5 Strong Buy Stocks With More Room To Run

Image: Bigstock

Earnings season is upon us and initial estimates show that this will be another strong quarter for companies. But with most companies likely to benefit from easier comps, choosing the true winners can be tricky.

A basic strategy of sticking to Buy or Hold ranked stocks with positive earnings Expected Surprise Prediction (ESP) could help you identify those that are most likely to beat estimates. And usually, companies that beat estimates also see their prices appreciate over the next few months. So this gives you a chance to pick up some quick gains.

However, there’s also another way to make the most of earnings season. And that involves taking stock of the companies that have already reported. The companies that will have already reported at this time are the ones that have their quarters ending in April or May.

The stocks you’d want to pick are ones with strong upward revisions in estimates. Just make sure that they also have Zacks #1 (Strong Buy) or #2 (Buy) ranks, that they operate in attractive industries, and have a VGM Score of A or B to increase your chances of success.

When such stocks are still undervalued, you can be sure that they are headed up. Here are a few examples-

Commercial Metals Company (CMC Quick Quote CMC - Free Report)

Commercial Metals Company manufactures, recycles, and markets steel, metal products, and related materials and also offers related services.

The Zacks Rank #1 stock with a VGM Score of B operates in the attractive Steel - Producers industry, which is in the top 5% of Zacks classified industries.

After reporting strong results in the May quarter when reported earnings topped estimates by 28.4%, the Zacks Consensus Estimate for 2021 (ending August) jumped 20.6% while that for 2022 jumped 15.2%. The four-quarter average surprise is also attractive, at 17.5%. So this isn’t a one-off thing.

However, the shares are still trading at a 10.9X P/E multiple, which is well below the S&P average of 22.2X and also its own median value of 11.5X over the past year. So further upside seems likely.

GMS Inc. (GMS Quick Quote GMS - Free Report)

Zacks #1 ranked GMS sells wallboard, suspended ceilings systems, and complementary interior construction products used in commercial and residential buildings.

Since it is also a member of the Building Products - Retail industry, which is at the top 7% of Zacks-classified industries, there’s a strong likelihood of near-term share price appreciation.

Its VGM Score of A indicates that the stock suits value, growth, and momentum investment styles.

The Zacks Rank is of course related to the company’s recent strong performance wherein it topped the Zacks Consensus Estimate by 25.9%, as well as the strong estimate revision action (the Zacks Consensus for fiscal 2022 ending in April is up 19.3% while that for 2023 is up 25.9%).

The fact that the last 4-quarter average surprise is 15.7% indicates that this is the continuation of an ongoing trend.

What’s more, the shares still look cheap at a forward P/E of just 9.7X (median 10.2X over the past year). For comparison, the S&P 500 is trading at 22.2X while the concerned industry is trading at 20.0X.

Earthstone Energy, Inc. (ESTE Quick Quote ESTE - Free Report)

Earthstone develops and operates oil and gas properties with primary assets in the Midland Basin of West Texas and the Eagle Ford trend of south Texas. Given recent pricing trends, the related industry (Oil and Gas - Exploration and Production - United States) is currently at the top 9% of Zacks-classified industries. The Zacks Rank #1 stock also has a VGM Score of B.

These factors in combination are a good enough indication of upside potential. But it’s also encouraging to note that the company topped The Zacks Consensus Estimate by 240% in the last quarter and that its four-quarter average surprise stands at 103.8%. Not only that – since the announcement of these strong results, its 2021 (ending December) estimate is up 22.4% while the 2022 estimate is up a whopping 56.0%.

Valuation also looks attractive with a forward P/E of 10.1X that remains well below its median value of 19.2X over the past year.

Smart Global Holdings, Inc. (SGH Quick Quote SGH - Free Report)

Smart Global is a designer, manufacturer, and supplier of electronic subsystems to OEMs in the computer, industrial, networking, telecommunications, aerospace, and defense markets.

The Zacks Rank #1 stock, which belongs to the Electronics - Semiconductors industry (top 41%) has a VGM Score A.

The company reported strong results in the last quarter, beating estimates by 26.4%. This surprise was stronger than the four-quarter average of 12.2%, indicative of the momentum in its business. Analysts are also optimistic about the stock, raising the 2021 (ending August) estimate by 17.1% and the 2022 estimate by 13.5%.

Valuation remains attractive at 9.8X forward P/E, which is why the stock could be worth buying right now. Both the S&P 500 and the concerned industry look way more expensive.

Smith & Wesson Brands, Inc. (SWBI Quick Quote SWBI - Free Report)

This well-known provider of pistols, revolvers, rifles, handcuffs, and other related products and accessories is ranked #1 by Zacks. The company belongs to the attractive Leisure and Recreation Products industry (top 9%), so the shares look set for appreciation. They also have a VGM Score of A, which generally indicates that investors would find them useful, irrespective of whether they are inclined toward value or growth investing or simply, momentum trading.

After the company topped April-quarter estimates by 59.8%, estimates were raised for 2022 and 2023 (ending April) by a respective 100.0% and 66.0%. The combined earnings surprise for the four preceding quarters is 58.9%, so demand doesn’t appear to be slowing down. Given the strong demand the company is seeing, further upward revisions certainly seem to be in the cards.

As far as valuation is concerned, the forward P/E of 6.5X makes the shares really cheap, both with respect to the S&P 500, which is trading at 22.2X and the industry, which is trading at 29.3X. They are also trading below their median level over the past year.

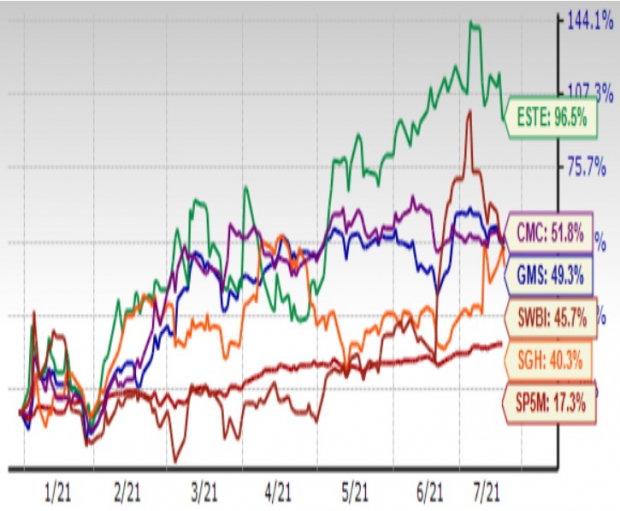

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more