3 Gold Dividend Stocks For Record Gold Prices

Image Source: Pixabay

Gold can be an excellent hedge against inflation. Typically, gold is inversely valued against the U.S. dollar. When inflation runs high, investors might consider purchasing precious metals, such as gold.

In fact, gold prices recently hit a record price above $5,000 per ounce. Gold spot prices are currently at just over $5,080 per ounce, up 85% in the past 12 months.

For investors looking for more from their gold positions, such as dividend income, owning gold stocks can be a way to generate income while countering inflation.

Gold stocks operate in the basic materials sector.

While owning physical gold pays no dividends, investors looking for exposure to rising gold prices can buy gold stocks, many of which do pay dividends to shareholders.

Therefore, this article will examine our 3 top gold dividend stocks right now.

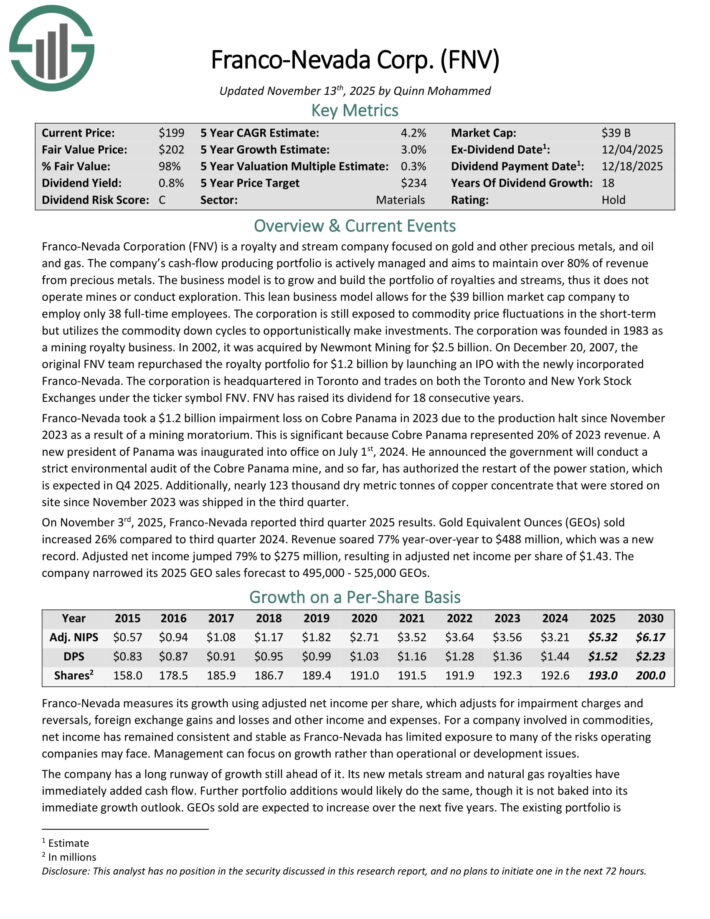

Gold Dividend Stock #3: Franco-Nevada Corp. (FNV)

- Dividend Yield: 0.6%

Franco-Nevada Corporation is a royalty and stream company focused on gold and other precious metals, and oil and gas.

The company’s cash-flow producing portfolio is actively managed and aims to maintain over 80% of revenue from precious metals.

The business model is to grow and build the portfolio of royalties and streams, thus it does not operate mines or conduct exploration. This lean business model allows for the $39 billion market cap company to employ only 38 full-time employees.

The corporation is still exposed to commodity price fluctuations in the short-term but utilizes the commodity down cycles to opportunistically make investments.

The corporation is headquartered in Toronto and trades on both the Toronto and New York Stock Exchanges under the ticker symbol FNV. FNV has raised its dividend for 18 consecutive years.

On November 3rd, 2025, Franco-Nevada reported third quarter 2025 results. Gold Equivalent Ounces (GEOs) sold increased 26% compared to third quarter 2024.

