5 Best Natural Gas Stocks, Ranked In Order

Photo by Martin Adams on Unsplash

U.S. natural gas prices recently reached $6/MMBtu, for the first time since 2022.

The key factor responsible for the increase in natural gas prices in the past month is freezing weather that swept across much of the U.S., boosting heating demand and disrupting supplies.

With natural gas prices hitting levels not seen since in four years, investors might naturally be interested in natural gas stocks that could benefit.

More information can be found in the Sure Analysis Research Database, which ranks stocks based on their dividend yield, earnings-per-share growth potential, and changes in the valuation multiple.

This article will review 5 top natural gas stocks. These 5 stocks have significant businesses in upstream natural gas production, midstream activities such as natural gas transportation and storage, or natural gas utilities.

Read on to see which U.S. natural gas stocks are ranked highest in our Sure Analysis Research Database.

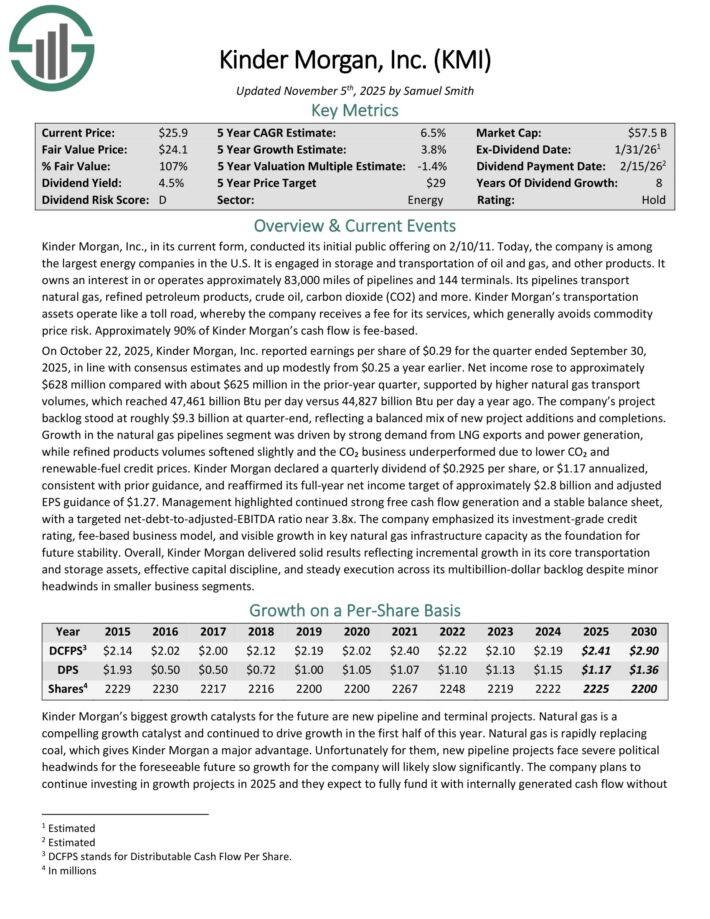

Natural Gas Stock #5: Kinder Morgan Inc. (KMI)

- 5-year expected annual returns: 3.4%

Kinder Morgan is among the largest energy companies in the U.S. It is engaged in storage and transportation of oil and gas, and other products. It owns an interest in or operates approximately 83,000 miles of pipelines and 144 terminals.

Its pipelines transport natural gas, refined petroleum products, crude oil, carbon dioxide (CO2) and more.

Kinder Morgan’s transportation assets operate like a toll road, whereby the company receives a fee for its services, which generally avoids commodity price risk. Approximately 90% of Kinder Morgan’s cash flow is fee-based.

On October 22, 2025, Kinder Morgan, Inc. reported earnings per share of $0.29 for the quarter ended September 30, 2025, in line with consensus estimates and up modestly from $0.25 a year earlier.

Net income rose to approximately $628 million compared with about $625 million in the prior-year quarter, supported by higher natural gas transport volumes, which reached 47,461 billion Btu per day versus 44,827 billion Btu per day a year ago.

The company’s project backlog stood at roughly $9.3 billion at quarter-end, reflecting a balanced mix of new project additions and completions.

Growth in the natural gas pipelines segment was driven by strong demand from LNG exports and power generation, while refined products volumes softened slightly and the CO₂ business under-performed due to lower CO₂ and renewable-fuel credit prices.

