). With the Fort Cady’s simpler stratigraphy, its possible that if there is any gypsum produced (there shouldn’t be), it simply flows back without causing problems. Existing sulfates in the well should be highly insoluble, resulting in minimal sulfate dissolved in the pregnant leachate solution. General in-situ leaching risks, such as aquifer contamination or regulatory delays are still relevant.

Conclusion

I am mostly interested in silver (and gold) mining companies as we approach what could be a price outbreak for silver and gold, and a subsequent massive run for associated, high quality junior miners. However, in the U.S., critical minerals are becoming an increased focus for our domestic supply chain, and aside from discerning whether specifically boron is a mineral one wants to invest in, the type of due diligence required to analyze this opportunity is similar to a PEA-staged precious metals explorer. While FEAM trades under 20% of its post-tax, Phase 1 NPV and at below 15% of its pre-tax NPV, despite reaching an initial smaller-scale commercial stage, I consider the company attractively valued. As operations improve and expand, I expect the company to trade at a higher percentage of its NPV, with the optionality of an increased multiple as they fill the void in the fragile and unbalanced boron supply chain.

More By This Author:

ZenaTech Poised For Growth With String Of Acquisitions And Regulatory Clarification

HIVE Digital Technologies: Trading At A Discount To Peers Despite Superior Capital Deployment

Apollo Silver: Two World-Class Silver Assets In One Stock

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more