Revenue soared 77% year-over-year to $488 million, which was a new record. Adjusted net income jumped 79% to $275 million, resulting in adjusted net income per share of $1.43.

The company narrowed its 2025 GEO sales forecast to 495,000 – 525,000 GEOs.

Click here to download our most recent Sure Analysis report on FNV (preview of page 1 of 3 shown below):

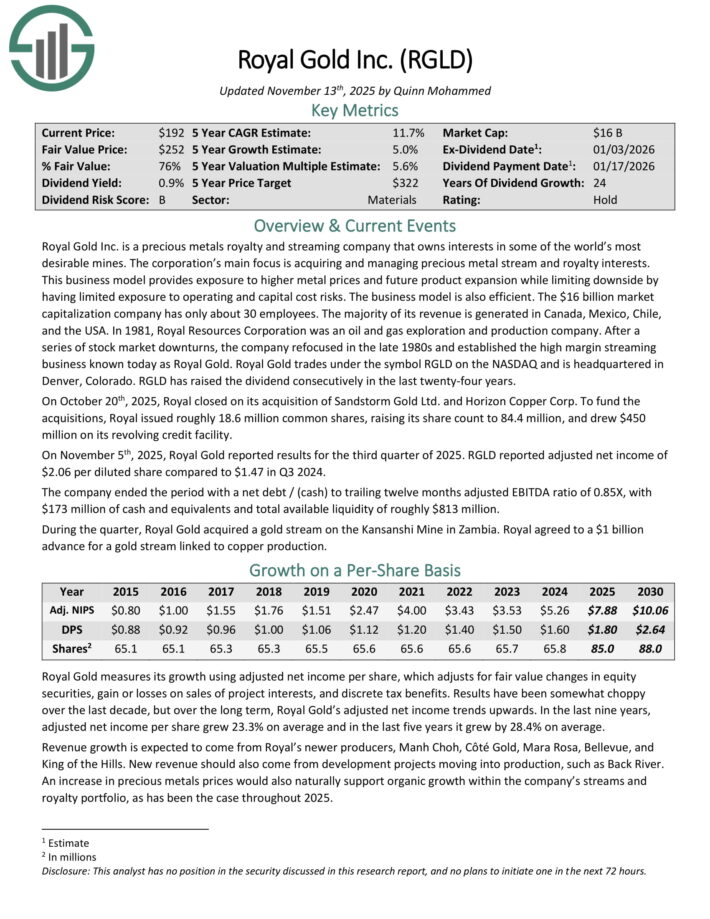

Gold Dividend Stock #2: Royal Gold Inc. (RGLD)

- Dividend Yield: 0.6%

Royal Gold Inc. is a precious metals royalty and streaming company that owns interests in some of the world’s most desirable mines.

The corporation’s main focus is acquiring and managing precious metal stream and royalty interests. This business model provides exposure to higher metal prices and future product expansion while limiting downside by having limited exposure to operating and capital cost risks.

The majority of its revenue is generated in Canada, Mexico, Chile, and the USA. In 1981, Royal Resources Corporation was an oil and gas exploration and production company.

RGLD has raised the dividend consecutively in the last 24 years.

On October 20th, 2025, Royal closed on its acquisition of Sandstorm Gold Ltd. and Horizon Copper Corp. To fund the acquisitions, Royal issued roughly 18.6 million common shares, raising its share count to 84.4 million, and drew $450 million on its revolving credit facility.

On November 5th, 2025, Royal Gold reported results for the third quarter of 2025. RGLD reported adjusted net income of $2.06 per diluted share compared to $1.47 in Q3 2024.

The company ended the period with a net debt / (cash) to trailing twelve months adjusted EBITDA ratio of 0.85X, with $173 million of cash and equivalents and total available liquidity of roughly $813 million.

During the quarter, Royal Gold acquired a gold stream on the Kansanshi Mine in Zambia.