Kinder Morgan declared a quarterly dividend of $0.2925 per share, or $1.17 annualized, consistent with prior guidance, and reaffirmed its full-year net income target of approximately $2.8 billion and adjusted EPS guidance of $1.27.

Click here to download our most recent Sure Analysis report on KMI (preview of page 1 of 3 shown below):

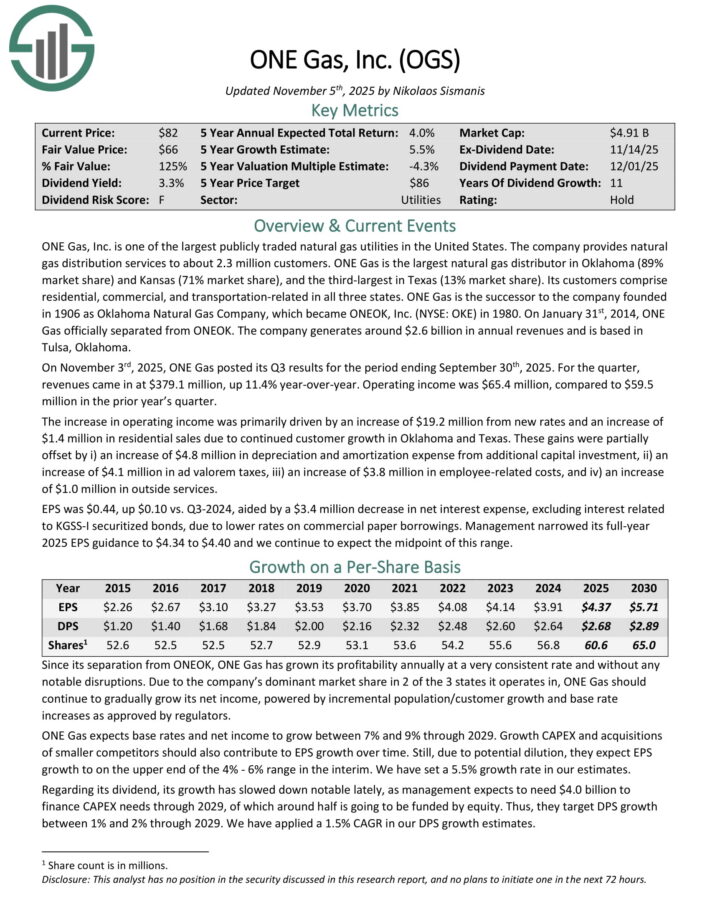

Natural Gas Stock #4: ONE Gas, Inc. (OGS)

- 5-year expected annual returns: 5.2%

ONE Gas, Inc. is one of the largest publicly traded natural gas utilities in the United States. The company provides natural gas distribution services to about 2.3 million customers.

ONE Gas is the largest natural gas distributor in Oklahoma (89% market share) and Kansas (71% market share), and the third-largest in Texas (13% market share).The company generates around $2.6 billion in annual revenues and is based in Tulsa, Oklahoma.

On November 3rd, 2025, ONE Gas posted its Q3 results for the period ending September 30th, 2025. For the quarter, revenues came in at $379.1 million, up 11.4% year-over-year. Operating income was $65.4 million, compared to $59.5 million in the prior year’s quarter.

The increase in operating income was primarily driven by an increase of $19.2 million from new rates and an increase of $1.4 million in residential sales due to continued customer growth in Oklahoma and Texas.

These gains were partially offset by an increase of $4.8 million in depreciation and amortization expense from additional capital investment.

EPS was $0.44, up $0.10 vs. Q3-2024, aided by a $3.4 million decrease in net interest expense, excluding interest related to KGSS-I securitized bonds, due to lower rates on commercial paper borrowings.

Management narrowed its full-year 2025 EPS guidance to $4.34 to $4.40 and we continue to expect the midpoint of this range.

Click here to download our most recent Sure Analysis report on OGS (preview of page 1 of 3 shown below):

