Buy These Tech Stocks For The Momentum Wave

Image: Bigstock

Tech stocks were taking off as the first quarter of 2023 came to a close. Impressively, the technology sector held up throughout the past month as other areas of the market declined amid financial concerns stemming from the collapse of Silicon Valley Bank and Credit Suisse (CS - Free Report).

With the Nasdaq up 16% this year, let’s take a look at some top-rated tech stocks that have an “A” Zacks Style Scores grade for Momentum at the moment.

Arista Networks (ANET - Free Report)

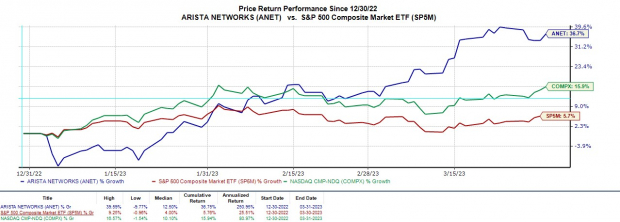

Sporting a Zacks Rank #1 (Strong Buy), Arista Networks is a cloud networking solutions provider for data centers and cloud computing environments.

Recently seen trading at $167 per share, Arista stock is up +37% year-to-date to easily top the Nasdaq’s +16% and the S&P 500’s +6. The earnings estimate revisions have been the key catalyst here, which attributes to Arista’s high Zacks Rank.

Fiscal 2023 EPS estimates are still up 11% during the quarter, with FY24 earnings estimates soaring 15%. Arista’s earnings are now projected to climb 26% this year and jump another 11% in FY24 at $6.44.

Image Source: Zacks Investment Research

DocuSign (DOCU - Free Report)

Next up is DocuSign, which sports a Zacks Rank #2 (Buy). At $58 a share, DocuSign stock is up +5% this year to trail the broader indexes. However, earnings estimates have recently trended higher, making DOCU look attractive with shares still 49% from their 52-week highs.

Supporting more upside in DocuSign stock, its current fiscal 2024 earnings estimates have gone up 9% over the last 30 days, with FY25 EPS estimates up 5%. DocuSign’s earnings are now expected to jump 15% in FY24 and rise another 10% in FY25 at $2.57 per share.

Image Source: Zacks Investment Research

Infineon Technologies (IFNNY - Free Report)

Among prominent chipmakers, Infineon Technologies could have more upside, yet it is still able to land a Zacks Rank #1 (Strong Buy). Infineon is an application-oriented semiconductor solutions provider for use in speech and data communications, peripherals, wireless communications, automotive and industrial electronics, security and chip cards, along with memory products.

Infineon stock has recently been seen trading at $40 per share and has soared 36% year-to-date to outperform the S&P 500 and Nasdaq. With earnings estimates on the rise, Infineon’s P/E valuation also stands out and supports more upside.

Infineon stock trades at 16.7X forward earnings, which is nicely below the industry average of 19.6X and the S&P 500’s 18.6X. Even better, Infineon trades 66% below its decade high of 49.5X and at a 21% discount to the median of 21.2X.

Image Source: Zacks Investment Research

Takeaway

Rising earnings estimates are a great sign that these tech stocks will be top performers this year, especially if the rally in the broader technology sector continues. Furthermore, their unique businesses can reach a wide range of clients, making them viable investments for 2023 and beyond.

More By This Author:

Airline Stock Roundup: United Airlines' Environment-Friendly Deal, Hawaiian Holdings In FocusDon't Ignore The Strength Of These 3 Large-Caps

Bear Of The Day: Vulcan Materials

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more