Click here to download our most recent Sure Analysis report on RGLD (preview of page 1 of 3 shown below):

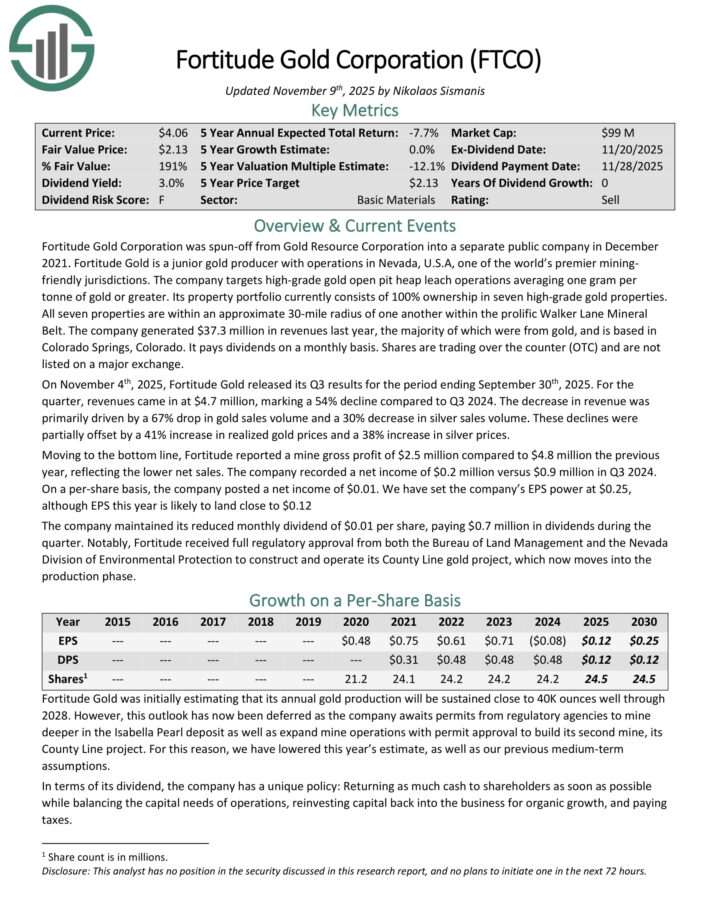

Gold Dividend Stock #1: Fortitude Gold (FTCO)

- Dividend Yield: 2.1%

Fortitude Gold Corporation was spun-off from Gold Resource Corporation into a separate public company in December

2021.

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining-friendly jurisdictions. The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater.

Its property portfolio currently consists of 100% ownership in seven high-grade gold properties. All seven properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt.

The company generated $37.3 million in revenues last year, the majority of which were from gold, and is based in Colorado Springs, Colorado. It pays dividends on a monthly basis.

On November 4th, 2025, Fortitude Gold released its Q3 results. For the quarter, revenues came in at $4.7 million, marking a 54% decline compared to Q3 2024.

The decrease in revenue was primarily driven by a 67% drop in gold sales volume and a 30% decrease in silver sales volume. These declines were partially offset by a 41% increase in realized gold prices and a 38% increase in silver prices.

Moving to the bottom line, Fortitude reported a mine gross profit of $2.5 million compared to $4.8 million the previous year, reflecting the lower net sales. The company recorded a net income of $0.2 million versus $0.9 million in Q3 2024.

On a per-share basis, the company posted a net income of $0.01. We have set the company’s EPS power at $0.25, although EPS this year is likely to land close to $0.12.

The company maintained its monthly dividend of $0.01 per share, paying $0.7 million in dividends during the quarter.

Notably, Fortitude received full regulatory approval from both the Bureau of Land Management and the Nevada Division of Environmental Protection to construct and operate its County Line gold project, which now moves into the production phase.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

More By This Author:

Monthly Dividend Stock In Focus: Nexus Industrial REITMonthly Dividend Stock In Focus: Canadian Net Real Estate Investment Trust

Monthly Dividend Stock In Focus: Decisive Dividend Corp.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more