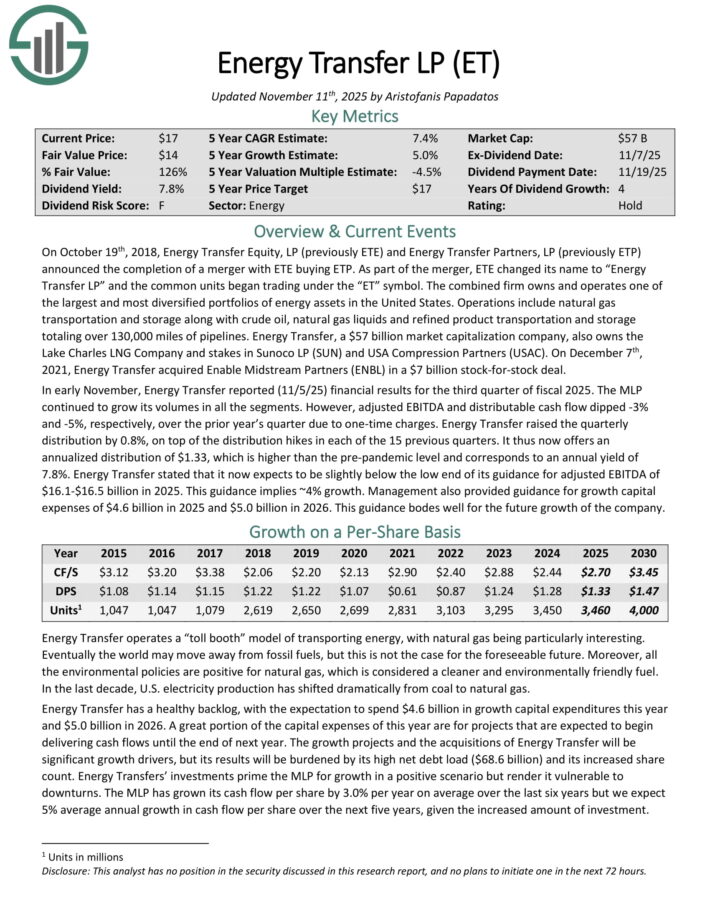

Natural Gas Stock #3: Energy Transfer Partners LP (ET)

- 5-year expected returns: 6.5%

Energy Transfer LP owns and operates one of the largest and most diversified portfolios of energy assets in the United States.

Operations include natural gas transportation and storage along with crude oil, natural gas liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Energy Transfer also owns the Lake Charles LNG Company and stakes in Sunoco LP (SUN) and USA Compression Partners (USAC).

In early November, Energy Transfer reported (11/5/25) financial results for the third quarter of fiscal 2025. The MLP continued to grow its volumes in all the segments.

However, adjusted EBITDA and distributable cash flow dipped -3% and -5%, respectively, over the prior year’s quarter due to one-time charges.

Energy Transfer raised the quarterly distribution by 0.8%, on top of the distribution hikes in each of the 15 previous quarters.

Click here to download our most recent Sure Analysis report on ET (preview of page 1 of 3 shown below):

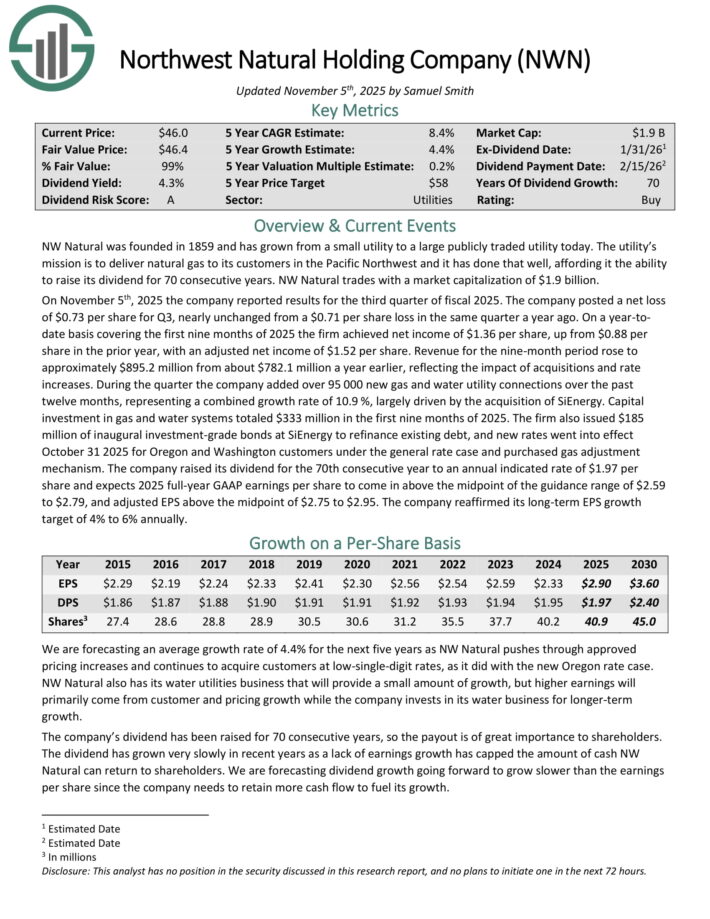

Natural Gas Stock #2: Northwest Natural Gas Holding Co. (NWN)

- 5-year expected annual returns: 8.3%

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

The company’s locations served are shown in the image below.

