5% Pullback Hit – Low At Hand

I remember when COVID hit and NYC was the epicenter. The hysteria around metro living was pervasive and most predicted mass exoduses from the major cities for years and years to come. After all, who in their right mind would ever get into an elevator with other people? Who would ride subways and busses packed with others? Well, as I walked across town, the city was more crowded than ever, both in vehicles and walking. I didn’t see a single person wearing a mask and except for a rapid COVID testing tent near 6th Avenue, you would never know there a global pandemic just a few short years ago.

In the summer and fall of 2020 when hysteria was at its peak I was in NYC a few times as I was preparing for another ankle surgery. My surgeon was at HHS on the upper east side. I alternated between driving myself in and taking the train. The city was crazy. I came home and told my wife we should buy a two-bedroom apartment on the upper east side. She thought I was clinically insane. I said that everyone wants to sell and get out. They’re all moving to the burbs. Now, my wife has never been a city girl, even for a quick trip or dinner. I knew it would be a hard sell, even though prices were collapsing. We didn’t buy and the rest is history. Prices bottomed quickly during the darkest hour and are right near all-time highs.

That is probably a better story for a 10% or greater decline in stocks, but I thought about it on the train home yesterday. Longtime readers know my philosophy. Buy when no one else wants to. Get cautious when everyone is celebrating. Easier said than done for sure. I have spoken with lots of folks lately and many are referencing a coming crash since The Big Short star, Michael Burry, put 90% of his portfolio ($1.6B) up for stocks to collapse. He isn’t the only one.

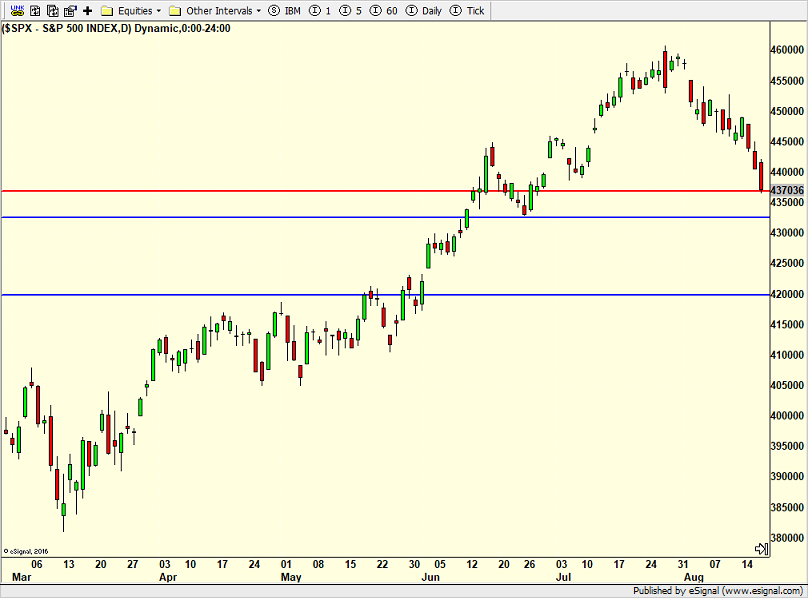

I have been waiting for the S&P 500 to be down 5% from its closing high. That is the red line on the chart below. Thursday’s selloff hit that level. Mind you, there’s nothing special or magical about a 5% decline from a high, only that in bull markets, that’s the first line to look for buys. After that, it’s 10% and 19%.

(Click on image to enlarge)

Today is options expiration and I sense that some of the decline this week is associated with derivatives going off the board. Stocks are short-term oversold. Sentiment is getting fearful. We should expect a low and bounce any day. You know I dislike Friday bottoms so today isn’t my first choice, but we play the hand we’re dealt. Today is as good a day as any for the bulls to make a stand and get back 1-3% of what was lost. I do think the ultimate bottom is a little lower, somewhere around 4200-4300, but let’s get a low in place first and then worry about what’s next which I think is a huge rally.

And yes, I still like tech, semis in particular. And banks look like they’re setting up again. I will hone my shopping list over the weekend and do a new video.

The weekend is here and people are complaining that summer is over. It seems like I hear that every August. It’s not over! Kids may be going back to school, but we are going to see great New England weather for the next two to three months. I am guaranteeing it. I am thankful football is close by because my Yankees truly stink and they are painful to watch. And don’t look now, but UCONN basketball is raring to go.

On Wednesday we bought QQQ. On Thursday we bought IVV, levered S&P 500, and more PDBC. We sold GDXJ, FREL, EEM, DXHYX and XLC.

More By This Author:

Pullback Not Over But Multi-Day Bounce Setting Up

Hard To Find Places To Hide

Apple, Amazon And Employment Report Lead To A Big Friday

Please see HC's full disclosure here.