5 Diverse Medical Stocks To Buy For 2023 And Beyond

Image Source: Pexels

Healthcare will always be essential to society, making many health companies viable investments for growth.

Here are five top-rated Zacks Medical stocks that investors may want to consider buying for 2023 and beyond.

Chugai Pharmaceutical (CHGCY - Free Report)

The first stock on the list sticks out for its attractive price, at $12 per share Chugai Pharmaceuticals’ price-to-earnings valuation also supports that shares of CHGCY are cheap.

Even better, earnings estimates are much higher for Chugai which sports a Zacks Rank #1 (Strong Buy). Japan-based Chugai provides pharmaceutical products for the treatment of cancer, kidney diseases, kidney transplantation, and bone and joint diseases.

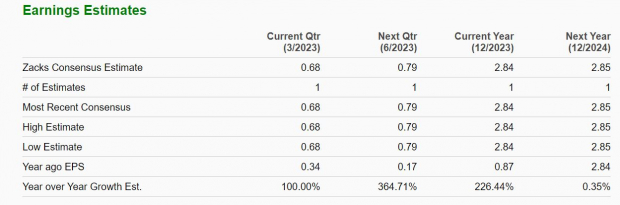

Image Source: Zacks Investment Research

Chugai’s fiscal 2023 earnings estimates have climbed 264% over the last 90 days with FY24 EPS estimates soaring 247%. More impressive, earnings are now forecasted to leap 226% this year to $2.84 per share compared to EPS of $0.87 in 2022.

Plus, Chugai stock only trades at 4.3X forward earnings which are well below the industry average of 12.9X, and the S&P 500’s 18.9X.

CSL Limited (CSLLY - Free Report)

Next up is CSL Limited which sports a Zacks Rank #2 (Buy). CSL is a biopharmaceutical company that produces vaccines and plasma protein biotherapies to treat and prevent human medical conditions.

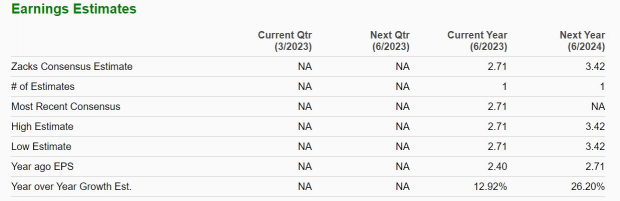

Headquartered in Australia, CSL’s top and bottom line growth is standing out. CSL’s earnings are now projected to rise 13% in FY23 and climb another 26% in FY24 at $3.42 per share. On the top line, sales are forecasted to leap 31% this year and jump another 12% in FY24 to $15.14 billion.

Image Source: Zacks Investment Research

Horizon Therapeutics (HZNP - Free Report)

Also sporting a Zacks Rank #2 (Buy) Horizon Therapeutics stands out for its impressive growth as well. Based in Dublin Ireland, Horizon is a biopharmaceutical company focused on making drugs for arthritis, pain, inflammatory, and orphan diseases areas.

Based on Zacks estimates, Horizons earnings are expected to rise 9% this year and soar another 26% in FY24 at $6.72 per share. Sales are forecasted to be up 10% in FY23 and climb another 15% in FY24 to $4.58 billion.

Image Source: Zacks Investment Research

Humana Inc. (HUM - Free Report)

One of the more known names on the list is Humana, and its stock lands a Zacks Rank #2 (Buy) at the moment. Humana is one of the largest healthcare plan providers in the United States.

Humana provides health insurance benefits under Health Maintenance Organization (HMO), Private Fee-For-Services (PFFS), and Preferred Provider Organization (PPO) plans.

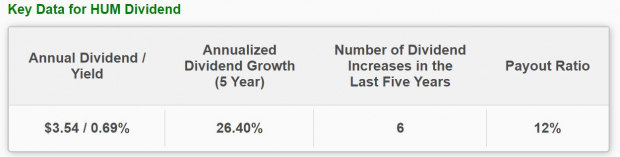

Investors may want to consider Humana stock for its top and bottom-line expansion along with its steady dividend growth. Humana earnings are anticipated to jump 11% in FY23 and pop another 13% in FY24 at $31.78 per share.

Sales are projected to be up 11% this year and rise another 8% in FY24 to $112.42 billion. Better still, Humana recently increased its dividend by 12.4% in February and has now raised it six times in the last five years.

Image Source: Zacks Investment Research

Novo Nordisk (NVO - Free Report)

Rounding out the list is Novo Nordisk which boasts a Zacks Rank #1 (Strong Buy). Novo is based in Denmark and is a global healthcare leader in the worldwide diabetes market with a full portfolio of GUP-1 receptor agonists, modern insulins, and human insulins.

Novo is also a key player in hemophilia care, growth hormone therapy, hormone replacement therapy, and obesity. Notably, Novo’s earnings estimate revisions have continued to trend higher throughout the quarter.

Image Source: Zacks Investment Research

Fiscal 2023 earnings estimates have risen 10% over the last 90 days with FY24 EPS estimates climbing 20%. Novo’s earnings are now expected to soar 30% this year at $4.51 per share compared to EPS of $3.46 in 2022. Plus, fiscal 2024 EPS is forecasted to expand another 16%.

Novo’s sales are projected to jump 19% in FY23 and rise another 12% in FY24 to $33.49 billion. Furthermore, Novo is continuing to grow its dividend as well with six increases in the last five years for a current annual yield of 1.07% at $1.69 per share.

Takeaway

The top and bottom line growth make these Zacks Medical stocks very attractive. Even better, they offer diversification and exposure to a variety of global economies, health treatments, and healthcare plans which should make them sound investments for years to come.

More By This Author:

Acuity Brands Beats Q2 Earnings Estimates

Buy These Tech Stocks For The Momentum Wave

Airline Stock Roundup: United Airlines' Environment-Friendly Deal, Hawaiian Holdings In Focus

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more