On November 5th, 2025 the company reported results for the third quarter of fiscal 2025. The company posted a net loss of $0.73 per share for Q3, nearly unchanged from a $0.71 per share loss in the same quarter a year ago.

On a year-to-date basis covering the first nine months of 2025 the firm achieved net income of $1.36 per share, up from $0.88 per share in the prior year, with an adjusted net income of $1.52 per share.

Revenue for the nine-month period rose to approximately $895.2 million from about $782.1 million a year earlier, reflecting the impact of acquisitions and rate increases.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

Natural Gas Stock #1: National Fuel Gas (NFG)

- 5-year expected annual returns: 10.4%

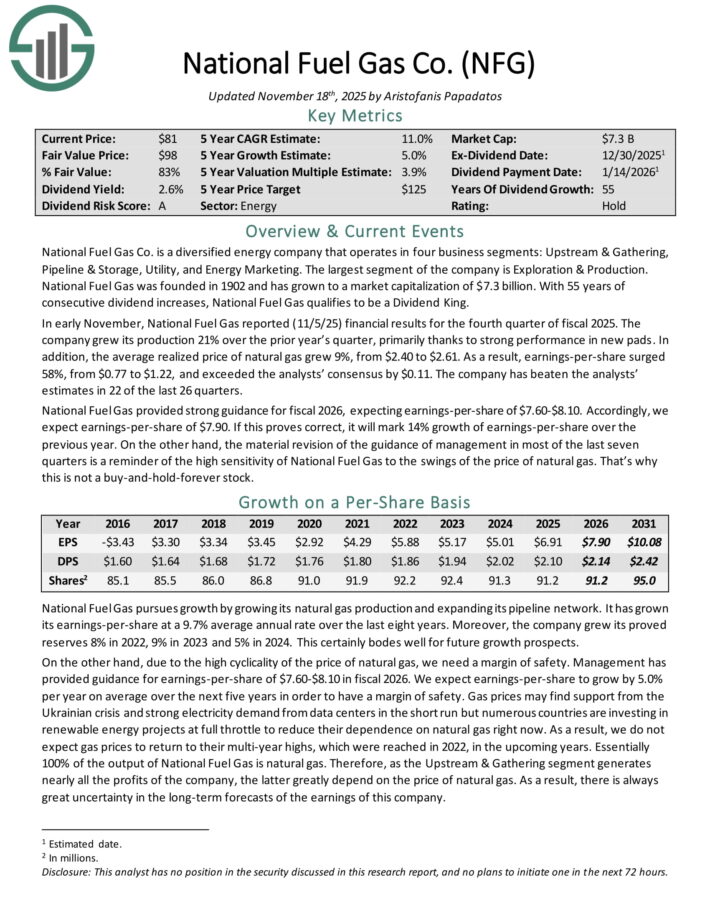

National Fuel Gas Co. is a diversified energy company that operates in four business segments: Upstream & Gathering, Pipeline & Storage, Utility, and Energy Marketing.

The largest segment of the company is Exploration & Production. With 55 years of consecutive dividend increases, National Fuel Gas qualifies to be a Dividend King.

In early November, National Fuel Gas reported (11/5/25) financial results for the fourth quarter of fiscal 2025. The company grew its production 21% over the prior year’s quarter, primarily thanks to strong performance in new pads.

In addition, the average realized price of natural gas grew 9%, from $2.40 to $2.61. As a result, earnings-per-share surged 58%, from $0.77 to $1.22, and exceeded the analysts’ consensus by $0.11.

The company has beaten the analysts’ estimates in 22 of the last 26 quarters. National Fuel Gas provided strong guidance for fiscal 2026, expecting earnings-per-share of $7.60-$8.10.

Accordingly, we expect earnings-per-share of $7.90. If this proves correct, it will mark 14% growth of earnings-per-share over the previous year.

Click here to download our most recent Sure Analysis report on NFG (preview of page 1 of 3 shown below):

More By This Author:

3 Dividend Stocks To Profit From Record Gold Prices

3 Gold Dividend Stocks For Record Gold Prices

Monthly Dividend Stock In Focus: Nexus Industrial REIT

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more